Analysis

More IPOs needed on ChiNext

By Li Xiang (China Daily)

Updated: 2010-04-09 16:34

|

Large Medium Small |

|

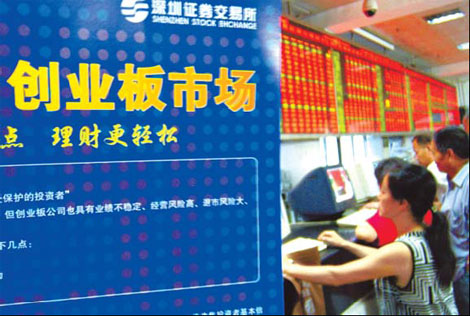

Individual investors watch stock prices. The ChiNext board, envisioned as a way for startup firms to raise capital, has a much higher average price-earning ratio than the main board. [Ren Weihong / China Daily] |

Relative few listings on new exchange fueling overvaluation, speculation

Securities regulators should gradually loosen listing restrictions on the ChiNext board to empower more innovation-driven but cash-starved small companies to tap the capital market, financial experts say.

The Shenzhen-based bourse - likened to China's NASDAQ - has listed 65 companies through the initial public offerings (IPO) since it was launched last October.

"The ChiNext won't be able to play its full role in helping startup companies raise capital if there are not enough companies approved for listing each year," said Cao Fengqi, director of the finance and securities research center at Peking University.

Unlike the main board that has stringent rules about past company performance such as a requirement for three consecutive years of profit, the ChiNext should be more forward-looking by focusing on the growth potential of companies, Cao said.

Startup companies in China are in dire need of credit, but they have largely been bypassed by the country's recent lending boom, as banks are reluctant to lend them money due to perceived risk in bad loans.

While the government is taking measures to curb lending to forestall an asset bubble, it is small enterprises that are likely to be the first to feel the pinch, experts say.

Cao noted that accelerating IPOs on the ChiNext will not only ease pressure on small companies that need capital, but also help tamp down high valuations and rampant speculation on the board.

The ChiNext currently has an average price-earning ratio of 84.9, much higher than the main board's 26.6.

The share price of software developer Beijing Ultrapower Software Co Ltd even hit a record high of 200.81 yuan, replacing liquor producer Kweichow Moutai Co Ltd as the highest-priced stock on any Chinese exchange.

Cao said improved rules including a direct delisting mechanism and a life-tenure sponsorship system are essential to curb excessive speculation on the board.

President of the Shenzhen Stock Exchange - the ChiNext's parent board - Chen Dongzheng said recently that the bourse was set to improve its direct delisting mechanism in order to speed up the process and prevent potential backdoor listings.

High valuations of recent ChiNext listings were partly due to the lack of risk in delisting, a mechanism that helps alert investors and would make the board more market-driven, Cao said.

He also noted the ChiNext could learn from the underperforming Hong Kong's growth enterprise market (GEM) launched in1999.

Hong Kong's GEM has not performed well in market turnover, capitalization and promotion of technological development, partly due to Hong Kong's relatively weak technology base and small manufacturing sector that failed to offer enough new listings.

"An inactive market with very low turnover, just like an excessively speculative one, is not good for healthy development," Cao said. "A successful growth enterprise market has to have sufficient listing resources and high liquidity in order to fulfill its full function of supporting startup companies."