Daryl Guppy

Gloomy outlook bodes ill for global economy

By Daryl Guppy (China Daily)

Updated: 2011-06-13 14:23

|

Large Medium Small |

The next few weeks sees the collision of four significant economic events in the United States. It's not yet clear if this is a looming train wreck or a breakthrough to a new and better economic environment. The developing behavior on the Dow Jones Industrial Average Index hints at a train wreck. Caution is the order of the day.

The first significant event is the well publicized end of the second round of quantitative easing. The Federal Open Market Committee (FOMC) in April was the last real opportunity to announce any change in direction toward a new round of quantitative easing. The FOMC meeting on June 20 is unlikely to announce any new policy.

This is the end of the Treasury-bond-purchase program and it means the Federal bank will stop buying about $225 billion of the Treasury's $400 billion quarterly funding needs. The effect on the Treasury bond market will be significant.

The two largest T-bond buyers have left the game. The Bank of Japan is committed to spending money on reconstruction after the combined effects of the earthquake, tsunami and nuclear power plant accident. They are not interested in buying US government debt. The other large buyer China has made it clear that it increasingly thinks the US is a growing credit risk.

The second significant event is the US debt ceiling. Under US law, the total amount of debt issued by the government is limited to $14.3 trillion. This limit was reached in the last week of May and no more debt can be issued until Congress votes to raise the debt limit.

Currently the US Treasury is holding off disaster by stopping contributions to government employees pension plans. Treasury figures suggest this will defer any default until August 2.

The idea that the US might default on its debt is no longer unthinkable. A substantial number of Republicans are now openly talking about a default. Republicans shut down the US government twice during the Clinton years and almost did the same again to the current government in April.

Now some argue that the US government could carry on by going into a "technical" default. This seems to mean the US government could stop making interest payments and instead issue IOUs.

It has long been assumed that since debt was denominated in US dollars that a US government unwilling or unable to pay its bills would encourage an inflationary environment. The idea of default or repudiation of debt was considered unthinkable. World markets shuddered when Mexico defaulted so there is a real danger of a full-scale panic if the US moves into formal default.

The third significant event is the financial problems of European countries. The Greek and Spanish dramas are a sideshow that pale into insignificance when compared with the mountain of debt accumulated by the US. It is important in a European context, but these are debts smaller than that of California. They are minuscule compared with the US problem, but they have provided a useful distraction from the looming US problem.

The fourth significant event is the continuing decline in the US dollar. The weak rally has retreated from $0.76 and the US Dollar Index is on the way to testing support at $0.715. The situation is worse than indicated on the chart because the US Dollar Index measures the dollar against a basket of other mainly European currencies. The US dollar is declining relative to other falling currencies.

China, a major investor in US Treasuries and, by default, in the health of the US economy, is concerned about its stake in America. China central bank spokesman and bank advisor Li Daokui says US federal and state government debt have become a serious burden which could sink the dollar even further. He said: "To tell the truth, the state of US finances is not good, and it will be difficult to avoid a sharp dollar depreciation, falling US Treasury prices and rising yields."

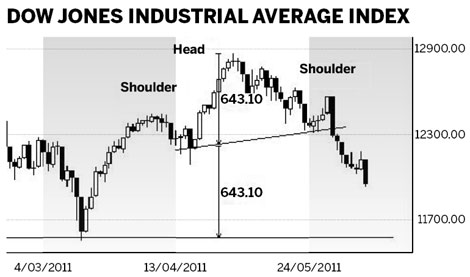

These four events are reflected in the behavior of the Dow Jones index. After peaking near 12900 the Dow has developed a pattern of retreat towards 12300. The rally from 12300 in the last week of May was followed by a dramatic retreat on June 1. The trigger events for this sell-off are not as important as the pattern that was confirmed with the retreat.

A continued fall below 12300 confirms the development of a head and shoulder pattern. This is an end of the upward trend reversal pattern and it is used to set a measured move downside target.

| ||||

The downside targets for head and shoulder patterns are often minimum targets. Markets often fall further before developing consolidation band trend rebound patterns. The developing head and shoulder reversal pattern on the Dow is invalidated if the Dow can move above 12600.

We are not sounding the tocsin bell of doom, but this confluence of factors suggests a need for greater caution and a more careful analysis of the market situation. The collateral damage from problems in the United States can be substantial as the global financial crisis proved.

Daryl Guppy is a well-known international financial technical analysis expert.

| 分享按鈕 |