Tough conditions set to continue for a few years on high fuel costs, weak economy

Even though the shipping industry usually enters its peak season during the third quarter of the year, it now finds itself struggling as the world economy continues to grow sluggishly and China's economy slows down.

Amid these circumstances, many companies are saying that they expect tough market conditions to persist for another few years.

Losses have been widespread in the industry. China COSCO Holdings Co Ltd, controlled by the State-owned shipping conglomerate China Ocean Shipping (Group) Co and the country's largest shipping line measured by capacity, registered a loss of 4.87 billion yuan ($766 million) during the first half of this year, up from a deficit of 2.76 billion yuan during the same period a year ago. The latest figure marked the company's sixth consecutive quarterly loss.

China Shipping Container Lines Co, under the State-owned China Shipping (Group) Company, saw a loss of 1.28 billion yuan during the first half, up from a loss of 630.3 million yuan in the same period last year. The company's profit of 173 million yuan during the second quarter was offset by a loss of 1.45 billion yuan in the first.

Shipping companies blamed the industry's woes in part on the difficult market conditions that have resulted from surging oil prices, an oversupply of vessels, depressed freight rates and the world economy's lackluster recovery.

Meanwhile, the third quarter, which is when many Western retailers begin placing Christmas orders and is thus usually a peak season for the shipping industry, is unlikely to see an increase in cargo volumes this year, they said.

"We expect the global container demand to bottom out in the third quarter before improving somewhat in 2013," said Soren Skou, chief executive of Maersk Line, the container unit of the Danish shipping conglomerate AP Moller-Maersk Group.

The company forecast that global demand for shipping containers will remain weak in the near future, a result in part of the world economy's slow growth.

Compared with an average annual growth of 10 percent during the past 45 years, "we expect global container demand growth to stay at 5 to 8 percent in the next few years," Skou said.

But the poor prospects for global trade do not necessarily suggest that there is nothing but losses ahead. Shipping companies, for one, have managed to raise their freight rates.

And to save on fuel, they have reduced the traveling speeds of container ships, taking them down from about 20 knots to about 17 knots.

At the same time, the companies laid idle their ships. According to data from Alphaliner, an industry consultancy, the global volume of the idled container ship fleet surged by three times from last year to 467,000 twenty-foot equivalent units by the end of July.

These steps have helped shipping liners restore their profits, analysts and companies said. Maersk Line is one example of this. Despite reporting a financial loss of $372 million for the first half of the year, the Danish company managed to make a profit of $227 million during the second quarter, compared with a loss of $95 million in the same period last year. The group has also improved its expected results for this year.

Even so, companies still find that freight rates are too low to let them make profits and have announced plans to increase them further.

Maersk Line said it plans to raise them by between 10 and 20 percent for its Asia-Europe route on Nov 1.

"We expect (container) rates to hold up somewhat, but potentially with a sliding tendency if deployed capacity reveals itself as abundant," Peter Sand, chief shipping analyst at the Baltic and International Maritime Council, said in a market report.

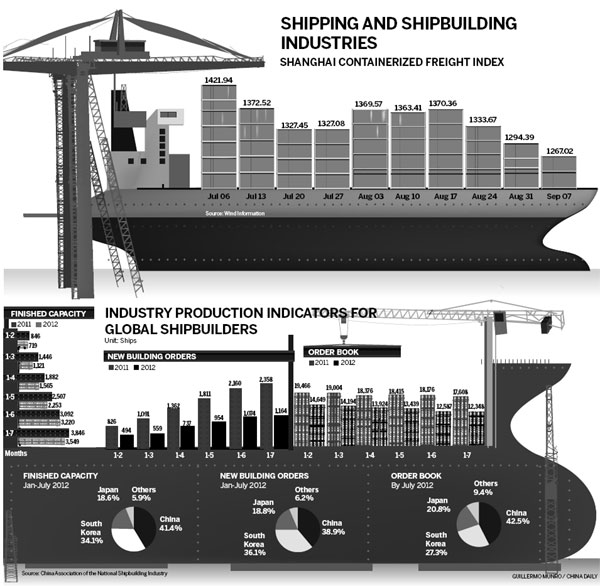

The Shanghai Containerized Freight Index, a measure established by the Shanghai Shipping Exchange to reflect spot rates on the Shanghai transport market for export containers on the world's chief trade routes, rebounded to around 1,200 this week from around 900 in late 2011.

zhousiyu@chinadaily.com.cn