Repo announcement causes market jitters

Despite the assurance of a flexible monetary policy, the announcement by China's central bank last week of repos worth 30 billion yuan ($4.9 billion) has continued to cause market jitters.

The People's Daily cited data released by the People's Bank of China on Monday, saying the broad M2 money supply reached 103.61 trillion yuan by the end of March, making up a quarter of the world's total.

The PBOC last week announced it would drain 30 billion yuan from money markets through a 28-day bond repurchase.

The central bank had for nine consecutive weeks drained money from the market to mop up excess liquidity in the banking system since the Spring Festival.

But analysts are not expecting a much-loosened monetary policy.

"The PBOC is aiming to stabilize the money rate at a reasonable low level through open market operation. Data for the first quarter show weaker-than-expected economic growth and rising CPI momentum," said Lian Ping, chief economist with the Bank of Communications.

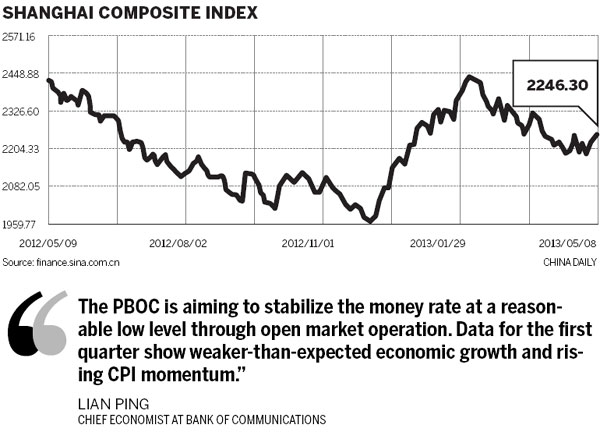

The central bank's modest steps in recent months to tighten money supply to ease inflationary pressure have sent a chill through the stock market and stopped the rally in its tracks since the end of 2012.

The widely watched Shanghai Composite Index has plunged by about 8 percent from the high level reached in late February, despite occasional spurts, to close at 2,205.5 on Friday.

A repo plan was introduced in June when the property market was driven to frantic levels by overflowing liquidity, prompting the government to introduce various cooling measures. But there are signs that the property sector is back on the boil after a lull.

Another repo plan was announced at a time when the government reiterated its commitment to maintaining a stable property market.

This has apparently brought many stock analysts and investors to the view that the central bank may introduce further measures to tighten liquidity.

To be sure, few property developers are listed on the stock exchange and their weighting on stock market indicators has remained small.

But the fate of the property sector is intractably tied to that of the banking sector, which dominates the index weighting, because a large portion of total bank loans are tied to properties, either in the form of development financing, mortgages or other lending with property as collateral.

It was clear before and after New Year's Day and the Spring Festival that liquidity was the loosest it had been in the last three years, but it is also natural that the PBOC has to moderately regulate the loose liquidity.

"As the PBOC specifically emphasized the possible impact of expectation changes on future prices' and the economic recovery, demand expansion may be transmitted more quickly to the CPI," said Chen Li, head of China equity strategy at UBS Securities Co.

The central bank said it would tighten liquidity by issuing up to 30 billion yuan of repurchase orders, or repos on May 2, instead of reverse repos, which inject funds.

Some analysts have concluded that the PBOC had turned hawkish.

"The re-introduction of a longer-dated draining operation suggests a hawkish bias as it means removing liquidity for a more extended time," said Dariusz Kowalczyk, senior Asia economist at Credit Agricole in Hong Kong.

However, many analysts said they believe the recent credit tightening is a move from the central bank to moderately tighten liquidity, due to concerns over a possible flood of hot money, the overheating property market and inflation risks. There is no clear signal that the central bank's position is turning hawkish.

"We believe that the PBOC will not cut lenders reserve requirement ratios throughout 2013, given signs of a recovery and rebound in housing prices for first-tier cities. We believe the central bank will continue to rely on reverse repos to manage liquidity," said Lucy Feng, co-head of regional banking, Research for Asia ex-Japan, Nomura.

China's stock market has seen a strong rally since December after it hit a four-year-low at 1,949 earlier that month. It rose by almost 5 percent in January, but began to fluctuate after the seven-day Spring Festival holiday.

The benchmark SCI has struggled to stay about 2,200 since late April. Analysts said concerns over capital market liquidity drain, the authority's clamping down on the property sector and a weaker-than-expected economic recovery are the major causes.

Bad news on overseas capital, liquidity, the economic recovery and real estate controls constitute short-term correction pressure on the index.

Following the rapid run-up of the index, perhaps the market needed an excuse for correction, said Chen, head of China equity strategy at UBS Securities Co.

"People were pricing in tightening risks, and hence there is a discount in stock market valuation," said Wendy Liu, head of China equity research at Nomura.

With slower growth and lower-than-expected inflation, that risk is being pushed out, Liu said. She sees April and May as the "bottom" for the market and forecasts up to 15 percent upside for the MSCI China in the following months.

"Bank and property shares have led the last round of rally in the A-share market. If taking a long-term scope, the rally will still continue, as economic recovery and consumption growth are still sure to continue," said Liu Jun, an analyst with Changjiang Securities.

"The revaluations of the shares just unfolded. And we will have some corrections in the process."