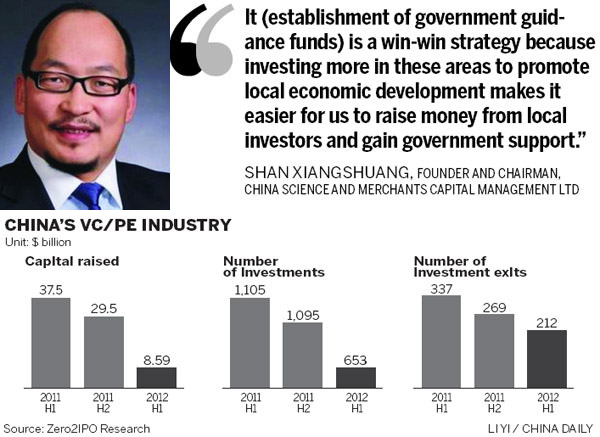

China Science and Merchants Capital Management attracts attention with its portfolio of winning deals

Thirty-eight newly launched funds, 111 investment deals totaling 11.2 billion yuan ($1.76 billion) and 11 successful applications for initial public offerings by companies it invested in.

That's the track record of Beijing-based private equity firm China Science and Merchants Capital Management Ltd, also known as CSM Group, in 2011 alone. It drew the attention of the whole Chinese venture capital and PE market with its outstanding investment performance over the course of the year.

|

Venture capital and private equity firms in China are eyeing small and micro companies and those in crisis. [Photo/China Daily] |

In the first half of this year, of 104 companies that went public in China, four were invested in by CSM Group.

Shan Xiangshuang, the 45-year-old founder and chairman of CSM Group, told China Daily that although other players in the industry had their doubts, he was not surprised with the compelling investment achievement of his company, because it has 13 years of experience in China and has developed many successful tactics specific to China.

"In the past 10-plus years, we have positively sought out private entrepreneurs as our LPs (limited partners) and given them power to make decisions in the deals in which we invest," Shan said.

Shan said that LPs in the West are usually managers of large institutions such as pension funds. However, in China they are mostly private entrepreneurs who are very hard-working and show great interest in the activities of the equity investment funds into which they put money.

"Consequently we invite entrepreneurs who are the main LPs of our equity investment funds into the decision-making commissions and they can be very helpful when the deals we are going to invest in are in the fields in which they have expertise," said Shan.

"Unlike many VC and PE firms in China, we set up regional offices and look for local partners with good resources to join us, which helps us find investing deals faster and better," Shan said.

Business development

Shan graduated from Xiamen University as an accountancy student and started his career in government, becoming a low-level official in China Communications Import and Export Co when he was 25.

During his leisure time he wrote novels. Now his interest is in art and film.

In 1998 he became determined to seek business opportunities in Shenzhen and found a job in a securities company. Later, he initiated an investment and financing commission under the management of the China Communications and Transportation Association and a venture capital investment research center at Peking University.

|

|

In 2000, when China's growing enterprise market - currently ChiNext, which is the nation's Nasdaq-style stock market - was expected to open, he set up CSM Group with just 600,000 yuan in available funds. He and his team succeeded in raising the cash pile to 300 million yuan from five large enterprises within four months. They included State-owned audio and video company China Hualu Group, and Erdos Group, a company with interests in cashmere, coal, electricity, metallurgy and chemistry.

"We paid attention to cooperating with local governments from 2006 and set up government guidance funds together. It is a win-win strategy because investing more in these areas to promote local economic development makes it easier for us to raise money from local investors and gain government support," said Shan.

He cited Guangdong as an example. Guangdong CSM Venture Capital Management Co Ltd, a subsidiary of CSM Group, and Guangdong provincial government set up CSM Baiyun Fund in 2009 with 5 billion yuan. As much as 1.1 billion yuan of the total was invested in 19 projects mainly in Guangdong in advanced manufacturing and agriculture.

That sum would yield at least 3.58 billion yuan with a net internal rate of return of nearly 48 percent.

Fifty million yuan from the CSM Baiyun Fund was invested in Guangzhou Xiangxue Pharmaceutical Co Ltd in 2009 for a 6.8 percent stake. The company listed in 2010 on ChiNext and CSM received more than quadruple its investment in return.