|

|

|

|

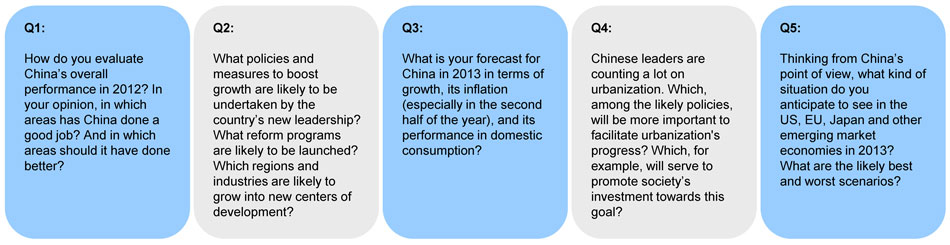

Editor's Note: In 2012, China's economy encountered more difficulties than it would in a normal year. Some difficulties are, so to speak, imported - like the sluggish demand from its major trade partners while they were trying, with difficulty, to solve the problems brought by the financial crisis of four years ago. Other difficulties stem from precautions the country has taken to prevent wider trouble - controlling inflation, repressing surging prices in the real estate market, and slowing resource-and energy-intensive industries. The main purpose of these efforts is to make the economy less dependent on exports and inexpensive labor, and more on quality production and domestic consumption. A new phase of this endeavor began as the new national leadership, headed by Xi Jinping, emerged from Beijing's power transition in November. At the Central Economic Work Conference last week, policy makers decided to muster "greater courage and wisdom" to take the nation's reform and development forward. Society's initial response to the renewed commitment to reform was clear. The Shanghai stock market saw its strongest rally in two years. But how do economists assess China's opportunities in 2013 after studying the Central Economic Work Conference communique? What changes are they looking forward to? And what dangers do they think China should watch out for? We invited five of them to share their views.

|

|

|

Corporations reduced their inventories throughout much of 2012, and excess capacity became a concern as demand weakened. Corporate profits dropped sharply. But there is less of a push now to reduce inventories, and industrial profits are increasing again in the fourth quarter.

We expect the leadership to push forward in 2013 with measures that have already won wide support. These may include reforms to energy prices and resource taxes, as well as developing the bond market and expanding pension and health insurance. I think various services, particularly healthcare and public services, should be developed more rapidly.

We expect the US economy to maintain a modest growth rate (2.3 percent), Europe to stagnate and Japan to grow very little. Emerging markets may recover somewhat from 2012 as their exports become more stable and they no longer have to worry about inflation when setting their monetary policies. For China, this means the rate of increase for exports will become stable at about 8 percent. In the best case, the US will show strong growth if it avoids the fiscal cliff. And the crisis in the eurozone will be resolved. In the worst case, the US will go over the fiscal cliff, driving down the country's growth. Or the eurozone crisis will worsen. ----- Wang Tao chief China economist with UBS AG |

|

|

The country's fiscal and monetary policies this year were appropriate, showing the government's good assessment of the international situation. The country's GDP growth this year, I estimate, may be in the range of 7.5 to 7.8 percent. The economy bottomed out in the third quarter and stabilized in the fourth quarter, but it is still hard for the economy to rise above 8 percent for 2012. Looking forward, the global economy still needs five to six years to completely shrug off the recession.  I don't think the new leadership will roll out a large-scale economic stimulus package next year. In fact, there is little room for them to maneuver with fiscal and monetary policies, but they can do more with the social welfare system by building more kindergartens, schools and hospitals. Meanwhile, the government has approved a number of mass transit rail projects this year, which will help to boost investment in the coming two to three years.

Considering the leadership transition next year, steady development should be a primary concern for the central government. They may first promote reform in social security and income distribution. If GDP growth does not exceed 8 percent, it is not difficult to keep the CPI between 2 to 3 percent, as China's CPI pressure is mainly decided by the country's monetary policy. Consumption growth next year will be around 13 to 15 percent, almost the same as this year.

Emerging economies, which face very similar challenges to China, will see a slowdown in their GDP growth. All that means China's imports and exports are not likely to improve much next year. ----- Wang Haifeng director of international economics at the Institute for International Economic Research |

|

|

The key limitations are as follows: limited progress so far on rebalancing towards a more consumption-led growth model, and still a lack of clarity about how the buildup of debt in 2009-10 will be dealt with. That debt overhang, as we see it, is a key factor behind the Negative Outlook on China's local currency rating of "AA-". The foreign currency "A+" rating, meanwhile, remains well supported at Stable Outlook by China's exceptionally strong foreign currency sovereign balance sheet and $3.3 trillion in official reserves.

Investment cannot go on growing faster than GDP, or it will start to outstrip even China's huge domestic savings, and China would become a current account deficit country, which we think the authorities would wish to avoid. One key question is how quickly the authorities make progress on structural reforms to facilitate rebalancing. These could include, but are not limited to, financial liberalization and strengthening of household incomes.

The point is how efficiently capital is invested, along with the fundamental macroeconomic constraint of the investment-savings balance. There is another constraint in terms of the ability of the financial system to grow the credit to fund further sharp rises in investment, which we think is pretty limited, given the banking system's weak capitalization and emerging strains in liquidity.

----- Andrew Colquhoun head of Asia-Pacific Sovereign Ratings with Fitch Ratings |

|

|

The highlight of the economic situation in 2012 was the increasing contribution of consumption. In the past 10 years, the contribution of final consumption expenditure to GDP has lagged behind that of investment, but that trend was reversed in 2012.

But that doesn't mean that some investments, especially those needed to accelerate urbanization, won't be made. A host of reforms could be launched in 2013, including the overall plan for income distribution, pricing reforms of energy resources, and measures to improve equality of public services. Industries related to people's livelihoods, such as education and healthcare, are facing a period of opportunities to meet the current gap between supply and demand.

However, external factors also matter as the latest rounds of quantitative easing in the United States may trigger higher imported inflationary pressure.

Most of the migrant workers still face barriers when trying to access equal social welfare. Local governments must reduce their reliance on land finance deals, and urbanization should be market-oriented instead of led by administrative orders.

The worst scenario is a breakup of the eurozone, but that's not likely. The economic situation in emerging economies may be a bit polarized in the coming year. The Indian and South African economies may face greater pressure, while the outlook for the Chinese, Russian and Brazilian economies is more optimistic. ----- Kuang Xianming director of Economic Institute at the China Institute for reform and Development |

|

|

But still there is not much of a driving force for economic growth. A large portion of investment has been wasted without carefully calculating possible output and long-term interests. The quality and cost of local government financing vehicles needs to be given more attention.

Inflation could rise slightly in the next year. Food prices will remain uncertain. If there is extreme weather, the rising price of grains and vegetables may offset the falling prices of manufactured goods. China's urbanization rate has surpassed 50 percent, but the data also take into account a large percentage of migrant workers who haven't become official urban residents. Without reforms to the hukou (household registration) system, these migrant workers cannot really become urban residents. According to research, a city dweller spends about three times as much as a rural resident. Rapid urbanization doesn't only lead to housing and real estate development. It should also be accompanied by more job opportunities, public services and improvements to the quality of educational and medical systems. All of this will bring opportunities to more public and private investors.

According to our research, Asian economies, excluding Japan, will grow by 6 percent this year and 6.6 percent in 2013. Both figures are 0.1 percent lower than what was expected in October. The US economy is seeing signs of recovery and the European economy won't be worse than it was this year, although its debt troubles persist. I think external conditions will see some improvements in the coming year. ----- Zhuang Jian senior economist with the Asian Development Bank |