To keep pace with the prospering banking sector regulations should focus on quality and structural optimization

widespread drastic slump in the prices of financial stocks has sparked grave concerns and intense speculation about whether the world's second-largest economy is suffering a money squeeze.

However, according to data released by China's central bank, the country's M2 supply grew 15.8 percent year-on-year in May and its deposit balance approached 100 trillion yuan ($16 trillion). The volume of its social financing reached 9.11 trillion yuan in the first five months of this year, an increase of 3.12 trillion yuan from the same period last year. China's lending balance had reached 67.22 trillion yuan, a 14.5 percent rise year-on-year by the end of May, and its funds outstanding for foreign exchange held by financial institutions was more than 1.5 trillion yuan from January to April, in sharp contrast with the 494 billion yuan in the whole of 2012. All these indicate that China's financial liquidity is still at a high level and the recent "funds shortage" has been mainly caused by structural factors.

As a matter of fact, China's currency supply has remained abundant, as indicated by the great enthusiasm among agencies and individuals to purchase gold, wealth management products and real estate. Large volumes of non-government capital are actively seeking new investment chances.

From a superficial perspective, the recent "liquidity freeze" among some of C hina's commercial banks has been caused and exacerbated by factors such as increased pressure to add funds to the central bank reserves within required deadlines and the increased withdrawal of funds by enterprises to pay half-year bonuses to employees, as well as their own mid-year performance assessments. Relevant departments' accelerated tightening of monitoring over commercial banks' wealth management products and cross-border arbitrage activities have also increased the demand for funds so the banks can bring themselves in line with States regulations.

However, the fundamental factors underlying the recent "money crunch" lie in the unrestrained expansion of China's financial business, lack of supervision and management to keep pace with its prospering financial sector, as well as the serious departure of the country's financial development and service system from meeting the demands of the real economy.

What China needs is not more money supply, but a fully fledged financial system that can provide a sound guarantee mechanism for the real economy. The country's stock market also needs systematic improvements to restore investor confidence and effectively protect their interests.

The government has injected a lot of liquidity into the market to stimulate economic growth in the years following the onset of the global financial crisis, but a large portion of this liquidity has flown to the financial sector in search of higher profits instead of going to funds-thirsty manufacturing.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

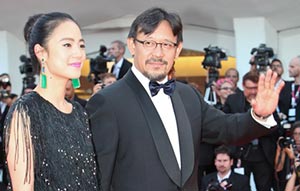

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant