|

|

|

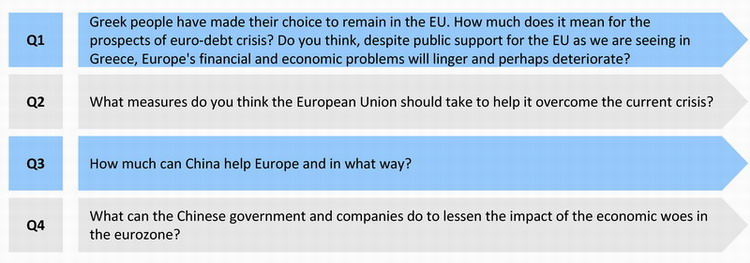

Editor's note:

The world may have breathed a sigh of relief at the results of the Greek election, which showed a choice to stay with the European Union. But Chinese economists and business leaders have hastened to point out that the eurozone debt crisis is far from easing up. On the part of China, many worries persist - ranging from a lingering slowdown in trade to a possible exodus of European capital, and even to a larger financial crisis affecting the global banking industry. While looking forward to a more capable European leadership, many Chinese believe, as implicit from the following interviews, that China can continue to help the crisis-stricken region in one way or another. Chinese leaders have said many times that the more Europe remains united, in spirit and in action, the more it can count on a concerted support from the international community, in which China will certainly play a due part.

|

|

The election result of the Greek Parliament can help (the country) implement austerity measures and continue to take bailouts. It is also a benefit for the stabilization of the European financial system. However, the possibility of a Greek exit has not yet been eliminated as the crisis may deepen in the next two or three years. Other countries may also have the potential to quit the eurozone, adding risks to the global economy.

At the same time, market-based debt restructuring should start along with financial retrenchment. To some extent, fiscal integration on the continent should be accelerated with the help of issuing eurobonds.

The steady growth and reform of the Chinese economy can increase confidence of the global market, especially providing trade and investment opportunities for the EU countries, which can help them get out of their dilemma. The Chinese government should encourage domestic companies to expand investment in Europe while improving risk management capacity. It can also inject new vitality into economic growth. More preferential measures can be introduced to attract European companies to increase investment in China and reduce their market risks.

China should maintain the continuity and stability of macroeconomic policies. More fiscal and monetary fine-tuning measures need to be taken to support the development of the manufacturing industry. Encouraging expansion of the real economy such as manufacturing and stimulating domestic demand can help stabilize GDP growth while accelerating economic restructuring. What should be avoided is to expand supply recklessly. The tight measures for the property market should not be eased soon, and more market-based reform is expected to rebalance development among different industries. ??????????????????????????????? -----Wang Haifeng Director of international economics, Institute for International Economic Research,

|

|

Although all the stakeholders could be relieved for a while, it's impossible that the debt crisis will come to an end in the short term. Austerity is too shortsighted a method to solve the debt problem. In the future, the eurozone must put more emphasis on stimulating economic growth, otherwise Italy will be the fifth country to beg for aid.

First, the European leaders must find ways to save the banks, to make sure the banks don't fail. While implementing austerity, the eurozone should reach a consensus on issuing EU bonds. And the European Central Bank could further intervene in an "appropriate" way to provide backup for the countries in trouble. It should be allowed to purchase European treasury bonds directly, or buy the treasury bonds from the vaults of commercial banks.

China also has to take on more obligations to help Europe overcome the current difficulties. But given the high-level risks of the eurozone, it's better for China to help through international institutions such as the IMF, which has better credit and would work as an underwriter for Europe. However, the government should keep in mind that Europe leaders should, and still could solve their own problems in a decent way.

For the government, it should watch how the situation develops very carefully and maintain smooth communications with European leaders. The authorities could also help create more investment opportunities for enterprises that are interested in developing business in Europe.

-----Song Hong

Senior researcher, Institute of World Economics and Politics,

|

|

I hope now that the political leadership that created this crisis will be able to agree on a plan to solve it.

The last two-and-a-half years of austerity have hit the weaker classes without improving productivity because of a lack of structural reforms.

-----Christos Vlachos

Managing Partner of Silky Financiers Ltd in Greece

|

|

Before the crisis, we used to admire the service sector's large share of the (Western) economy, usually above 80 percent. Now in time of crisis, we see the damage of high indebtedness and it is difficult for the service industry to generate growth quickly. It is the manufacturing sector that is really powering growth and improving productivity. Now I see slight hope for the EU to restore its resilience, unless a major technology revolution emerges and ramps up productivity.

The euro debt crisis unfolded in the past year, but China's trade in 2011 grew 22.5 percent to hit $3.64 trillion. Compared with weakening external demand, domestic factors, like the rising labor and raw material costs, pose a bigger threat to China's exports. China has already taken several steps to counter weakening demand, such as reducing some consumer goods tariffs. I think generally China should expand its imports, with moderate growth in consumer goods. There is concern that as the eurozone debt crisis deepens, there may be an exodus of European capital from China. At present, I think this is unlikely. I think we should not worry too much about foreign direct investment. China's current situation differs greatly from 30 years ago when we were cash-strapped. Compared with money, advanced equipment and technology are more urgently needed.

-----Li Yushi

Vice-president, Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce,

|