|

|

Runners pass Tian'anmen Square in Beijing, where the locals, always in high spirits, participate in various running and jogging activities throughout the year.[Photo/China Daily] |

Global and domestic companies shrug off years of losses as city dwellers jog, run, exercise and take part in marathons

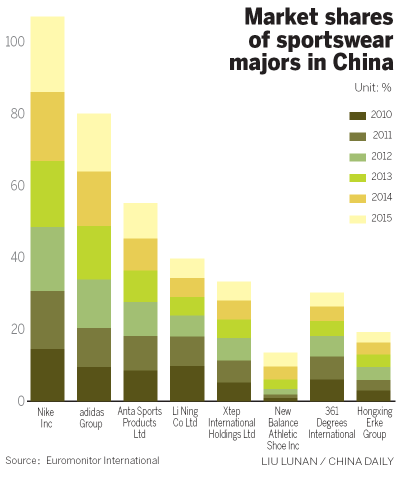

International and domestic sportswear companies have finally turned the corner after being in recession for years. Sportswear majors posted strong growth in the China market in 2015, boosted by city dwellers' pursuit of a healthy lifestyle.

According to Euromonitor International, China's sportswear industry was valued at nearly 150 billion yuan ($22.8 billion) in 2014.

Adidas Group's China unit reached its sales target of 2 billion euros ($2.19 billion) for 2015, and thus successfully completed a five-year business strategy makeover that began in 2010.

In the first nine months of 2015, its gross profit rose almost 40 percent year-on-year to 1.05 billion euros.

Colin Currie, managing director, Adidas Group, Greater China, attributed the "record achievement" to the company's ability to execute "a decisive strategy".

Rising disposable incomes, which are increasing consumer spending, helped expand the sporting goods industry in 2015, Adidas said.

This trend is particularly evident in China's smaller cities.

Adidas has expanded its retail presence to more than 8,500 stores in both big and small cities and launched retail stores in new segments for women, sportswear collections and basketball.

In the next five years, the company will continue to focus on five main drivers: football, running, women, kids and Originals. This is part of its brand strategy to strengthen key categories and lead mindshare.

Adidas said the plan will cash in on its continued growth by meeting the demands of China's burgeoning middle class "who are placing a higher emphasis on quality of life experiences and the needs of a nation with an ignited interest in sports".

Adidas's rival and global market leader Nike Inc, too, has shrugged off sluggish growth trend.

In second quarter revenue to Nov 30, Nike's China unit rose 28 percent to record $938 million.

Earlier this month, Chinese sportswear maker Li Ning Co Ltd said it expects to break even in 2015 after years of losses. This expectation itself buoyed its stock.

That would have pleased its investors, including private equity firm TPG Capital Management and Singapore's sovereign wealth fund GIC Private Ltd. Li Ning posted a loss of 781.5 million yuan in 2014.

"The board believes that the expected turnaround in operating results is principally due to an increase in both the sales revenue and gross profit of the group and a decrease in expense ratio in 2015," said Li Ning, the company's chairman, in a filing to the Hong Kong Stock Exchange.

The company attributed its improved performance to efficient operations at its directly owned stores, which turned profitable, better relationships with partners and expanding e-commerce.

Anta Sports Products Ltd, another Chinese sportswear firm, too, found glad tidings in the past couple of years, after the 2011-13 downturn kept its annual profit from surpassing the 2010 level of 1.5 billion yuan.

In 2014, however, Anta's profit reached 1.7 billion yuan. Anna's revenue in the first half year of 2015 increased 24 percent year-on-year to 5.1 billion yuan, much higher than Li Ning's 16 percent year-on-year rise in revenue in the same period.

Similarly, in the first half year of 2015, Xtep International Holdings Ltd's net profit reached 345.5 million yuan, up almost 21 percent year-on-year, while that of Peak Sport Products Co Ltd grew 45 percent year-on-year to 176 million yuan.

According to CLSA Asia-Pacific Markets, the number of participants in marathons and other such outdoor physical activities doubled between 2011 and 2014.

Zhang Qing, founder of sports marketing agency Key-Solution, said running is popular among fitness-minded people.

This had a positive impact on sportswear brands, fueling sales of products like running shoes, knee supports, apparel and track suits.

The trend is expected to bring steady growth for sports brands for at least 10 years, he said.

"Sportswear firms used to focus on casuals and style, now they are turning their attention to function-specific products," said Zhang. "This requires investments in research and development and professional knowledge."

Zhang said domestic brands should invest more on professional races and marketing strategy.

"Local sportswear brands have been timid in communicating with younger generations, who swear by the 'no-baggage, no-fear' principle. Domestic brands should be more expressive to motivate such consumers."

It is said the government has a plan for the sportwear industry to continue to grow to an estimated value of 5 trillion yuan by 2025.

Runners pass Tian'anmen Square in Beijing, where the locals, always in high spirits, participate in various running and jogging activities throughout the year.