|

|

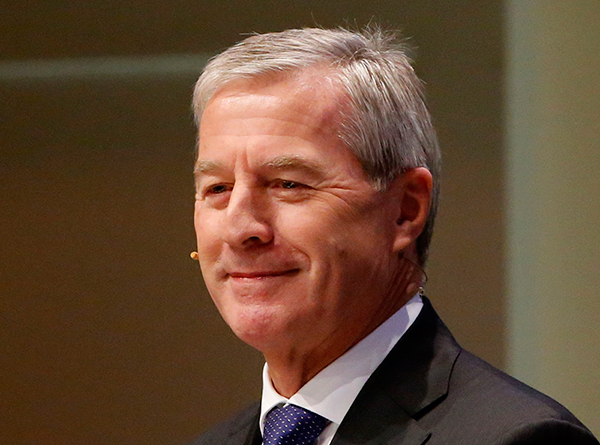

Jürgen Fitschen, co-CEO of Deutsche Bank. [Photo/Agencies] |

A1: We have observed the growth in the industrial sector lagging behind that in the service sector for some time. The process has involved challenges in commodities and mining sectors, but within these sectors there are those that have been able to withstand the headwinds better than others. There are also sectors that continue to grow rapidly, such as tourism and entertainment. Foreign firms continue to search for opportunities to invest in China, as the size of the country dictates its importance in the global market. The ability of lenders to differentiate underlying credit strength of companies is very crucial during the adjustment process.

A2: Depreciation is not a major issue for the foreign companies operating in China, as the magnitude of depreciation is relatively small. We need to keep in mind that renminbi may depreciate against the US dollar, but its outlook against other currencies such as euro and yen is uncertain. Reforms, which introduce a greater role of market forces, will inevitably raise market volatility, which is part of the maturing process of the financial system. In a more volatile environment, be it in the currency or commodity space, hedging tools, liquidity and market risk management have become more important. As a bank, we can offer our expertise and assistance in this area. China's financial markets have deepened and widened over the years and the process will continue. Higher transaction volume translates into opportunities for the financial industry as a whole.

A3: Our business in China and the region continues to perform strongly. China is a core global market for Deutsche Bank and we are deeply committed to developing our franchise here.

China has many characteristics that support a healthy pipeline of demand for both investment and consumption. The plan to bridge the gap of regional disparity spells plenty of opportunities in infrastructure investment. Also, the process of urbanization means there will be greater demand for social services and clean energy in city areas. The story of an emerging middle class is still unfolding. Private consumption proxy such as retail sales and property market data tells us that the household balance sheet has been very resilient.

A4: Economic restructuring is tackling the consequences of past credit overhang so the country can move on and allocate resources to continue to grow in a more sustainable way.

Focusing on the right opportunities during different cycles, being able to offer diversified financial services and products and being nimble will be a key to our further success. While the securitization market may grow rapidly over the next few years, a new cycle could emerge soon after, which will bring different opportunities. As a strong global well-diversified financial institution with a long history in China and the Asia region, we are ready for new market opportunities.