Li Yan, a 32-year-old company executive based in Beijing, had a not-so-pleasant National Day holiday last week. The new housing policy, rolled out on Sept 30, shattered her dream of owning an apartment in the city's Haidian district, home to well-known educational institutions.

Li, mother of a five-year-old son, hails from Anhui province in East China. She had plans to buy a two-bedroom flat close to a good primary school in Haidian, and ask her parents to move into her current home, a one-bedroom flat in Chaoyang district. She was able to somehow save enough money for the 30 percent down payment in late September.

But, according to the new housing policy, which was announced just ahead of the holiday, she has to make a 50 percent down payment. This, despite having paid off all mortgages on her first home, which required only a 30 percent down payment earlier.

"I know the new policy is mainly aimed at curbing speculative home purchases, but that's also bad news for homebuyers like us who need a home for children's education or for improved living standards," said Li.

From Sept 30 to Oct 6, 19 cities introduced similar measures, mostly higher down payments for a second home, but some prohibited the purchase of second and third homes.

For instance, Beijing increased the down payment for first-time homebuyers from 30 percent to 35 percent; that for second homes rose from 30 percent to a minimum 50 percent. For a second home larger than 140 square meters, the down payment is now 70 percent.

"I expect more cities will roll out similar policies, especially those satellite cities close to metropolitan cities and those that may face risks of a new round of home price hikes," said Zhang Dawei, an analyst with Centaline Property.

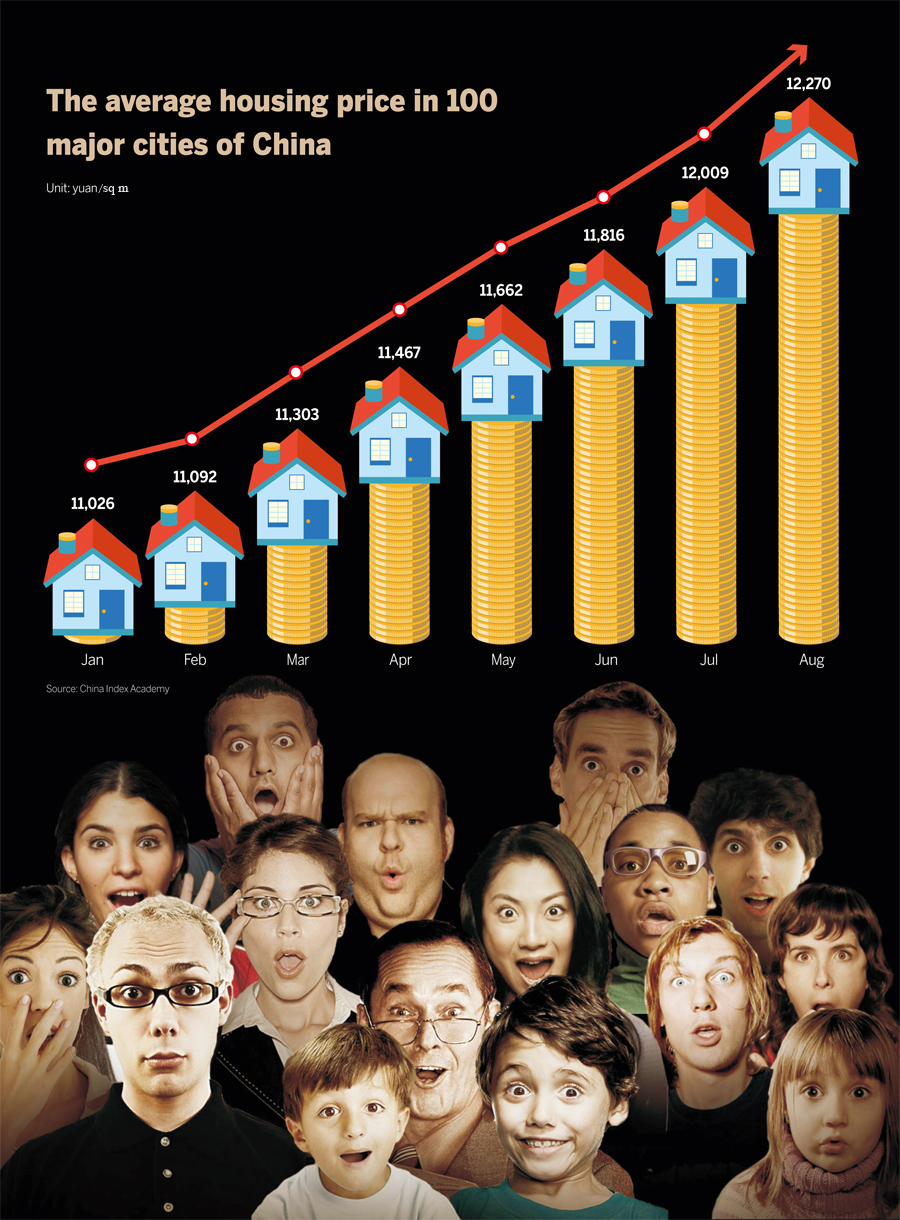

The retrictive moves follow an extraordinary upswing in home prices this year that left many homebuyers fuming with astonishment, anxiety and anger.

Home prices rose in 64 of 70 cities tracked by the Bureau of Statistics in August, up from 51 the previous month. Shanghai home prices surged a record 4.4 percent month-on-month and 31 percent year-on-year; Beijing's levels climbed 31 percent month-on-month and 24 percent year-on-year.

When property major Vanke's Shanghai branch started an online sale of 442 new houses in mid-September, 1,760 prospective buyers bid as soon as the event started at 10 am, almost causing the server to crash. Minutes later, all the 442 units were snapped up.

The frenzy also spread to provincial capitals. The volume of transactions for apartments in Hangzhou, for instance, rose more than 180 percent week-on-week between Sept 12 and Sept 18 as investors flocked to the city to buy second homes before the new home purchase limits for non-resident buyers took effect.

"Buying a house is like a fierce battle fought over and over again," said Shi Rujia, an employee of a State-owned enterprise in Nanjing. Twice in a day, she failed to qualify as a buyer in the draw of lots. She is now waiting for other opportunities.

Soaring home prices and rise in transactions, which mark the current property rush, have contributed to a surge in housing mortgages and a fall in construction land.

Central bank data showed that Chinese banks in August issued 529 billion yuan ($79 billion) in household medium- and long-term loans, mortgages accounting for 55.7 percent of the total. In the first eight months of the year, these loans rose 90.4 percent year-on-year to 3.63 trillion yuan.

One difficulty in reining in the home-buying frenzy is the larger leverage residents used through commercial banks with a growing appetite for mortgage loans, JPMorgan Chase & Co analysts led by Zhu Haibin wrote in a research note.

Buyers in second- and third-tier cities are able to obtain the same mortgage discounts as in the largest hubs, normally between 10 percent and 15 percent, a sign that a liquidity surge has backed up the rally, said Jeffrey Gao, a Hong Kong-based property analyst at Nomura Holdings Inc.

In contrast, enterprises received fewer loans from banks, although China's current easy monetary policy-it is marked by low interest rates and reserve requirements-was meant to help them.

"The rising home prices are now based on household loans, which is risky," said Yao Zhizhong, a global economic and political researcher with the Chinese Academy of Social Sciences.

A natural, and sometimes artificial, shortage of land for housing development could be another reason for the home price hikes, particularly in big cities, experts said.

For instance, Beijing plans to supply only 4,100 hectares of construction land this year, down from 4,600 hectares in 2015 and 5,150 hectares in 2014.

Prices of recently auctioned plots in many cities were higher than those of nearby existing homes, meaning that home prices in these areas are set to increase. High land and home prices have created a chicken-and-egg conundrum.

In response, local government unveiled new housing policies, and revved up their efforts to introduce new land parcels into the market.

Despite growing concern about a potential bubble ballooning in the real estate sector, an increasing number of investors are jumping on the housing bandwagon because they don't have many alternatives to maintain or increase the value of their assets, industry observers said.

For instance, the interest rate on one-year deposits is 1.75 percent. The Shanghai Composite Index, after a slump last year, has been moving around 3,000 points with trading remaining muted last month.

Zhang Di and his wife, a young couple living in Tianjin, recently used idle funds to invest in the housing market because their family business in the chemical industry was treading on thin ice.

"My father has been talking about closing the factory, after a lifetime of efforts. What can I do? Investing in property seems to be the only way out," Zhang said on phone.

To stabilize the home market, China needs to quicken its economic restructuring and develop new growth engines that can generate returns higher than that of the property sector, said housing market analyst Liu Ce.

Xinhua contributed to this story

Contact the writer at huyuanyuan@chinadaily.com.cn