China's outbound direct investment in overseas manufacturing sectors surged dramatically in January, highlighting the shift of Chinese capital into technology-intensive projects from traditional energy- and resource-focused ones, official data showed on Wednesday.

China's ODI in the manufacturing sector rose by 87.8 percent in January on a year-on-year basis to 10.6 billion yuan ($1.62 billion), according to the Ministry of Commerce.

A major chunk of the capital flowed into the telecommunications, electronic equipment, pharmaceutical and automobile manufacturing sectors, Shen Danyang, the ministry's spokesman, told a news conference in Beijing.

Meanwhile, investment in manufacturing equipment surged by 128.3 percent year-on-year, accounting for more than half of the total investment.

Marking a sound start to this year, total ODI rose 18.2 percent year-on-year in January to 78.76 billion yuan, according to the ministry.

The growth of China's outbound investment benefited from the country's Belt and Road Initiative designed to improve regional connectivity between Asia, Europe and Africa and favorable government policies to facilitate industrial cooperation between Chinese companies and international players, Shen said.

The fresh investment data also reinforced the structural change of China's outbound investment, said Xu Hongcai, director of the economic research department at the China Center for International Economic Exchanges.

"Slumping oil and commodities prices suppressed the investment desire of Chinese companies in energy sectors while the technological and human resource advantages in the manufacturing sectors of developed economies continue to attract Chinese investment," he said.

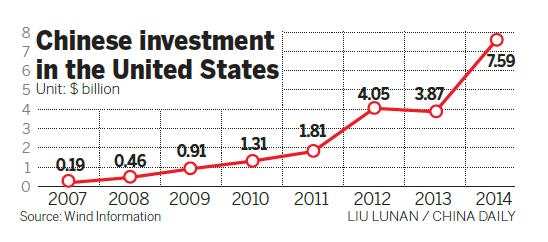

Direct investment in the United States by Chinese companies soared to 10.2 billion yuan in January, nearly four times the amount of investment in the same period of last year, according to official data.

Recent high profile M&A deals by Chinese companies in the US include Shandong-based household appliances multinational Haier Group's $5.4 billion purchase of General Electric Co's appliances business and private conglomerate Dalian Wanda Group's $3.5 billion acquisition of Hollywood filmmaker Legendary Entertainment.

"The potential of the US market as well as its branding and intellectual property assets are among the factors that help drive the growth of Chinese investment," said Lu Jinyong, director of international investment research center at the University of International Business and Economics in Beijing.

The desire of Chinese private companies to diversify assets in mature markets will continue to drive China's direct investment in the US, Lu added.

Local enterprises rather than central State-owned ones were the main contributor to outbound direct investment.

China has surpassed Canada to be the largest trading partner of the US, with bilateral goods trade reaching $598 billion last year.