China's investment stimulus program a sign of economic strength

When it comes to the Chinese economy, it seems that there are none so blind as they who will not see. For once again, hard facts last year got the better of those who are forever predicting doom.

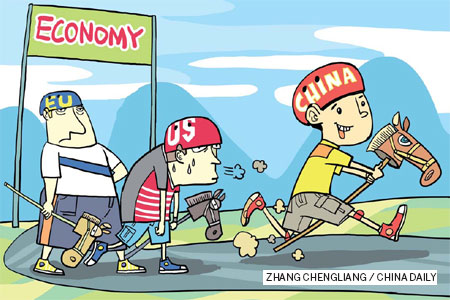

In the fourth quarter, China's economy picked up steam, with GDP growing 7.9 percent year-on year. This contrasted with the EU and Japan, both of which have registered new downturns, and the US, where economic growth last year is likely to have been below 3 percent, which is anemic compared with previous recoveries. China's industrial production in the year to December rose 10.3 percent, compared with 2.9 percent in the US. China's annual economic expansion now exceeds the US in dollar and percentage terms, while China's GDP rose almost $1 trillion (750 billion euros) last year.

The scale of change in the world economy is even more apparent if you look at the period since the international financial crisis took hold. Peak US GDP before the crisis was in the fourth quarter of 2007. Since then China's GDP has grown 52.5 percent. But in the third quarter of last year, the latest quarter for which data is available, US GDP was only 2.5 percent above its level before the crisis, and when the fourth-quarter figure is revealed it will be only slightly over 3 percent above its peak before the crisis.

In the last five years China's economy has therefore grown almost 20 times as fast as that of the US, and the economies of the EU and Japan have shrunk. In current dollar prices China's GDP has risen by $4.7 trillion and the US by under $2 trillion.

In industrial production, the most internationally traded sector, and the one with the fastest productivity growth, the change in the last five years is even more dramatic. On the latest available figures, EU industrial production is 12 percent below its peak before the crisis and Japan's is 22 percent below. In the US, despite unsubstantiated talk of "industrial revival", industrial output last month was still more than 2 percent below its peak of more than five years previously. In the five years to last month, US industrial production had shrunk 3 percent, but China's had grown 80 percent.

These huge economic shifts pose two questions. Can China maintain the pickup in economic momentum this year that was clear in the fourth quarter of last year? Can it maintain this over the medium and longer term with the attendant consequences of further changes in the structure of the world economy? Looking at what is going on economically right now, the answer to both questions is yes, and for the same reason.

Turning back to the short-term trends, there is no doubt that at the beginning of last year China's economic policymakers underestimated the difficulties in the developed economies. China's prediction of a 10 percent export increase in 2012 could not be achieved without significant growth in developed markets. This did not materialize, and exports rose only 7.9 percent.

As external demand was overestimated, there was a delay in launching a program to stimulate domestic demand. So China's economy slowed. By May, annual fixed asset investment growth had fallen to 20.1 percent, the lowest for a decade. In August the annual increase in industrial production fell to 8.9 percent. In the same month the annual increase in industrial company profits fell to 6.2 percent.

However, by the middle of the year policy was adjusted appropriately. In late May Premier Wen Jiabao announced an infrastructure-centered investment program that grew to $157 billion. Theoretical support to this new stimulus was given by the former World Bank chief economist and vice-president Justin Yifu Lin, who has now returned to Beijing to be a major influence in China's economic policy making.

The correctness of these policies was rapidly shown. By December the investment decline reversed, with the annual increase in fixed-asset investment rising to 20.6 percent, and industrial output growth accelerating to 10.3 percent. Industrial company profits rose, to an annual 22.8 percent in November. These trends underlay the GDP growth increase from 7.4 percent in the third quarter to 7.9 percent in the fourth.

In a perfect world, China would doubtless have launched its domestic stimulus a few months earlier. But in economics it is impossible, with the many variables, to make precisely accurate projections; only orders of magnitude can be accurately predicted. In particular, policymakers had to take into account that China's population is extremely inflation adverse. If export demand had been at the level expected, launching a domestic stimulus would have brought the risk of economic overheating with inflationary dangers. In the grand economic scheme of things, with China's GDP rising at 7.9 percent, the US at probably less than 3 percent, and the EU and Japan not at all, a few months' delay is virtually neither here nor there.

Nevertheless the small industry of those who reckon China will soon suffer a deep economic crisis refuses to die, the "soon" merely being moved further into the future when their predictions fail to materialize. The fact that events regularly disprove such predictions does not stop them being advanced. So a slight delay in China launching a domestic stimulus last year created a frenzy of speculation in such circles regarding a "hard landing" or "crash" in China's economy.

So a new "theory" had to be invented on why China's economy will substantially slow, that China's government is allegedly sacrificing the long-term interest of its economy for a short term "fix". According to one formulation of this: "China went into reverse in the second half of 2012 in its efforts to rebalance its economy Though steady, consumption took a back seat to capital spending as a driver of growth."

This line of argument makes as little sense as the numerous others and will equally be disproved by events.

First, looking at the long term, modern econometrics shows clearly that as an economy develops it becomes more dependent on investment for growth, not less. As China moves from a developing economy to a developed one, investment would be expected to play a greater role in its growth.

Second, Lin has rightly stressed that the industrial upgrading of an economy consists of it moving from labor-intensive to increasingly investment-intensive industries. This is precisely the path China is following with its exports increasingly switching from labor-intensive products such as textiles and toys into more capital-intensive ones such as ships, construction equipment, smartphones and cars.

Finally, in the purely short term, the present global economy conforms to economic theory showing that investment fluctuates more than consumption, and it is investment downturns that therefore create economic recessions. The latest figures show that in developed economies fixed investment is nearly 10 percent below its peak and has been falling since the first quarter of last year. China's ability to counter such threats by an investment stimulus program is therefore a sign of the strength of its economy, not of weakness.

Consequently, rather than China's government's policies sacrificing the long-term strength of the economy to short-term expedients, the stimulus launched from summer 2012 takes account of both short and long-term considerations in economic development. This is why most predictions for growth in China's economy this year, from Chinese observers and most international ones as well, are for GDP growth to speed up to more than 8 percent, the World Bank's 8.4 percent prediction being typical.

So the main dangers to the country's growth this year are not domestic but from external weakness in developed economies. The latest prediction by the World Bank for growth this year is 1.9 percent in the US, 0.8 percent in Japan and -0.1 percent in the eurozone. For this reason the bank's overall projection for global growth is a low 2.4 percent for the year.

Naturally China, as the world's second-largest economy, and the largest exporter of goods, cannot isolate itself from world economic trends. If the world economy slows this year, China is likely to slow, and if the world economy speeds up, China's economy is likely to do likewise. But whatever the short-term ups and downs, China will continue to enjoy its 6-7 percent growth lead over the developed economies.

As for the medium term, a major turning point in world history is being approached. The IMF projects that in comparable price levels, that is parity purchasing power, China will overtake the US to become the largest economy in 2017. At market prices China will overtake the US to become the world's largest economy a few years later. Exactly when the latter transition happens depends on the assumption on exchange rates, with 2019-20 being the most central date. To be safe, it may be said China will become the world's largest economy within 10 years. Given the short time scale, unless China's economy slows drastically and very quickly this transition is inevitable.

The author is a visiting professor at Shanghai Jiao Tong University. The views do not necessarily reflect those of China Daily.