Editor's note: There are concerns lingering on China's banking sector. China's banking shares are priced at their lowest range in a long time, which reflects investors' expectations that the sector may pose too many risks. But how risky is the banking sector? Different parties have quite different viewpoints.

Fitch reiterates warning on China's banking system

Fitch Ratings Inc again warned of significant risks to China's banking system over the next few years, saying the property market poses the biggest threat. [S&P lowers developers' outlook in China]

A Fitch analyst said at a seminar the ratings firm was more concerned about the property sector than local government financing vehicles, even as the latter have taken on substantial amounts of debt. [Full Story]

Except for loans through local financing platforms and real estate loans, Chinese banks should not underestimate the risk exposure of infrastructure facility loans. [Full Story]

Fitch Ratings warns Chinese banks on asset quality risks

Fitch Ratings warns Chinese banks on asset quality risks for their relatively low viability ratings, the National Business Daily reported.

The international rating agency assigned its newly launched viability ratings (VRs) to a total of 16 Chinese commercial banks, finding their VRs ranging from bb to b. [Full Story]

Local debts controllable amid tightening regulations

Senior Chinese officials from the nation's central government departments said that debt risks facing local governments are controllable as regulations are increasingly tightening to prevent such risks. [Audit concerns provinces' debt-GDP ratio]

The debt-to-GDP (Gross Domestic Product) ratio covering both the central and local governments was less than 50 percent, which was far lower than that of the world's major economies currently mired in debt crises. [Full Story]

Local govt loan risks 'under control': CBRC

China's top banking regulator has said that local government debt risks are "under control" and efforts to ease them are "going smoothly".

Liu Mingkang, chairman of the China Banking Regulatory Commission (CBRC), was quoted as saying in an interview published in the Wednesday edition of the People's Daily that the CBRC has been closely monitoring local financing vehicles and working with local governments to help them manage their debts.

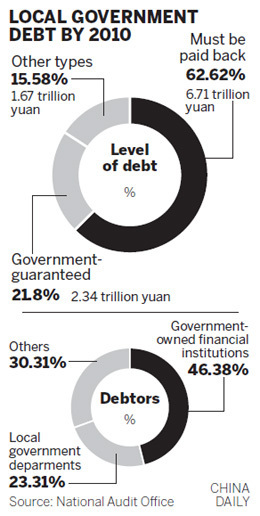

Local government debt totaled 10.72 trillion yuan ($1.66 trillion) at the end of 2010, the National Audit Office announced. [Local govts' overall debts hit $1.65 trillion]

Efforts to overhaul existing local financing vehicle loans and reduce debt risks have been "progressing in an orderly fashion", Liu said.[Full Story]

Local govt debt risk 'is under control': MOF

Local government debt is "controllable", the Ministry of Finance said on Monday, easing fears that bad loans could derail the world's second-largest economy.

"Judging from the audit results, local government debt is, generally, controllable, though there are potential risks in some areas," the ministry said in a statement posted on its website. [Full Story]

China banking chief warns of shadow banking risks

Liu Mingkang, chairman of the China Banking Regulatory Commission called for banks to step up their prevention of risk associated with shadow banking, which has expanded amid tightening liquidity this year.

Shadow banks are non-banking financial institutions that function like commercial banks. These institutions include insurers, mutual funds and private equity funds.

The CBRC will strictly examine all financing products promoted by commercial banks to ensure that risk from these products will not extend into the banking system, Liu said. [Full Story]

China to re-book some local govt loans

Chinese regulators have been rejigging local government debts to ease risks to banks, the China Securities Journal reported on Monday, citing a source who said over 40 percent of the troublesome local government debt falls due this year and next.

The "authoritative source" told the paper that about a third of loans granted to local government financing vehicles, or some 2.8 trillion yuan ($438 billion), will be booked as general corporate loans. Banks can then put fewer provisions for these loans, a move that is set to relieve the pressure on banks to raise fresh capital.

If true, it would mean that the problem of local government financing vehicles would have a less severe impact on Chinese banks than previously expected as long as the loans don't go sour. [Full Story]

China caps quasi-municipal bonds: NDRC

China will steadily increase the issuance of urban construction investment bonds but will limit total local government debts at 100 percent of their revenues, Reuters reported, citing the National Development and Reform Commission.

"It's unnecessary to short urban construction investment bonds based on irrational judgment on China's local government bond risks," he told the China Securities Journal in an interview. [Full Story]

|

|

|

Sources: the attitudes towards Chinese banks of the international rating companies have always been discriminatory, based-on China's poorer sovereign rating than the OECDs'. Therefore, reducing the rating of Chinese banks is not justified, and the value of these banks is quite underestimated.

In the first half of 2011, loans extended to local government financing vehicles and overcapacity industries accounted for a smaller share of the Bank's overall credit portfolio, while growth in real estate loans dropped significantly compared to the same period of last year. Asset quality remained stable. [Full Text]

As at the end of June 2011, identified impaired loans totalled 62.694 billion yuan, while the ratio of identified impaired loans to total loans stood at 1.01 percent, decreases of 1.182 billion yuan and 0.12 percentage point from the prior year-end, respectively. The allowance for loan impairment losses to non-performing loans was 217.29 percent, up 20.62 percentage points over the prior year-end. The Bank's credit cost was 0.43 percent, down 0.01 percentage point compared with the first half of 2010.

The Industrial and Commercial Bank of China Limited (ICBC) paid special attention to the changes in the real estate market under macro-control, took a series of risk management measures such as exerting reasonable control over total credit, tightening customer access standards and intensifying post-loan management.

Additionally, it also recognized and cleared risks regarding to the loans in relation to Local government financing vehicles and took measures such as confirming the legitimacy and validity of collateral and pledged assets by loan, thus effectively controlling the risks in the loans in relation to Local government financing vehicles.

The Agricultural Bank of China (ABC) strictly restrained loans to government financing vehicles and real estate, and strengthened the control of the existing loans to government financing vehicles, conducted bank-wide inspection of the risks on loans to government financing vehicles, enhanced customer list-based management, analyzed and monitored the risks of each core account, and strengthened the management of due loans.

The Bank carried out more prudent risk classification standards on loans to government financing vehicles. The Bank also raised the approval criteria of real estate customers and projects, and implemented imperative exposure limits.

In response to the latest developments in the real estate market, the China Construction Bank (CCB) took the initiative to control the growth of property loans, and the loans to real estate industry grew by 4.09 percent year-on-year in the first half of the year 2011.

Produced by Song Jingli and Zhi Yun [Back to chinadaily.com.cn]