Since assuming office in mid-March, Premier Li Keqiang has taken a different policy path. Its key economic policy framework, which could be summarized as "Likonomics", consists of three key pillars: no stimulus, deleveraging and structural reform.

In the three months since taking office, the government has resisted repeated calls for new stimulus because it believes State-led investment is no longer sustainable. Instead, the authorities are making efforts to control financial risks, especially the flow of credit that could be fuelling asset bubbles.

If Japanese Prime Minister Shinzo Abe's "Abenomics" is about reversing deflation and restarting growth, Likonomics is about deceleration, deleveraging and improving the quality of growth.

June 24 marked the 100th day of Li in office, but the markets were in no mood for celebration. The Shanghai A-share index dropped below 2,000 that day. Four days earlier, the Shanghai inter-bank overnight rate had shot past 10 percent, compared with its normal level of close to 2 percent. A little earlier, the HSBC PMI for May was reported to be 48.3, a nine-month low. Market sentiment is understandably downbeat, again.

However, some of these developments are intended policy results of the new government. Its three key pillars may imply further downside risks for the economy and the markets in the coming year. But China has to take such policy measures now in order to avoid much more disruptive outcomes in the future.

Li's prize-winning dissertation for his doctoral degree in economics from Peking University in 1994 analyzed China's three-sector economy in the 1980s and 1990s - agriculture; township and village enterprises; and the urban sector. In Li's analysis, structural change is a constant source of productivity growth and economic development.

Over the past few years, economists and policymakers have reached a consensus that China should accept slower growth and focus on structural reforms. And this is the foundation of the three pillars of Li's economic policy.

No stimulus: On May 13, in a speech broadcast to officials around the country, Li said: "To achieve this year's targets, the room to rely on stimulus policies or direct government investment is not big - we must rely on market mechanisms." This is because relying on government-led investment for growth "is not only difficult to sustain, but (it) also creates new problems and risks".

In fact, many heavy industries, such as steel, cement and aluminum, are struggling because of serious overcapacity problems. Recently, the government delayed the planned urbanization conference in order to revise the official document to downplay the importance of fixed asset investment in China's new urbanization drive.

The hard truth is that the days of 10 percent annual growth are over for China. The growth potential is now around 6-8 percent. Of course, the government is not completely passive in this regard. Government-led infrastructure spending on energy, water and transportation has been accelerating since the beginning of 2012, but its scale is much more constrained compared with earlier programs. As long as the unemployment rate and consumer price index do not surprise, the government will not adopt any new stimulus measures to boost growth.

Also, the minimum acceptable growth rate has shifted, from 8 percent at the beginning of last year to 7 percent now. It could fall further in the coming years.

Deleveraging: At a recent meeting of the State Council, China's cabinet, Li said banks must make better use of existing credit and expedite efforts to contain financial risks.

Following the implementation of the stimulus package in 2008, China's total credit increased from $9 trillion to $23 trillion by early 2013. As a proportion of credit-to-GDP, the growth has been from 75 percent to 200 percent. According to Ken Rogoff and Carmen Reinhart, who examine the pattern of global financial crises during the past eight centuries in their book, This Time Is Different, countries experiencing rapid credit expansion for extended periods always end up enduring a painful economic adjustment. What we think is more worrisome for China is the divergence in growth rates between credit (above 20 percent) and nominal GDP (below 10 percent) in recent quarters.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

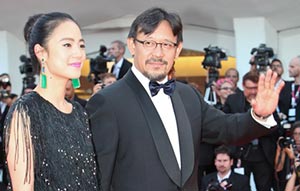

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant