The capital raised through IPOs in China's A-share market may increase by up to 30 percent in 2013 after the amount plunged to a three-year low in 2012, Ernst & Young said on Tuesday.

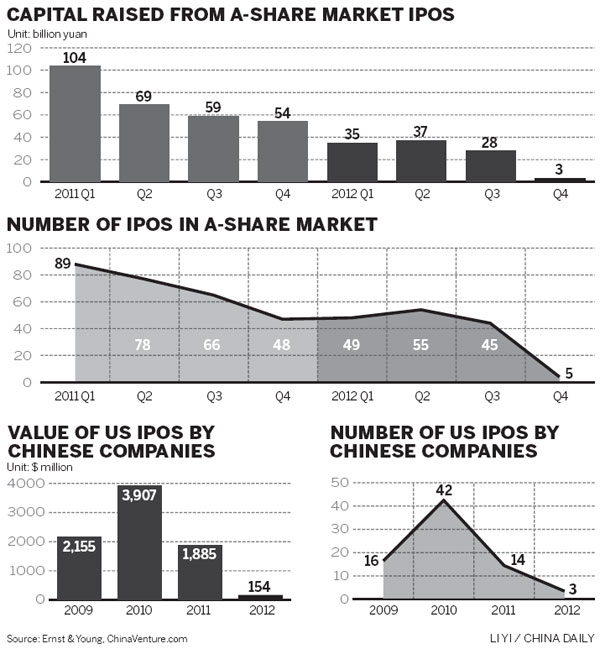

This year, the total number of IPOs in the A-share market is on a course to fall by 45 percent to 154, and the total amount of money raised is likely to decrease by 63 percent to 103 billion yuan ($16.5 billion), according to a report published by the company. Ernst & Young blamed the decline on the slowing economy and tougher regulatory supervision.

Exampled by quarter, the number of IPOs fell from 89 in the first quarter of 2011 to a meager five in the last quarter of this year. The China Securities Regulatory Commission hasn't approved a new issuance since October.

Another cause of the decline this year has been a lack of a large IPO deals. For example, the equipment maker CITIC Heavy Industries Co Ltd, which raised 3.2 billion yuan in a recent offering, the second-largest amount among any company to hold an A-share IPO this year, would not have even made the top-10 list last year.

China, was the site of 30 percent of all IPO deals in the world, the largest percentage globally, the report said.

The country also ranked second measured by the amount of capital it raised, following the United States, the report said.

The A-share market's poor performance came amid a sluggish global market that saw the amount of capital raised decline by 30 percent to $118.5 billion and the number of deals decrease by 37 percent to 768 IPOs.

"But, eventually, we'll see a rainbow after the storm," said Terence Ho, Greater China strategic growth markets leader for Ernst & Young.

Although IPOs are expected to remain scarce in the first quarter of 2013, Ho said the policies of China's new leadership will lead to IPOs becoming more common in the second quarter.

He said that will especially be true among companies in certain industries and regions, citing "the environmental protection industry and western provinces".

"A reasonable estimate would be for the number of IPOs for the whole year to increase by 20 to 30 percent, which means the total amount of money raised will be around 130 billion yuan."

In 2012, ChiNext, a NASDAQ-style exchange that tracks high-tech companies, ranked first among all A-Share markets measured by IPO numbers and total money raised.

More than 800 companies have filed with the China Securities Regulatory Commission to hold IPOs on the A-Share market, seeking to raise an estimated 500 billion yuan.

Since regulators cannot approve all of those deals at once, Ho suggested that more companies, especially small and privately owned businesses, may try to hold IPOs on the H-share market.

The regulatory commission now requires companies seeking to issue shares in the Hong Kong market to have at least 400 million yuan in net assets, a goal to raise at least $50 million through an offering and at least 60 million yuan in annual net profits, standards largely tailored to accommodate State-owned enterprises.

Ho said authorities are looking at removing such restrictions.

China International Marine Containers Co Ltd recently moved its shares from the B-share market to the H-share market, a change that is likely to be followed by more such "B-to-H conversions", especially by companies that want to expand overseas, Ho said.

Ernst & Young's report estimated more than 80 IPOs will take place in the Hong Kong market in 2013, raising HK$130 billion ($16.8 billion), up from this year's HK$ 88 billion.

weitian@chinadaily.com.cn