A not-so-hot property

Updated: 2011-07-11 09:31

By Yu Ran (China Daily)

|

|||||||||||

Still profitable

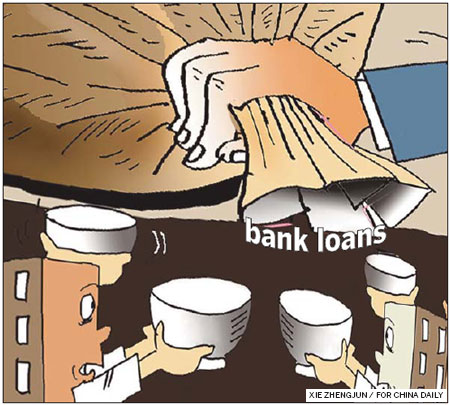

Over the years, the credit underwriting industry has flourished as the economy has boomed, with increasing amounts of private capital joining the line, providing underwriting services to real estate developers and other businesses.

"At the moment, there are some 240 underwriting agencies, asset management and investment consultancies, offering underground banking as a part of their services, in Wenzhou," said Yi.

|

As the current restriction policies only apply to the residential property market, investments in commercial real estate remain largely unrestricted.

Statistics from property agencies in Wenzhou also show an increase of roughly 30 percent in the number of commercial property deals in the second quarter of this year.

"Although profits from commercial properties will be lower than those from residential properties, and it also takes longer for developers to see the results, the real estate market is still quite profitable compared with other investment choices," said Sun Lianqun, an individual property investor. He said he owns more than 20 apartments and commercial properties in Wenzhou.

He added that the real estate market will remain his main focus of investment, in both the long and short terms, so long as he can make a profit from his investments.

Shifted focus

As property developers in smaller cities face less pressure from the restriction policies - it is mainly the major cities that have issued such measures - their businesses will stabilize as their sales increase. Many developers, therefore, have opted to explore the opportunities in smaller cities.

Peng Shangyue, a property developer originally based in Wenzhou, has launched two real estate companies in the third-tier cities of Suqian in Jiangsu province and Jinhua in Zhejiang province.

"I chose not to develop properties in popular regions in first- or second-tier cities such as Shanghai and Hangzhou, because I just want to make some money from reasonable investments," he said.

Peng said he has focused on commercial blocks in superstores and shopping malls in third-tier cities, which offer relatively lower profits but pose fewer risks than residential properties in larger cities.

As investors begin to shun the less popular residential properties in the bigger cities, many of them have moved to smaller cities and, as a result, Peng said the number of commercial properties he's sold in the second quarter has increased by about 10 percent, compared with the last quarter of 2010.

"I think I've made the right choice, because my property businesses haven't been affected by the policies so far, although the problem of financing is always our weak point," said Peng.

He admitted that he has had to borrow money from private capital holders, such as those cash-rich property developers in Wenzhou, on occasion.

"We always need cash to pay for the land use, construction work and other material costs over the short term to ensure that we get the project completed smoothly and on schedule, so we have to find secure sources of private capital in the lending network," said Peng.