Personal Finance

Chinese settle on London as prime location

By Andrew Moody (China Daily)

Updated: 2010-08-09 09:32

|

Large Medium Small |

|

|

Asians dominate property market in UK's capital city center hot spots

LONDON - Walking around some of London's affluent retail areas such as Bond Street and Knightsbridge, the intonations of Putonghua are never far out of hearing.

Expensively dressed Chinese people are there to shop for the expensive items they now see as their right.

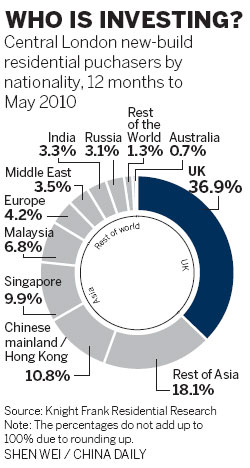

According to the research arm of Knight Frank, the leading estate agent, people from Hong Kong and the Chinese mainland are now the biggest overseas buyers of central London new-build property, accounting for one in 10 of all purchases.

Such properties do not come cheap. Even modest flats in central London can change hands at more than 1 million pounds ($1.57 million), or 11 million yuan.

One of the most exclusive new developments currently on the market, which has attracted a lot of Chinese interest is The Lancasters by Hyde Park, where the biggest four bedroom apartments are for sale for 20 million pounds.

John F. J. Kennedy, a partner at Knight Frank, said the influx of Chinese buyers has been a relatively recent phenomenon.

"Just over 12 months ago we began to see the first signs of this. The people coming in are mainly from the Chinese mainland and Hong Kong. They are either looking for investment or somewhere for their children while they are at university," he said.

The Chinese buyers appear to be taking advantage of what seems to be a once in a generation opportunity.

The value of the pound (in which London properties are obviously valued) has slumped by around 30 percent against the yuan over the past two years while properties fell in value in prime central London by around 25 percent from their peak in 2007 to the first quarter of 2009. Although values have since recovered, at one stage prices in yuan terms were half the price they were at the top of the market.

"The exchange rate has been a major driver for investment in London over the last 12 months," said Lucian Cook, director of Savills Research, the property information division of the leading international estate agents.

Few ask questions about how the Chinese manage to get their money out of China when the individual annual limit for them for foreign exchange is just $50,000, a hopelessly inadequate amount for even the smallest deposit on a London property.

According to those close to the market, people buying properties are often doing so through corporate transactions, usually involving their own companies, or taking advantage of underground money exchangers who have proliferated in southern China, in particular.

Some speculate what might happen should the Chinese government relax the restrictions on people taking money out of the country.

Edward Lewis, a director of Savills estate agents in the company's Berkeley Square headquarters, has no doubts.

"At some stage there will be a relaxation of the amount of money you can take out of China and at that point the dam bursts," he said.

The company is arguably one of the best placed to capitalize on such an event with 14 offices in China already.

"We want to make sure we are there to offer our service when that happens," he added.

Property developers are already adjusting the layouts of their schemes to make them attractive to Chinese buyers.

Daniel Knight, 35, who develops properties around exclusive St John's Wood in London, just northwest of Regent's Park, said he was conscious of the Chinese concerns about the feng shui of any building.

"I stopped putting mirrors opposite the front door in my properties since that apparently reflects the energy flow right back out again," he said.

Knight developed an apartment in a block that listed no fourth floor in Abbey Road, famous for the pedestrian crossing the 1960s pop sensation band The Beatles were pictured walking across on a top-selling album cover. The number four is considered unlucky in parts of China because in Cantonese it sounds like the word for death.

"This was a property mainly marketed at Hong Kong buyers so it was thought sensible not to have a fourth floor," he said.

Knight said Chinese buyers, like other international buyers, have key demands that must be met.

"They want security and they want porterage. It is often their second and third home and they just want a place they can just lock up and leave. I have a flat in St John's Wood with a garden that has been on the market for nine months and they are not interested. It would normally be bought by a UK buyer but they can't get mortgages at the moment," he added.

According to Knight Frank Research, UK buyers now make up only just over a third (36.9 percent) of those buying central London new-build property with many struggling to raise finance.

Asian buyers, including substantial numbers from Singapore and Malaysia as well as China, completely dominate, making up nearly half (45.6 percent) of all purchases in this category.

"The UK banks have gone back to traditional lending," said James Hyman, partner of the residential sales division of chartered surveyors Cluttons, at his office, near Tower Bridge.

"Before the financial crisis UK buyers were able to borrow eight times their salary. Now it is back to three-and-a-half times. They are also required to put down a hefty 25 percent deposit and have a completely clear credit history. Any late payments on any credit card and a mortgage could fall through."

By contrast, the sky seems to be the limit for Chinese buyers. Joseph Lau, the 59-year-old Hong Kong billionaire and chairman of Chinese Estate Holdings, paid 33 million pounds for a six-floor mansion in Eaton Square, Belgravia. The property had its own cinema, swimming pool and gym as well as plenty of room for servants.

Mainland buyers - often using intermediaries - tend to keep their purchases out of the media spotlight, avoiding questions about how they managed to get their money out of the country in the first place.

Over in Grosvenor Square next to the American Embassy in London, Matt Tack, director of global investments and asset management for Hamptons International, is planning to open an office in Hong Kong this autumn to take advantage of this new wave of buyers.

"We are going to Hong Kong rather than Shanghai or Beijing because our brand is already recognized there," he said.

Tack said that although Chinese investors have been painted as unsophisticated, they have proven to be quite calculating in their purchases.

"They are actually very astute investors. We are not witnessing what we saw with Middle East buyers who had a lot of money and had to invest in something with no real science behind it," he said.

Tack went out to Hong Kong in May to present a portfolio of prime London property at the Mandarin Oriental Hotel.

"If we had done that 10 years ago most of the people there would have been British or Australian expats. The people attending now are mostly from the mainland. They might have up to 1.5 million pounds to spend even to buy accommodation for their children while they are students."

Tack says sales efforts by UK estate agents have met with resistance from Hong Kong property sellers.

"While we were there, there were people outside the hotel handing out leaflets presumably representing Hong Kong agents referring to the efforts of UK agents to sell property as FILTH (Failed in London Try Hong Kong)," he said.

Having a London property is now seen as the badge of the international rich, who have traditionally owned properties in such places as Switzerland, Monaco and New York.

Middle East buyers have been a feature of the London property market since the 1970s.

Before the recent influx of Chinese, the big buyers were the Russian oligarchs and Indian business tycoons.

Kennedy at Knight Frank said people from the Far East do not prevaricate when it comes to buying a property.

"Hong Kong people take about one hour to decide, people from Singapore about three hours and people from the UK, well, we could be waiting a long time to see whether they can get a mortgage," he said, laughing.

He said the market is not now just dominated by overseas Asians but people working in areas such as Canary Wharf, London's new business district to the east of the City of London.

"With its 50-storey skyscrapers overlooking the Thames, it has the feel of a mini-Hong Kong. Young Asian professionals who were previously renting have been buying a lot of property in this area of London," he said.

Whether central London property, which has more than doubled in value over the past decade, will continue to be a good investment in future remains to be seen.

However, for many Chinese and other fabulously wealthy buyers this is no longer the central question since a rise or fall in property values is unlikely to put too much of a dint in their wealth.

"To a growing number of property owners in prime London, the real answer appears to be 'who cares?'" said Liam Bailey, head of residential research at Knight Frank.

|

|