|

The acquisition of US hotel chain operator Starwood by Chinese insurance conglomerate Anbang Insurance Group, if successful, will increase the hotel group's global market share and ensure the continuity of its operation and brand, analysts said on Tuesday.

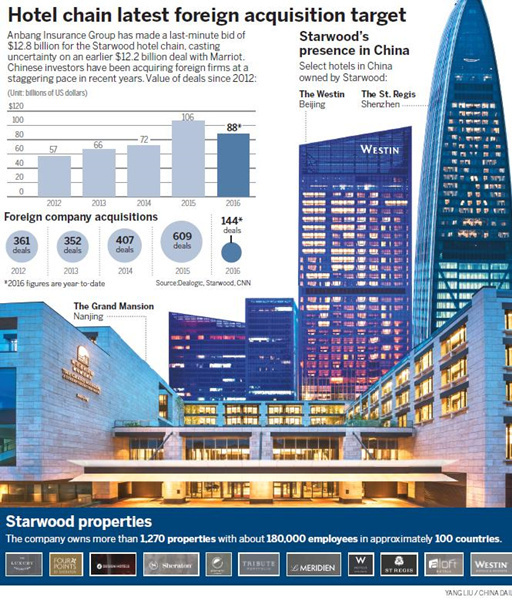

The consortium led by Anbang has offered $12.8 billion in cash for the hotel operator, compared with an earlier offer by Marriott of $12.2 billion.

If completed, the transaction will be the largest acquisition made by a Chinese company in the US, according to financial data provider Dealogic.

Analysts said the combination of Starwood's extensive global hotel chain network and the purchasing power of affluent Chinese tourists will likely produce a successful deal.

"It will have a very positive impact on Starwood's global market share given the rapid growth of China's outbound tourism. Chinese tourists will naturally select hotel brands that are owned by the Chinese," said Michael Chin, executive chairman of WT Global Hospitality Investment Co in Hong Kong.

A source close to the Chinese insurer said Anbang intends to ensure the stability of the management team without any layoffs. Anbang will also keep Starwood's headquarters in the US.

"This could be an attractive factor for Starwood because it is very likely that Marriott will implement substantial adjustments, including firing members of the management team in the overlapping business if it takes over Starwood," Chin said.

"Anbang will also boost the advertising campaign for Starwood's hotels in China," he added.

News of Anbang's bid for Starwood came just days after it agreed to acquire Strategic Hotels & Resorts Inc from US private equity firm Blackstone Group for $6.5 billion.

Anbang's latest mega merger deal underscores an overseas buying spree by cash-rich Chinese companies.

An insurance analyst at a global investment bank, who declined to be named, said it demonstrates Anbang's desire to diversify its investment portfolios and to hedge the potential risk of a weaker yuan. "The deal is unlikely to place pressure on Anbang's capital position, as most of its liabilities are long-term," he said.

While it is unclear how Anbang will fund its cash offer, some analysts said that forming a consortium with two private equity firms, JC Flowers & Co in the United States and Primavera Capital Group in China, would help Anbang avoid domestic regulatory hurdles.

The Chinese insurance regulator stipulates that the outstanding value of overseas assets owned by a Chinese insurer cannot exceed 15 percent of its total assets of the previous year.

Analysts said uncertainties remain over how the deal will unfold. Margaret Taylor, a senior analyst at credit rating agency Moody's Investors Service, said, "There is a high risk that Marriott may ultimately choose to increase its offer.

"We believe Marriott views the acquisition of Starwood as important as it would solidly position the combined company as the world's largest hotel chain and increase its brand and geographic diversification," she said.