The headquarters of the National Development and Reform Commission in Beijing. Since April, the commission has approved four new airports or airport relocations, about 100 clean-energy projects and the construction of three major steel mills worth more than 130 billion yuan in total. [Photo/China Daily]

New strategies intend to change longer-term economic structure

Call it Beijing's "Stimulus 2.0".

China is at an inflection point as its economic policy focus shifts to growth instead of inflation control.

This time, the method of boosting growth is different from the past. Instead of throwing money at the problem - up to 4 trillion yuan ($630 billion) was spent after the global financial crisis broke out in late 2008 - China is aiming for a more managed, selective stimulus.

In the next couple of months, more changes are likely in the run-up to the leadership transition, scheduled for the third quarter. The changes so far have fallen into the following categories:

Adjusting strategy

No top-down change can come without a signal from Beijing. Premier Wen Jiabao, during an inspection trip to Central China's Hubei province from May 18 to 20, told local officials that judging from "the new situation and new problems", the central government now sees the need for a greater emphasis on maintaining the speed of growth.

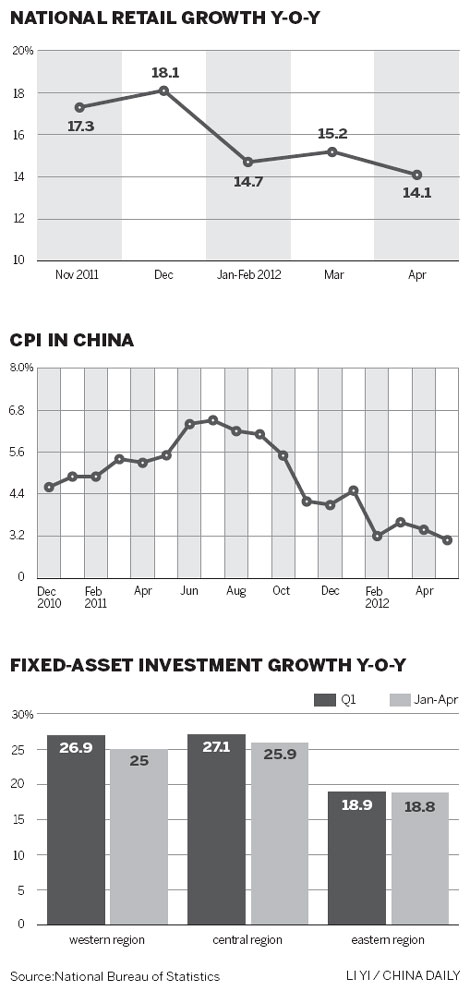

Last July, inflation was at what was considered a dangerous level of 6.5 percent. Even in January, inflation was 4.5 percent, still very high. Policymakers' top priority in such circumstances would inevitably be inflation control.

Monetary easing

In comparison with Wen's trip to Hubei in May, in his earlier local inspection trip last October, he promised only "appropriate fine-tuning" of macroeconomic policies.

One month later, the People's Bank of China cut commercial banks' reserve requirement ratio by 50 basis points, allowing for faster loan growth.

By mid-May, the central bank had lowered the RRR three times, most recently on May 12, and economists have forecast further cuts in the next few months.

Large financial institutions' RRR was lowered to 20 percent, while that for smaller banks fell to 16.5 percent.

Economists differ on how much RRR cuts help growth. That banks can lend more does not mean that they will do so, immediately or in the longer term.

Although the latest RRR cut made it possible for banks to lend another 400 billion to 500 billion yuan, there was little increase in new credit from the top four State-owned banks - Industrial and Commercial Bank of China Ltd, Agricultural Bank of China Ltd, Bank of China Ltd and China Construction Bank Corp - in the first 10 days of May.

In the subsequent 10 days, only a minimal increase in new loans was reported from those four banks.

Analysts have estimated that the consumer price index for May would be about 3.1 percent. In June, it could fall below 3 percent, making the once seemingly impossible goal of keeping the CPI below 4 percent this year look achievable.

Once the CPI falls below 3 percent, analysts said, the central bank would deem it more appropriate to cut interest rates, which would give a more direct boost to GDP growth.

Investment bank China International Capital Corp has said a rate cut might come as early as June.

Offering subsidies

On May 16, at a State Council executive meeting chaired by Wen, the central government decided to offer 36.3 billion yuan over the next year to subsidize the purchase of energy-efficient products.

Of the total, 26.5 billion yuan will be targeted to home air-conditioners, flat screen televisions, refrigerators, washing machines and heaters.

Another 2.2 billion yuan will go to LEDs and other energy-efficient lighting, 6 billion yuan for automobiles with engine capacities of 1.6 liters or less, and 1.6 billion yuan for high-performance motors.

The subsidies, economists said, could generate as much as 450 billion yuan in domestic consumption. That sounds like a lot. But analysts said it's a drop in the bucket for a 50 trillion yuan economy - the size of China's GDP last year.

Speeding investment

Moving at what the Chinese-language business press called a "markedly faster" speed, the government has green-lighted more investment in fixed assets - new factories and infrastructure.

Since April, the National Development and Reform Commission has approved four new airports or airport relocations and about 100 clean-energy projects.

Last Saturday, the NDRC announced its approval of the construction of three major steel mills worth more than 130 billion yuan in total.

Shanghai-based Baosteel will invest almost 70 billion yuan in a complex in Zhanjiang, Guangdong province.

The formerly Beijing-based Shougang Group will build a cluster of production facilities in its new headquarters at Qian'an in Hebei province. The budget was not disclosed.

Guangxi Iron and Steel Group will build a steel mill in Fangchenggang, Guangxi Zhunag autonomous region, at a cost of 64 billion yuan.

Officials of the Ministry of Transportation said in mid-May that funds for building new highways would be authorized more quickly by the central government, although they declined to specify the expected total amount.

Their announcement followed news that first-quarter spending on highway construction fell 9.5 percent year-on-year to 157.5 billion yuan.

But high-speed railways will take center stage. Wen has already promised 500 billion yuan for ongoing rail projects this year.

Building new homes

As of the end of April, the central government had authorized 148.3 billion yuan for the construction of subsidized urban housing.

These apartments are a strategic part of Beijing's efforts to control the real estate bubble while providing homes for low-income urban households.

Vice-Minister of Housing and Urban-Rural Developing Zhang Xueqin said in May that the central government would not reduce its efforts to support large-scale construction of subsidized housing.

Cutting taxes

What officials call a "structural tax cut," an experiment that started early this year in Shanghai, is expected to soon expand to 10 provinces and municipalities.

The experiment allows companies, mainly small ones in the service industry, to shift from paying business tax to value-added taxes, which are lower.

In Shanghai alone, according to municipal tax officials, the change cut local companies' tax burden by more than 2 billion yuan in the first quarter, compared with their old tax liability. In some cases, the reduction was almost 40 percent, tax officials said.

In the meantime, the government promised that the existing 50 percent tax cut for small and low-profit enterprises would be extended to the end of 2015.

Nurturing innovation

On Wednesday, the State Council decided to accelerate the growth of the seven so-called strategic new industries: energy efficiency and environmental protection, information technology, bio-engineering, advanced equipment, new energy, new materials and alternative-fuel vehicles.

These are to be the key industries to be developed during the 12th Five-Year Plan (2011-15).

They may not immediately generate an impetus for the economy. But in the longer run, they will act as new engines of growth.

Inviting capital

Also in May, six government agencies - the Ministry of Transportation, Ministry of Railways, Ministry of Health, the China Securities Regulatory Commission, the State-owned Assets Supervision and Administration Commission and the China Banking Regulatory Commission - released plans to allow private investment in the sectors under their supervision.

Barriers to private capital in State-dominated sectors is a long-standing problem. Few government agencies made any actual change, even after the State Council released its 36 guiding principles for supporting the development of the non-public economy in May 2010.

A lack of worthwhile investment opportunities inevitably drove private capital into a few very narrow channels and was partly responsible for the urban real estate bubble.

Allowing private investment into previously closed industries will make those sectors more competitive while helping the economy develop in a more balanced way, economists have said.

Some of the ministries' plans are still too vague and lack detail, critics said. But the plans could signal the start of a trend in which rules that actually implement the plans will be worked out by the central government and its agencies.

The Shanghai-based Jiefang Daily said the new policies on private capital will generate no less stimulus to the economy than the 4 trillion yuan that Beijing spent three years ago.

ed.zhang@chinadaily.com.cn and huangying@chinadaily.com.cn

|

|

Fishermen who clean enteromorpha

Fishermen who clean enteromorpha

Govt Carries out conservation program in Tibet

Govt Carries out conservation program in Tibet

Business giants celebrate the success of entrepreneurship

Business giants celebrate the success of entrepreneurship

Top 10 Chinese businesswomen in 2015

Top 10 Chinese businesswomen in 2015

Female robot sings in Shanghai

Female robot sings in Shanghai

21st Lanzhou Investment and Trade Fair kicks off in Lanzhou

21st Lanzhou Investment and Trade Fair kicks off in Lanzhou

Top 10 Chinese brokerage firms in H1 of 2015

Top 10 Chinese brokerage firms in H1 of 2015

Fancy sculptures sparkle in Chongqing

Fancy sculptures sparkle in Chongqing