Offshore yuan faces slower H2

Growth in the offshore yuan market will slow in the second half as expectations recede for further appreciation of the currency, Standard Chartered Plc said on Monday.

In the longer term, offshore yuan centers, including Hong Kong and Singapore, will maintain their momentum, as businesses shift from holding the yuan to speculate on its appreciation to actual use of the currency in their daily operations.

On Monday, the yuan weakened against the dollar for a second day to 6.137 yuan per dollar. It has appreciated about 1.5 percent year-to-date.

An index compiled by Standard Chartered that tracks the progress of the yuan business recently breached 1,000 points for the first time. The index stood at a high of 1,002 points in May, up 8.4 percent from the previous month and 66.2 percent year-on-year.

The index, which started on Dec 31, 2010 at 100 points, tracks yuan activity in Hong Kong, Singapore and London.

Kelvin Lau, a senior economist with Standard Chartered, said that expansion in yuan activity may slow in the remainder of the year due to a challenging macroeconomic environment and a pause in yuan appreciation.

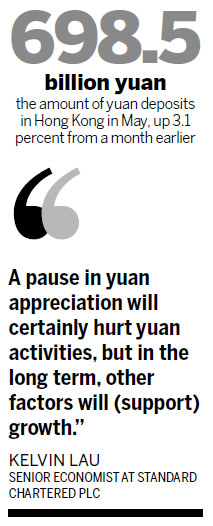

"A pause in yuan appreciation will certainly hurt yuan activities, but in the long term, other factors will (support) growth," said Lau. He expects the index to rise another 20 percent.

Total yuan deposits in Hong Kong, the world's biggest yuan center, will likely reach 700 to 750 billion yuan by year-end.

The Hong Kong Monetary Authority said last month that yuan deposits in Hong Kong rose to 698.5 billion yuan in May, up 3.1 percent from a month earlier.

Many investors in Hong Kong, especially individuals, hold yuan solely for appreciation, and a pause would make them reluctant to buy more of the currency, resulting in a slowdown in deposit growth.

Real corporate demand, in comparison, has been strong. A total of 88 percent of respondents to a corporate survey by Standard Chartered are either using offshore yuan products or considering doing so over the next six months. That was up from 76 percent in the last survey.

Total offshore yuan bond issues will reach 325 to 350 billion yuan this year, more than double the 150 billion yuan in 2012, according to Standard Chartered. So far this year, yuan bond issues have reached 225 billion yuan.