The great SOE turnaround

Reforms, financial deleverage, M&As, tech focus help revive government firms' fortunes

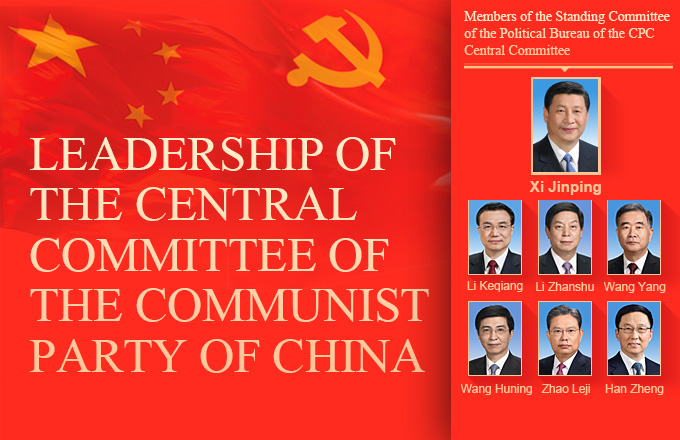

Last week, the 19th National Congress of the Communist Party of China learnt that since the last congress in 2012, as many as 34 central State-owned enterprises, or SOEs, have been restructured, with their overall number falling to 98 from 117.

An outstanding feature of the ongoing SOE reform has been the sustained drive to improve the companies' financials, mainly through sophisticated debt management.

The reform, which went beyond mergers, acquisitions and rationalization, helped improve central SOEs' efficiency and competitiveness, thus bolstering China's long-term march toward emerging as the world's largest economy, overtaking that of the United States.

Central SOEs posted a record high net profit of 1.11 trillion yuan ($167.2 billion) from January to September, thanks to supply-side reforms, which helped bring down the asset-liability ratio requirement and curbed capital outflows.

As a result of the reform, financials of 2,041 "zombie companies", all subsidiaries of 81 major central SOEs, also improved, with their losses shrinking by 88.5 billion yuan, compared with the same period of 2015. ("Zombie companies" are economically unviable businesses, usually in industries with severe overcapacity, kept alive only with aid from the government and banks.)

China will accelerate its efforts to prevent systemic financial risks from arising and infecting the broader economy, said senior government officials during the 19th CPC National Congress.

The ongoing supply-side structural reform-cuts to overcapacity in certain sectors such as steel and coal-and more flexible financial policies will be sustained, they said.

From January to August this year, debt risk at central SOEs was under control as these companies maintained a steady debt-to-asset ratio over the past five years, according to State-owned Assets Supervision and Administration Commission, or SASAC.

By August-end, the average debt-to-asset ratio of central SOEs dropped to 66.5 percent, 0.2 percentage points lower than the level at the beginning of this year.

"The debt risk level at central SOEs is reasonable and controllable," said Huang Danhua, vice-chairwoman of SASAC.

"Apart from asset restructuring, central SOEs can also direct their resources toward competitive companies or industries through equity cooperation, asset swaps, strategic alliances and joint ventures," she said.

Under the government plan, debt-to-equity swaps will be pushed forward, with State investment funds encouraged to participate in the process. Central SOEs will speed up the pace of mergers and acquisitions, or M&A's.

Already, the SOE sector has seen a merger of two of China's top high-speed train makers and another of two major steel producers.

To cut the leverage ratio, SASAC has also encouraged SOE behemoths to optimize capital structure via initial public offerings, and supported efforts toward asset securitization. Huang said central SOEs have made headway in cutting outdated capacity, reining in debt risks and improving competitiveness.

Given the favorable conditions, more effort is needed to cut the debt level of SOEs and a guideline will be formulated, he said.

As the debt-to-equity program is considered a significant and efficient method to tackle debt woes, China Shipbuilding Industry Corp, one of Chinese Navy's biggest contractors, converted debt into equity by offering eight investors stakes in two of its unlisted subsidiaries for an estimated 22 billion yuan ($3.27 billion) in August.

This is the country's first defense-related enterprise supervised by the central government to restructure its finances via such swaps.

China Cinda Asset Management Co Ltd and China Orient Asset Management Co Ltd, two of the eight investors, will contribute around 5 billion yuan and 2 billion yuan, respectively, toward servicing debt of CSIC's Dalian Shipbuilding Industry Co Ltd and Wuchang Shipbuilding Industry Group Co Ltd. In return, they would pick up equity in the two CSIC subsidiaries.

In the first nine months of this year, the government reached its goal of cutting 5.95 million metric tons of capacity of central SOEs in the iron and steel sector ahead of schedule. It also succeeded in cutting 23.88 million tons of coal overcapacity.

Zhou Xiaochuan, governor of the People's Bank of China, the central bank, said M&As remain an important way to rein in SOE debt, and should go hand in hand with efforts to cut outdated capacity.

"While opening up, China's financial sector must always stick to risk-management standards and shall not tolerate highly leveraged, low-capital and non-performing loans," said Zhou.

Yin Zhongli, a researcher at the Institute of Finance and Banking at the Chinese Academy of Social Sciences, said technological breakthroughs should continue to be made in sectors riddled with overcapacity, and innovation should play a role in deleveraging as it helps improve corporate strength.

"The reform should be further expanded to more heavily indebted industries and real economy sectors with competitive products and good market prospects," said Dong Ximiao, a senior researcher with the Chongyang Institute for Financial Studies of the Renmin University of China.

The mixed-ownership reform, which seeks to diversify the ownership structure of SOEs, has started to take off in recent years as SOE monopolies in many sectors shut out smaller firms and caused low efficiency and poor service.

So far, almost 69 percent of central SOEs at all levels have been involved in the mixed-ownership reform, while 47 percent of local SOEs were also involved, according to SASAC data.

In key sectors such as electricity, telecommunications, aviation and defense, 19 groups were chosen to start such reforms, according to Peng Huagang, deputy secretary-general of SASAC.

In August, China Unicom, one of the country's telecom giants, announced plans to bring in private investment mainly by issuing shares to companies including China Life and Tencent, marking top-level mixed-ownership reform at State firms.

"The SOE reform is an open process, which aims to attract partners in all types of ownership," said Peng.

"China also welcomes the participation of foreign enterprises in the process, if they are interested," he said. "With reforms deepening, the SOEs will take on a new look and make new achievements."

Agreed Li Jin, chief researcher at the China Enterprise Research Institute in Beijing. "Protecting the interests of SOE employees will be a major task in the next step of SOE reforms."

Looking ahead, the reform will be mainly pushed forward through M&As instead of bankruptcies, Li said, adding that China will not experience another upsurge in layoffs like the one seen during SOE reforms in the 1990s.

As restructuring has mainly involved mergers within the SOE sector, the Institute of International Finance, a global association of around 500 major financial institutions, said it does not expect widespread failures or losses to be incurred in the new round of SOE reforms.

Stated differently, the reforms would not threaten employment or create unmanageable systemic risk in China.

Data from the Ministry of Finance show that by the end of June, SOEs' total liabilities amounted to 94.13 trillion yuan, up 11.4 percent from last year, while assets were worth 143.5 trillion yuan, up 11.5 percent.

Gao Peiyong, director of the Institute of Economics at the Chinese Academy of Social Sciences, said it is good for China to gradually get rid of excess industrial capacity even though "quite a few workers will lose their jobs". He warned of risks to the financial sector if China does not move quickly enough on this front.

"(On their books), financial institutions have a lot of outstanding loans extended to 'zombie enterprises'. When you select companies, you're going to do some kind of clean up when you take the bad loans off the banks' balance sheets. It needs to be done fast and efficiently," he said.