Nation to ease corporate burden

Tax, fee cuts planned as well as policies that are favorable to small businesses

China will cut taxes and administrative fees by 550 billion yuan ($79.7 billion) this year to further reduce the corporate burden and will roll out favorable tax policies to support small innovative and technology companies, Finance Minister Xiao Jie said on Tuesday.

Xiao said the ministry will adopt a proactive and effective fiscal policy by increasing the fiscal deficit by 200 billion yuan to meet the demands for tax cuts and expenditures in key areas such as supply-side structural reform.

China has set its fiscal deficit target at 3 percent of GDP this year in the Government Work Report delivered by Premier Li Keqiang on Sunday to the annual session of the National People's Congress, the country's top legislature.

"While the deficit ratio is unchanged from last year, the fiscal deficit will increase as the overall volume of GDP expands," Xiao told reporters at a news conference.

"We will boost fiscal support for supply-side reform and to ensure a reasonable economic growth rate," he said.

In addition to tax relief, the minister vowed that the government will increase efforts to push forward more public-private partnership projects, which are still in their infancy in China.

A total of 1,351 PPP projects worth 2.2 trillion yuan had been signed by the end of last year, with the time frame for implementing such projects growing shorter. Compared with the situation in early 2016, there are now more PPP projects being put in place and a larger volume of investment, Xiao added.

Meanwhile, the finance minister said the government will roll out favorable tax policies for small and micro businesses. Companies with annual taxable income lower than 500,000 yuan will have a 50 percent tax cut, according to Xiao.

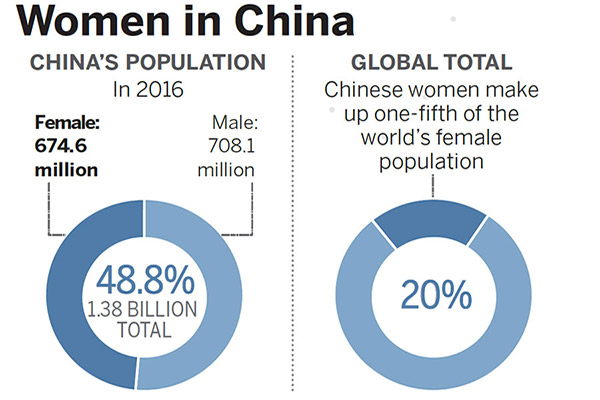

The ministry is also studying a plan to reduce the personal tax burden and is considering granting more tax cuts to families with two children, Xiao said.

While the target of China's fiscal deficit remains unchanged this year, Zhu Haibin, chief China economist at JP Morgan, said the authorities will likely seek alternative ways such as local government special bond issuance and off-budget spending to support an expansionary fiscal policy stance.

"It looks like the actual fiscal policy implementation will still largely rely on off-budget fiscal spending in 2017. Nevertheless, it is important to impose a hard budget constraint on local governments and to streamline the split between central and local government expenditure items," Zhu said.

Marie Diron, an analyst at Moody's Investors Service, said China's fiscal impulse will be larger to maintain robust economic growth, and government debt may edge up toward 40 percent of GDP.

"The gap between the government's revenues and expenditure is likely to be wider before funds are reallocated, as has been the case in the last two years. Other public sector spending such as investment by State-owned enterprises also contributes to maintaining robust growth," Diron said.

At Tuesday's news conference, Finance Minister Xiao said overall government debt risk is under control, with the debt-to-GDP ratio at around 36.7 percent.