|

|

Beijing United Family Hospital invested $32 million in the expansion of the main hospital two years ago. It also spent $38 million to build its Beijing rehabilitation hospital. [Provided to China Daily] |

Chindex's expansion is in accordance with China's advanced regulatory environment. The State Council (China's cabinet) guidelines released last October set a target for the health industry of 8 trillion yuan ($1.31 trillion) by 2020.

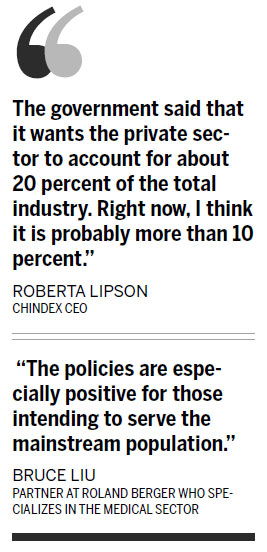

"The government said that it wants the private sector to account for about 20 percent of the total industry. Right now, I think it is probably more than 10 percent," Lipson said.

Health, not wealth, is main driver |

In the past 16 years, since the establishment of the Beijing hospital, Lipson has witnessed great changes in the Chinese market. One of the reasons for the company's continued investment in the sector is that Chinese consumers have become more educated about the choices offered by private medical care.

"The economic ability of Chinese patients to pay for private health treatment has also developed," she said. Still, as an early mover in the industry, it faces difficulties. "About half of the doctors at United Family are foreigners. We have to meld the teams from China and outside China," she said.

Further, when Chinese patients decide to pay out of their own pocket for a private hospital, their expectations are very high. For example, Chinese patients usually get scant time from doctors at busy public hospitals. So when they come to private hospitals, they deserve a lot of attention.

"They're comparing our services with those in a five-star hotel," said Lipson.

For delivering a baby, public hospitals charge about 4,000 yuan to 5,000 yuan. It's about 10 times that much at a United Family facility. "I think they deserve our best," Lipson added.

United Family began to make profits in the third year of operations, and the average growth of its business has been over 20 percent annually in the past eight years. The company invested $32 million in the expansion of the Beijing hospital two years ago. It cost $38 million to build its Beijing rehabilitation hospital.

"Competition will be less around ownership and more about differentiated value propositions and efficiencies," said Bruce Liu, a partner at Roland Berger who specializes in the medical sector.

Liu said the government's policy focus on the private sector doesn't mean just high-end facilities.

"The policies are especially positive for those intending to serve the mainstream population," said Liu.

Liu also cautioned that medical care is a bit different from other businesses, since it doesn't offer quick returns. "Compassion and passion beyond mere economic considerations sometimes may make the difference," he said.

The key to success for a high-end hospital lies in a clear definition of target segments, compelling value proposition for patients, commercial insurance and the physicians and staff, Liu said. Patience and perseverance in navigating the regulatory hurdles and building the brand are vital as well.

Liu estimated that China's health industry will more than triple within seven years. Opportunities abound for both high-end and mainstream segments.

Women's & Children's Hospital is also at the premium level. US-based Warburg Pincus LLC invested $100 million at the end of 2013 in Beijing-based Amcare Women's & Children's Hospital to help it expand.

Amcare, set up in 2006, owns three hospitals in Beijing and Tianjin. It is going to set up new hospitals in Shanghai, Shenzhen and Hangzhou.

"We're short of medical talent as we expand, and we hope to attract more qualified staff," said Hu Lan, chief executive officer of Amcare, during a joint interview in March.

Unlike many who are enthusiastic about the potential for private hospitals, Hu is not that optimistic. "Amcare has not encountered many hurdles at the policy level. However, it is difficult to make the private sector a core part of the country's health industry. It's not yet a completely market-oriented economy," said Hu.

Wang Zhuoqiong contributed to this story.