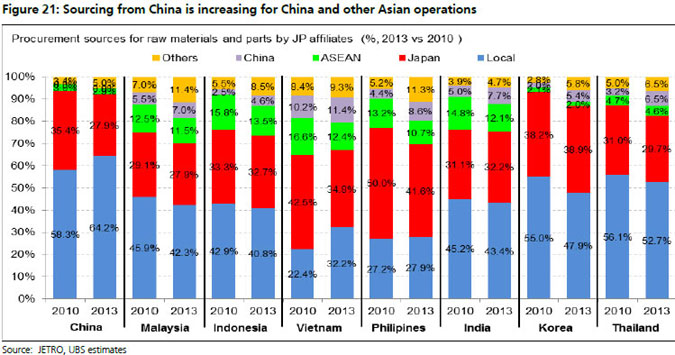

Last but not the least, China's role in the regional supply chain seems to be deepening as foreign companies producing in Asia are increasingly sourcing from China. Foreign companies producing for exports or local markets usually import high-end components from their home countries or more advanced economies while leaving the purchase of low-end components and assembly to local economies. Data from the Japanese External Trade Organization (JETRO) show that Japanese manufacturing companies with operations in Asia are increasingly sourcing their input from China. Not only local sourcing in China is the highest among Japanese companies operating in Asia and has been rising, but also Japanese companies operating elsewhere in Asia are all increasing their sourcing from China (Figure 21).

V. Conclusions

What do these developments mean for China's growth and exchange rate going forward?

In the coming year, the benefit from stronger growth in the US and Europe for Chinese exports should still outweigh the negative impact from real appreciation, but we can perhaps not expect a similar kind of rebound as before. Indeed we are only forecasting a 1.5 percentage point faster real export growth this year relative to 2013.

Over the medium term, as the costs of labour, capital and utilities continue to rise, China's real exchange rate should continue to appreciate even if the RMB holds steady against the US dollar. As a result, China may see a further erosion of its competitiveness in the traditional exports sectors unless it can generate higher productivity growth than partner countries. As such, the government will need to push forward with structural reforms to reduce labour market rigidity (for example by making social benefits portable and relaxing hukou system), improve efficiency in the services sector (for example by increasing private participation and competition), and to guide resource allocation to the more efficient areas.

The sectors that have been more open to market competition, including from imports, and where domestic demand can provide economies of scale, such as machinery and equipment, electronics, textile, home appliances, and automobiles, are more likely to be able to move up the value chain. Sectors that have enjoyed government's policy support or faced little competition may find it tougher. In the adjustment process, we are likely to see increased industrial consolidation, increased use of automation, and for some sectors, a further shift of production away from China.

Since the exchange rate is no longer undervalued, we see little support from economic fundamentals for continued nominal RMB appreciation - in fact, the government should manage capital flows more carefully to prevent large exchange rate overshooting. We do not expect trend appreciation or depreciation of the RMB against the US dollar in the next 12-18 months, but do expect increased two-way volatility ahead.

The authors are economists at UBS. The views do not necessarily represent those of China Daily.