Daryl Guppy

Keeping an eye on silver price trends

By Daryl Guppy (China Daily)

Updated: 2011-04-11 14:37

|

Large Medium Small |

Investors need to know when to get out before the bubble bursts

It hardly matters that the United States government narrowly avoided a shutdown because the damage has already been done with the prolonged budget debate. The debate has highlighted the profligacy of the US government's approach to responsible spending and financial management. Forget the details - arguments about $37 billion dollars out of a $3.6 trillion budget-spending bill and special-interest spending - and look at the broader issue.

Government shutdowns occurred in 1995 and 1996 and had only a small effect on the economy. This time the US economy is struggling to claw its way out of a serious recession and the economic recovery remains fragile. The specter of default is glimmering on the horizon.

This budget deadlock could lead to similar problems when the time comes for Congress to approve an increase in the current $14.29 trillion national debt ceiling before this level is reached around the middle of May. If the debt ceiling is not lifted then the government will be forced to immediately slash discretionary spending, increase the tax take by around two thirds to meet the debt requirement or, in a worst case scenario, default.

| ||||

The surge in the price of silver, reaching new highs near $40 an ounce, and the gold price breakout near $1,460 an ounce are reflections of this fear about the sustainability of an economy that has to even contemplate the specter of a shutdown or extreme measures to avoid a default. The counterpoint is continued weakness in the US dollar and the way this provides ammunition for a trade war.

Silver has outperformed gold at almost every turn in recent years. Between July 2010 and January 2011 the COMEX gold price rose by 22 percent. The rise started near $1,160 and peaked around $1,420 just before the current price breakout. Between July 2010 and January 2011 the COMEX silver futures price lifted by 72 percent from $18 to $31. Silver outperformed gold by more than three times.

This out performance is set to continue with new highs near $40 and the trend is fuelled by cheap money and fear. Fear tells investors it is better to have investments in hard commodities such as silver or gold. Cheap money, with loans in the US available at around 1 percent interest, makes commodity market investment even more attractive. An annual return of more than 70 percent from silver is even better if you borrowed money at just 1 percent to invest in it. The result is a speculative trend not seen since the Hunt brothers tried to corner the silver market in 1980.

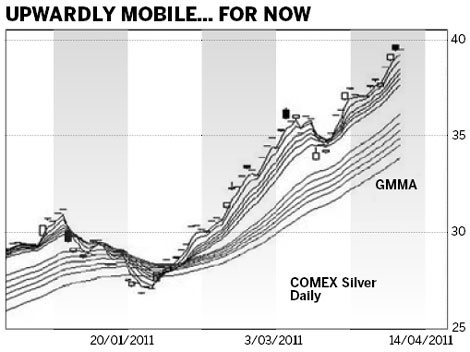

The upward trend is irresistible and all the charting and technical signals suggest it will continue. We use a Guppy Multiple Moving Average (GMMA) indicator to understand the behavior of traders and investors in the market. This analysis shows the underlying trend is very strong with excellent support from investors. The weakness in upward momentum that developed recently has been reversed with the drawn out resolution of the US budget problems and the potential for even more problems when the debit ceiling is discussed in May. This is the fear factor. Technically this sets upside price targets near $42, and $44 as the trend pressure continues.

In 1980 the speculative bubble in silver collapsed when COMEX changed the future contract margin requirements from 10 percent to as high as 100 percent. Traders had to come up with more money to finance each new trade and this caused the market to collapse.

In a speech last week, US Federal Reserve Chairman Ben Bernanke hinted at similar moves with his focus on clearing and settlement issues. This type of regulatory change, or the threat of regulatory change, destroyed the speculative bull run in oil in 2007. It has the potential to do the same to the increasingly speculative bull run in silver and gold.

These commodity trends offer excellent profits, but they are less certain as long-term investments. The increasingly speculative nature of these trends indicates growing pressure for a speculative collapse.

Traders and investors look for evidence of a developing correction. This includes the development of parabolic trends or head-and-shoulder patterns. These are trend reversal signals. The early warning of a trend collapse or reversal is the development of divergence signals on the Relative Strength Indicator (RSI). These happen when the price trend is upward but the trend on the RSI is downward. This is usually an early warning signal and encourages investors to look more closely for developing chart patterns that confirm the end of the upward trend.

The end of the commodity trend is not near but the development of increased speculative behavior as fear drives investors into the commodity markets ensures the bubble will burst. Our challenge is to keep the profits and exit before the upward trend ends.

The author is a well-known international financial technical analysis expert.

| 分享按鈕 |