Record year for Chinese firms seeking overseas mergers

This year is a remarkable one for Chinese companies when it comes to overseas mergers and acquisitions.

According to Thomson Reuters/China Venture, outbound M&A activities in the first three quarters reached a record high of 671 transactions in volume, or more than $160 billion in value disclosed, which exceeded the aggregate of 2014 and 2015.

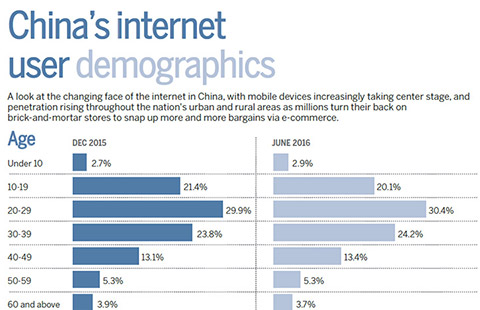

Thanks to the favorable government policies, sufficient capital and active corporates, the internet-technology sector has ranked among the top three of the wish list for various Chinese investors that accounted for approximately 16 percent of the outbound investment volume in the third quarter of 2016, doubling that from 2015's third quarter.

More than 50 percent of the M&A activities used to be led by the traditional information-technology giants-Baidu, Alibaba and Tencent, aka BAT-acquiring overseas-technology assets.

However, thanks to rapidly evolving market dynamics, more private enterprises are actively exploring the US and EU markets to pursue cutting-edge technologies or quality intellectual property for the China market.

Accordingly, non-BAT enterprises contributed to nearly 75 percent of the outbound transactions in the broad technology, media and telecom sectors.

With the advantages of broader industry distribution, flexible operation and rich experience, more private enterprises repeatedly conducted overseas M&A and became more active to drive business growth and diversification via overseas M&A.

This was also incentivized by the domestic economic growth slowdown and the relative low cost of overseas investment.

Through such outbound investment, Chinese investors (including public companies) took the opportunity to embrace the internet and transform their businesses through globalization and digitalization.

Ctrip recently announced a strategic investment in two US travel agencies to expand its overseas-travel service and enhance its footprint in the US market.

It is worth noting that out of the record-breaking 30 outbound $1 billion-plus transactions in the third quarter of 2016, there are two internet-related transactions by public companies in Hong Kong and the Chinese mainland: Supercell ($8.6 billion) and Playtika ($4.4 billion).

The availability of low-cost capital has enabled Chinese investors to diversify their global assets allocation and hedge the risk of potential depreciation of the renminbi and domestic economic-growth slowdown.

However, there is always the other side of the coin: The size and complexity of such mega deals are unprecedented, as well as the pressure from the bidding process.

This challenges Chinese IT players' ability to close the transactions and integrate the overseas business in a way that shifts from good to great.

When competing against experienced foreign consortium bidders, Chinese investors need to scrutinize various operational matters in connection with the potential carve-out. They should assess the alignment of the commercial-strategy roadmap in light of the differences in local cultures and business models.

It is also good for the target management to see the business plan to retain the value and grow the business post-deal.

Chinese companies are also pursuing disruptive technologies from mature markets, such as Silicon Valley. It is also encouraging to see Chinese IT companies emerging over the last few years and taking the lead globally in certain areas. Some are even starting to extend their global footprint by "exporting expertise", and helping to grow the local markets in Asia and Central and Eastern Europe.

After the investment in the Indian e-commerce giant Snapdeal in 2015, Alibaba announced in April 2016 its $1 billion acquisition of controlling stake in Lazada, a leading e-commerce platform in Southeast Asia.

By leveraging the know-how and strong commercialization capability accumulated in the domestic market, it is believed that the Chinese IT companies will also make tremendous contributions to the global business transformation in the digital era.

Alvin Bao is a transaction services partner, PwC China.