'Dim Sum' goes on the menu to feed investors

Updated: 2011-08-17 09:23

By Li Tao (China Daily)

|

|||||||||||

A security guard surveys a poster featuring the Chinese currency at a branch of Bank of China Ltd in Hong Kong. [Photo / Provided to China Daily]

One year after the Hong Kong and the mainland monetary authorities further relaxed restrictions on yuan transfers, the city's yuan-denominated bond market has become the talk of the town, driven by a spate of issuance during recent months.

On July 14, the asset-management company Agincourt Capital Management LLC launched yuan-denominated convertible bonds - also known as "Dim Sum" bonds - in Hong Kong. Agincourt's bonds are specifically designed for investment in Australia's booming real-estate market.

The bonds, equivalent to approximately AS$500 million ($521 million), give investors "access to the appreciation of the yuan and indirect access to the Chinese economy through Australia", according to Agincourt's chief executive officer Craig Turnbull.

"While many commentators see the yuan appreciating, we believe the Australian dollar trends very closely with the Chinese currency ... and the Australian dollar, has, in fact, outperformed the yuan over the last 12 months, although the trend might not continue," said Turnbull, explaining the rationale for issuing yuan bonds in Hong Kong at this moment in time.

Hong Kong's yuan bond market, while still very new, is growing rapidly and is now centralized in the city, according to Turnbull, who believes more companies will come to the city to raise capital because the volume of yuan deposits is becoming huge and the cost of capital is relatively low compared with the rest of the world.

Aiming to develop the city into an offshore yuan financial center, the Hong Kong Monetary Authority (HKMA) - in effect, the city's central bank - signed an agreement with the People's Bank of China (PBOC) on July 19, 2010, which agreed that the city will impose no restrictions on yuan deposit holders who transfer cash to buy wealth-management products, thus paving the way for the development of such products.

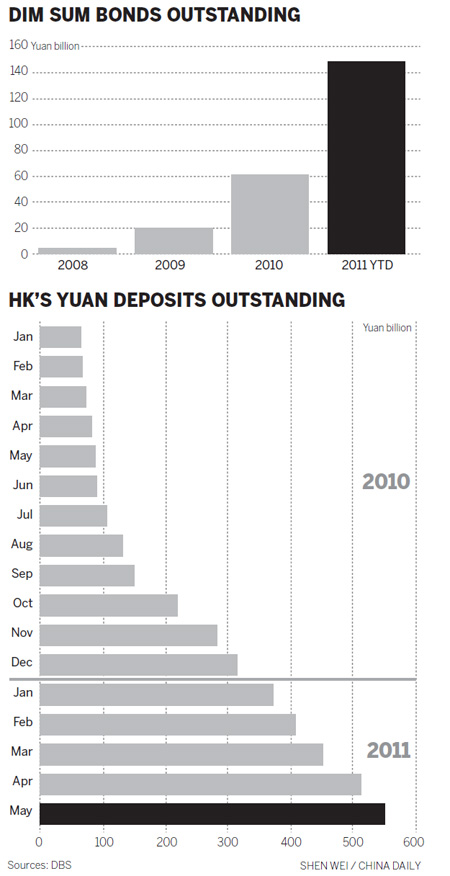

The rapid appreciation of the yuan has also increased investor enthusiasm for the conversion of Hong Kong dollars into yuan. The city's total yuan deposits reached 548.8 billion ($84.91 billion) in May 2011, almost four times more than the 149.3 billion yuan seen at the end of September 2010, according to data released by the HKMA in June.

"Many people understood this (the agreement between the HKMA and the PBOC) to be a significant development in the process of yuan internationalization, but most were surprised by the pace of development in the offshore yuan market," wrote Daniel Hui, senior foreign exchange strategist with HSBC Holdings Plc in a report on July 19.

With borrowing costs on the mainland still relatively high and yuan-based trade settlements proceeding at a rapid pace, more borrowers, especially those whose businesses have heavy exposure to the mainland, have rushed to the city to issue yuan bonds to tap the rapidly growing market.

On July 7, Caterpillar Inc, the US-based manufacturer of construction and mining equipment, sold 2.3 billion-worth of yuan-denominated bonds in Hong Kong, the biggest-ever sale by a foreign multinational company. Caterpillar also became the first foreign borrower to take a repeat shot at the nascent offshore yuan market, after its financial arm sold a two-year bond issue worth 1 billion yuan in Hong Kong in November last year.

McDonald's Corp, the first multinational company to issue yuan bonds in Hong Kong, is also reported to be planning a second sale, although in an e-mailed reply to China Daily's question its spokesperson Betty Tian declined to comment on potential financial deals. The fast-food chain sold bonds worth a total of 200 million yuan in the city in August 2010.

The Chinese steel maker Baosteel Group Corp is also expected to issue around 6.5 billion-worth of yuan-denominated bonds in Hong Kong - the largest-ever sale by a State-owned Chinese company, overtaking the 3.5 billion yuan raised by Sinochem Group from the issue of a three-year bond in January, according to media reports this month, citing unnamed sources.

The spate of issuance indicates that the offshore yuan bond market is becoming a sustainable financing venue for multinational companies and a beneficial investment vehicle for local residents, according to Joanne Yim, chief economist at Hang Seng Bank Ltd.

However, the market generally expects the yuan to appreciate for the next few years, and as a result, the rates of interest paid on the bonds remain very low.

Caterpillar's latest issue of two-year bonds has a coupon of 1.35 percent, well below its two-year dim sum bond, which had a 2 percent yield last November. It is also lower than the 3 percent offered by McDonald's yuan bond issued in August 2010.

"Although the yield of the yuan bond is not very attractive, it is better than just putting your money in the local bank. Moreover, people anticipate that the yuan will appreciate by about 5 percent each year in coming years, which is making yuan bonds a rather popular investment vehicle among Hong Kong investors these days," said Yim.

Multinational companies have a number of reasons for issuing dim sum bonds in Hong Kong, said Donna Kwok, an economist at Greater China Economics Research at HSBC Holdings Inc.

"First, Hong Kong remains the only active, functional and liquid offshore yuan market in the world, where foreign companies can raise funding in the Chinese sovereign currency," said Kwok.

"Issuing yuan-denominated bonds can also be considered a matter of prestige in terms of keeping up with the competition and trends. It's also a very effective marketing exercise, one that automatically attracts immense attention from customers and media both in Asia and the West."

"For foreign corporations with both offshore and onshore entities engaged in trade settlements, cheaper fund-raising costs offshore mean that it makes economic sense for funds to be raised in Hong Kong but spent on the mainland," said Kwok.

The issuance of offshore yuan bonds in the first half totaled 83 billion yuan, up 89 percent from the whole of 2010. The total amount of offshore yuan bonds outstanding reached 147 billion yuan in the same period, according to reports from Deutsche Bank AG in July.

The bank has revised up its forecast for new issuance this year by 23 percent to 160 billion yuan and said it expects outstanding dim sum bonds to reach 230 billion yuan by the end of the year.

Fast economic growth in Asia and the expectation of yuan appreciation have attracted a lot of fund flows from all over the world, according to Vishal Goenka, Deutsche Bank's head of local currency credit in Asia, who noted that monthly transactions of yuan bonds in the secondary market had reached 3 billion yuan by May, a far cry from the 200 million yuan recorded at the start of the year.

On July 18, Deutsche Bank also launched a tradable offshore yuan-bond index tracker, which monitors the performance of 42 yuan bonds at the initial stage, to boost its presence in the growing offshore yuan business.

A number of lenders, including HSBC Holdings PLC, Citigroup Inc, BOC Hong Kong (Holdings) Ltd and SinoPac Securities (Asia) Ltd have already launched indices for yuan bonds.

"The offshore yuan market is still in its infancy, and we expect growth to remain exponential," said HSBC's Hui, who estimates that by the end of the year the yuan deposit base will top one trillion and the gross issuance of bonds will reach as much as 230 billion yuan.

The rapid development of Hong Kong's offshore bond market is expected to continue. At the same time, an increasing number of yuan-denominated investment products will be introduced and will flourish, according to HSBC's Kwok.

"Not only will competition between these products gradually encourage higher yield offerings over time, but investors will become increasingly astute at differentiating between potential returns attributable to currency appreciation versus fundamental asset quality," she added.