Risk to State-owned banks 'still there' as stimulus projects ratchet up pressure

Large State-owned lenders had more loans made to local governments through financing vehicles in the first half of 2012 than in the previous six months.

Most large State-owned lenders, including the Bank of China Ltd, China Construction Bank Corp and Agricultural Bank of China Ltd, reported that they had more outstanding loans to the vehicles from the beginning of the year to the end of June than in the immediately preceding six months. The one exception was Industrial and Commercial Bank of China Ltd.

|

Industrial and Commercial Bank of China Ltd's booth at an exhibition in Fuzhou, Fujian province. [Photo/China Daily] |

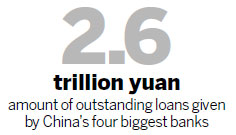

The banks, collectively called the Big Four, had 2.6 trillion yuan ($410 billion) in outstanding loans on their books by the end of June, up by 500 billion yuan from six months before.

Bank loans are the source of about 80 percent of all local government debts taken out through financing vehicles, and the Big Four were the source of nearly 50 percent of the total, according to official statistics released last year.

"Apparently, the risks related to these loans are still there," said Guo Tianyong, banking research director at the Central University of Finance and Economics. "But generally speaking, the current situation is better than at the end of last year, as there is a lower ratio of non-performing loans among these loans and higher provision coverage.

"And banks may have increased lending to certain projects to overcome their temporary liquidity difficulties."

| ?

|

He said most of the projects have enough cash flow to repay most of the outstanding loans and, when that's not the case, local governments will make arrangements to pay off the debts.

Even so, a slower increase in the amount of fiscal revenue being collected has given rise to more uncertainties, Guo said.

Year-on-year increases in fiscal revenue eased to 8.2 percent in July from 9.8 percent in June, as the current slowdown in China's economy stretched into its sixth quarter and the authorities declined to relax limits they have placed on the property market. Those limits affect local governments' ability to raise revenue through land sales.

The amount of Bank of China's outstanding loans to the vehicles rose by 27.6 billion yuan to 422.5 billion yuan in the first six months of the year, while that of China Construction Bank increased by 12.8 billion yuan to 442.6 billion yuan, according to their interim results released in late August.

Agriculture Bank of China's loans to the vehicles increased by 14.5 billion yuan to 414.2 billion yuan during the same period, an amount making up 7 percent of its total outstanding loans.

Industrial and Commercial Bank, meanwhile, said its outstanding loans to the financing vehicles declined by 2.3 billion yuan from the end of 2011, and its percentage of non-performing loans among those loans stood at 0.67 percent, down by 0.06 percentage point.

Concerns over the quality of assets related to local government loans have become more intense as the country's economy continues to lose steam and the National Development and Reform Commission accelerates its approvals of local construction projects in an attempt to shore up the economy.

Analysts have calculated that 1.84 trillion yuan worth of the vehicle loans will be due in 2012, and 1.22 trillion yuan will mature next year. Yet, despite predictions of difficulties ahead, figures for the first half showed that defaults weren't as common as expected.

China Citic Bank said it collected all of the loan repayments that were owed it in the first half, while Hua Xia Bank Co Ltd said it didn't experience any defaults in the same period, during which 60 percent of its loans to local financing vehicles became due.

"The amount of outstanding loans increased somewhat in the first half," said Liu Yongsheng, deputy manager of Agricultural Bank of China's risk management department. "But as long as projects still generate sufficient cash flow to cover the repayments, and there are enough mortgages to liquidate, the loans will be safe."

Li Lihui, president of Bank of China, said Bank of China plans to reduce the amount of such loans it carries on its books and strictly control its lending to industries that have too much production capacity and use large amounts of energy.

Any economic easing policies that the government adopts to shore up the economy will probably help to ensure more such loans are repaid and lessen the capital pressures that are weighing on local governments in their infrastructure projects, said Xu Wenbin, an analyst at Bank of Communications.

But the repayments might become less certain after decision-makers at the provincial or municipal levels announce local investment plans valued at 7 trillion or even 8 trillion yuan, Guo said.

"The projects are a new threat, as they will add to local government liabilities and make repayment of former loans even harder."

Moody's Investors Service Inc said in a newsletter on Monday that a net increase in local government debt amounting to only 0.001 percent of the country's GDP in 2011 - evidence that such debts had been effectively contained.

wangxiaotian@chinadaily.com.cn