|

|

|

A wall of logos of multinational companies in China. Despite the European credit squeeze, international investors still plan to expand their presence in the world's second-largest economy. [Photo / China Daily] |

At the same time, the Chinese government has been delivering mixed signals on monetary fine-tuning, thus further blurring the prospects of the yuan market.

The People's Bank of China (PBOC), the nation's central bank, cut the reserve-requirement ratio (RRR) for lenders by 50 basis points for the first time in nearly three years on Nov 30. The central bank made the move - helping to inject some 400 billion yuan ($63 billion) into the economy - to ease credit strains and shore up the economy as inflation eases.

Meanwhile, speaking at an investment seminar in Beijing, Xia Bin, an adviser to the PBOC, reiterated that the central bank would "fine-tune" its "prudent" monetary policy instead of announcing an outright shift, and added that curbs on the property market will be maintained.

The subdued performance of the manufacturing sector is also reflected in the HSBC Purchasing Managers Index for November, which slid to 47.7 from 51 in October, the lowest level since March 2009.

However, multinational companies contacted by China Daily have said that they will maintain their expansion plans in the country and have no intention of cutting budgets. That's because China is likely to remain one of the very few markets capable of maintaining growth even if the crisis in Europe eventually pushes the world into recession.

"We do not have a timetable for achieving this target, but our presence on the mainland will definitely double in five years," said Greene from Wyndham Hotels.

China's economy is expected to grow by 9.6 percent in 2011 with fixed-asset investment remaining a key driver, according to the annual report of the Asian Development Bank, released in Hong Kong earlier in the year.

Third-quarter GDP registered growth of 9.1 percent year-on-year, below general market expectations of 9.3 percent, according to data from China's National Bureau of Statistics.

Despite missing the GDP estimate, some components of the Chinese economy are holding up, including fixed-asset investment, which rose 24.9 percent year-on-year.

Unsurprisingly, some multinational companies are now desperate to find new sources of yuan funding as eurozone banks tighten credit. Some are seeking to secure improved credit lines with domestic Chinese banks.

"One of our clients is an overseas airline company. It has registered a wholly-owned subsidiary in China and in this way it can borrow money from a domestic bank, making the transaction a China-to-China banking pattern," according to an insider at Shanghai Pudong Development Bank Co Ltd.

"We have witnessed an increasing number of overseas companies doing the same thing to seek funds from domestic banks, and we have observed that the amount of yuan borrowing has increased during the past two years," said the insider.

This development has helped the domestic banks to expand their loan portfolios to multinationals and provided a business boost for foreign banks operating in China.

Moreover, many companies are stepping up their efforts to raise money in Hong Kong's capital market by issuing yuan bonds.

Since July 2010, when Hong Kong and the mainland monetary authorities signed an agreement aimed at further relaxing the restrictions on yuan transfers, a broad range of global borrowers together with mainland and Hong Kong issuers, have tapped the "dim sum" market. The companies include names such as McDonald's Corp, Caterpillar Financial Services Corp and Unilever PLC.

Meanwhile, a further easing of macro policy is widely expected, following the PBOC's November decision to lower the RRR. However, Banny Lam, a Hong Kong-based economist with CCB International Securities Ltd, believed the softened credit environment will not necessarily alter Hong Kong's attractiveness in yuan-bond issuance.

"Many companies will still feel strangled of funding because not all of them can obtain loans, even if the credit theme turns positive for local lenders. As far as I know, at this moment there are still quite a number of multinationals lining up to issue yuan-denominated bonds in Hong Kong next year," said Lam.

The offshore yuan market has more than tripled in size year-to-date to 210 billion yuan, and the dynamics continue to change rapidly, said a report from HSBC Holdings PLC, released on Nov 8.

"With domestic liquidity conditions remaining tight and the onshore-offshore interest-rate gap remaining wide, the incentive for Chinese companies to raise funding in overseas markets will remain high in the near future," said Becky Liu and Zhang Zhiming, HSBC economists and the primary authors of the report. They added that they expected gross issuance to be between 260 and 310 billion yuan next year, with the market growing to between 400 and 450 billion yuan.

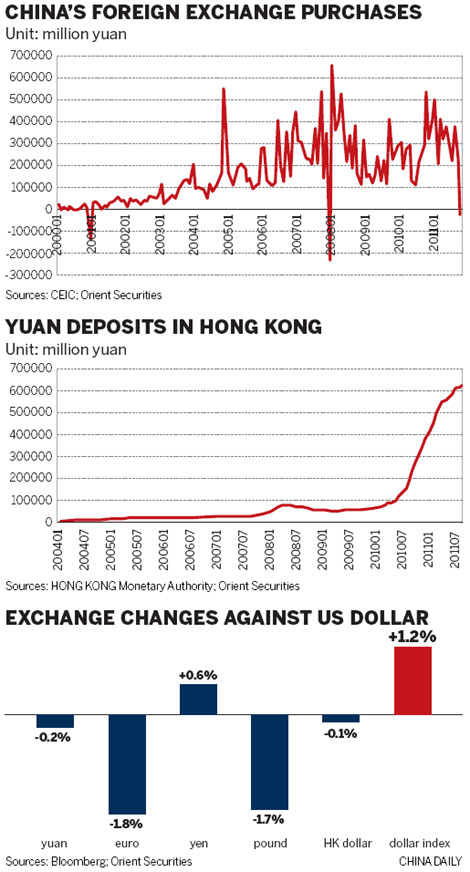

Although the yuan deposit base in Hong Kong declined in October, falling to 618.5 billion yuan from 622 billion in September as expectations of appreciation fade, the city has seen explosive growth in yuan deposits over the past 14 months. The figure was only 217 billion yuan at the end of October 2010, around one-third of the current level.

"With yuan appreciation expected to slow, the focus of yuan policy will shift increasingly toward internationalization (in 2012)," noted Paul Mackel, HSBC's head of Asian currency research.

During a visit to Hong Kong in August, Vice-Premier Li Keqiang announced a basket of new measures to boost the city's economic development and to enhance cross-border cooperation, particularly on the expansion of the yuan-denominated asset market.

The Renminbi Qualified Foreign Institutional Investor (RQFII) program, also unveiled by the vice-premier, is at the top of the agenda for mainland regulators. They are accelerating moves to trial the program in a bid to facilitate offshore yuan deposits in the special administrative region that will be invested in the mainland's A-share market, reported the Xinhua News Agency on November 29, without disclosing its sources.

Hong Kong-based subsidiaries of mainland fund houses and securities firms will be allocated the initial quota of the RQFII program, the PBOC said in an e-mailed statement in September. The central bank added that 80 percent of the total designated 20 billion yuan-funded foreign investment will go into the mainland bond markets in the initial stage.

"The RQFII scheme will likely be rolled out in early 2012, if not before the end of this year. There also may be regulatory changes to promote the offshore yuan-lending market. Finally, there are likely to be substantial moves toward expanding yuan settlement beyond Hong Kong," Mackel wrote in a report released on Dec 2.

Cai Xiao in Beijing contributed to this story.

Top 10 investment immigration destinations for Chinese

Top 10 investment immigration destinations for Chinese

New wind power group sprouts up in Chongqing

New wind power group sprouts up in Chongqing

Top 5 online rumors of latest iPhone

Top 5 online rumors of latest iPhone

A glimpse of former Shougang industrial site

A glimpse of former Shougang industrial site

Robot waiter introduced to restaurant in South China

Robot waiter introduced to restaurant in South China

Qingdao gets ready for huge beer festival in China

Qingdao gets ready for huge beer festival in China

Top 9 automobile recalls in H1 in China

Top 9 automobile recalls in H1 in China

Disabled veteran carves out success on Internet

Disabled veteran carves out success on Internet

Caixin China manufacturing PMI falls to two-year low

Caixin China manufacturing PMI falls to two-year low

China official manufacturing PMI falls to 50.0 in July, below forecasts

China official manufacturing PMI falls to 50.0 in July, below forecasts