|

|

A Chinese worker walks past a logo of Alibaba at the headquarters of Chinese e-commerce giant Alibaba in Hangzhou city, East China's Zhejiang province, September 15, 2014. [Photo/IC] |

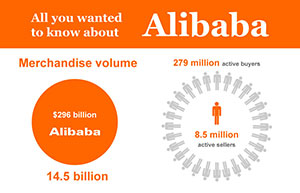

Alibaba Group Holding priced its initial public offering at $68 a share, the top end of the expected range, raising $21.8 billion on Thursday, in the latest sign of strong investor appetite for the Chinese e-commerce juggernaut.

At that price, the IPO, one of the largest-ever, would give Alibaba a market valuation of $167.6 billion, surpassing American corporate icons from Walt Disney Co to Boeing Co. The offering also vaults it atop US e-commerce rivals like Amazon and eBay and gives it more financial firepower to expand in the United States and other markets.

"I'd put them (Alibaba) in a class of Facebook and Google with the scale they have, growth prospects and profitability," said Scot Wingo, CEO of e-commerce software provider ChannelAdvisor. "There's a scarcity value there."

An Ipsos poll conducted for Thomson Reuters found that 88 percent of Americans had never heard of the Chinese e-commerce company, which is responsible for 80 percent of online sales in the world's second largest economy and works with a number of businesses there including consumer online marketplace Taobao and payment service Alipay.

But that didn't sap enthusiasm among multiple large US institutions, including Blackrock, which put in orders for allocations of at least $1 billion in shares, according to the sources.

Between 35 and 40 institutions placed orders for $1 billion or more shares each, investors briefed on the matter said.

Keen to buy into China's rapid growth and evolving Internet sector, investors have been clamoring to get shares since top executives at Alibaba, including Ma, kicked off the road show last week.

"It was one of the more impressive IPO presentations," said Jerry Jordan, manager of the $48 million Jordan Opportunity Fund . "I didn't realize just quite how successful they are."

Based on the amount raised so far, Alibaba's IPO is the third-largest ever behind Agricultural Bank of China Ltd's 2.1 billion listing in 2010 and ICBC's $22 billion flotation in 2006. If underwriters exercise an option to sell more shares, as many expect, Alibaba's will surpass both Chinese lenders to become the largest-ever.

Many investors reported difficulty in getting the full allocation of shares they were aiming for.

John Boland, president of Maple Capital Management in Montpelier, Vermont said he had put in orders for about 5,000 Alibaba shares on behalf of high net worth individuals and institutions and had been told the offer was oversubscribed and that they would probably not get the full order.

|

|

|

|

|