Middle class' money hopes get attention

The latest Government Work Report touches upon wealth creation, in line with consumer focus on protection products

When he delivered the Government Work Report on Sunday, Chinese Premier Li Keqiang may have been reflecting the financial aspirations and hopes of the nation's 109-million middle class among other things.During his speech to the annual meeting of the National People's Congress, Li highlighted government efforts to help boost people's wealth through productive work, so that they could reach their life goals. The country's personal per capita disposable income grew by 6.3 percent in real terms in 2016, he said.

The reference to "disposable income" seemed timely because, of late, the middle class-people with net assets worth between $50,000 and $500,000 each-have been groping for high-return options that increasingly appear to be few and far between, due to the changing economic growth trend, stricter regulations and fluctuating currency.

Personal finance and wealth management have become hot topics among China's retail investors. He Ziying, 32, a human resources manager at a private construction company in Beijing, is one such retail investor.

She is concerned about her family's financial future although her current situation suggests there is no real cause for worry.

Thanks to their parents' support, He and her husband own a two-bedroom apartment, which they bought outright, without any mortgages. They drive a VW Passat. Married in 2011 and yet to have their first baby, both hold stable jobs that pull in about 200,000 yuan ($29,000) a year.

But He has been uneasy ever since she began thinking of having a baby. Her parents will soon turn 70. "I get anxious as I think about it," He said. "I don't want to leave my family's financial future to chance."

She wants to support her planned child's overseas education and her parents' twilight years, and maintain the quality of her own life post retirement.

To do all that, He needs to protect and grow her family's wealth. She is on the lookout for a sound financial plan. Only, there don't seem to be many around due to shortage of investable assets. This is what makes her anxious in the current low-rate environment.

He wants to invest her family's savings in relatively safe instruments or schemes that could offer satisfying returns. But China's easy monetary policy, which has helped stimulate the economy all right, has also inflicted financial pain on small investors.

Consider new loans. In recent years, they have been growing at around 11 percent annually, higher than the GDP growth rate range of 10.6-6.7 percent (between 2008 and 2016).

Abundant money supply has driven down real interest rates as well as investment yields across all asset classes.

"It used to be easy to find investment products that offer more than 10 percent in returns," He said. "Now, easy profits are no longer available. I'd be happy if my wealth manager offers me something with a rate of return above 4 percent."

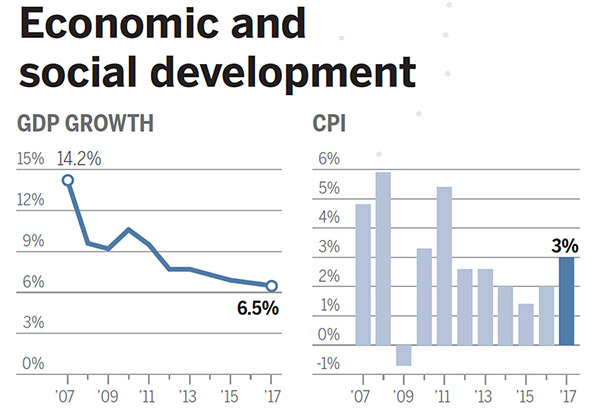

Over the past decade, China's GDP grew from 21.9 trillion yuan in 2006 to 74.4 trillion yuan in 2016, a growth record, with this year's GDP forecast to grow at 6.5 percent. The yuan appreciated from 7.8 per dollar at 2006-end to 6.96 at 2016-end. This led to a steady rise in people's income and family wealth.

China ranks third after the United States and Japan in terms of household wealth, according to the 2016 Global Wealth Reportby Credit Suisse.

But, even as GDP growth slows, in the next five years, China's wealth will likely remain on a strong upward trajectory, growing at 9.2 percent annually, to reach $36 trillion in 2021, the report said.

The consequent massive demand for financial products and professional wealth management services has not been matched by adequate supply.

This meant stocks and property remained key investment avenues for long. But the rollercoaster ride of the stock market in 2015, and the latest round of tightening measures by the government to tame the runaway home prices, have created a deep sense of uncertainty about investment prospects.

Driven by the desire to preserve and grow their wealth, small investors are seeking alternative investment options.

Life insurance, hedge funds, online financing, peer-to-peer or P2P lending, even trading in virtual currency Bitcoin ... have all faded into investment focus of late.

But some analysts said high-yield but risky investments ought not to be small investors' choice.

Thomas Deng, chief investment officer for China at UBS Wealth Management, said Chinese families would do well to buy property at prime locations in top-tier cities such as Beijing and Shanghai.

"The CPI (Consumer Price Index) is around 2 percent for 2016 (and forecast to be 3 percent for 2017), which means inflation is not an immediate concern. But every family can get a sense of it when they compare the rise in their income with the rise in housing prices, food prices and their children's education costs," Deng said.

Xu Yongwei, chief investment officer of insurer Manu-life-Sinochem Co, said Chinese families should consider allocating a portion of their wealth to mutual funds.

"They are less risky and more transparent. When picking a (mutual) fund, one needs to look at its investment performance for at least the past five years, instead of just focusing on the promised rate of returns," Xu said.

Stable but lower-yield mutual fund products are likely to regain favor among Chinese small investors as the financial regulators, in a bid to rein in shadow banking risks, have stepped up regulation of high-yield but dubious wealth management products sold by banks to retail customers.

For example, many risky financing projects and corporate debt have been packaged into banks' high-yield wealth management products.

Andrew Wang, chief investment officer of Manulife Teda Fund Management Co Ltd, said tighter regulation will be positive for the mutual fund industry as it will help chael money from risky investment products to more transparent products.

Also, small investors such as He are no longer expecting very high returns. Their risk appetite is shrinking in an environment of increased financial volatility and low interest rate. All this will increase the attractiveness of mutual funds, Wang said.

"The less-transparent products have been eating into our market share. We'd like to see some capital flow back to mutual funds as a result of tighter regulation," he said.