China Daily Exclusive

Avoiding a Greek tragedy

By Liu Junhong (China Daily)

Updated: 2010-06-26 15:08

|

Large Medium Small |

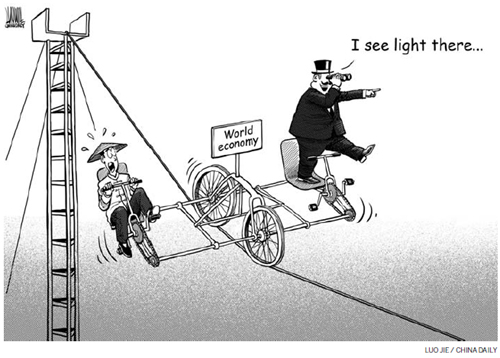

Concerted global efforts needed to check inflation in emerging economies and deflation in the developed world

The Greek debt crisis has not only put a question mark on the future of euro, but also increased the risk of a double-dip global recession. At this critical juncture, the major tasks of the Group of 20 (G20) leaders meeting in Toronto, Canada, are how to pursue well-coordinated economic policies, overcome the multiple crises and ensure a strong global economic recovery.

G20 finance ministers and central bank governors agreed at their meeting in April that global recovery, till then, had been better than expected. But shortly after that, with the Greek debt crisis worsening and its spillover effect on Mediterranean countries and some Central and East European countries preparing to join the European Union (EU), the eurozone's market fell into disorder. As a result, the euro dropped and world stock markets tumbled.

Now, the emerging economies have to pare their growth outlook because Europe's woes threaten to derail global recovery. The global economic crisis is thus becoming more complicated and creating new uncertainties.

Earlier this month, the meeting of G20 finance ministers and central bank governors in Busan, the Republic of Korea, put the uneven pace of recovery in countries and regions on its agenda, along with fiscal reestablishment and financial regulatory reform issues.

China and other emerging economies have been functioning as the new engines of global economic growth in the post-global financial crisis period. But after a year and half, the emerging economies are showing increasing signs of overheating and even bubbles. These economies need to take delicate decisions to avoid inflation and gradually deflate the bubbles, if there are any.

The developed countries have recovered from recession, at different speeds though, and begun walking the right path from "policy-stimulated recovery" to "market-driven growth". But they are headed toward an imminent deflationary shock because of Europe's debt and financial crises.

There is no sign of a decline in market liquidity yet, and enterprises' potency to raise funds by issuing bonds and shares is shrinking to the level seen just after the collapse of Lehman Brothers in September 2008. Worse still, Europe's financial and banking woes caused by sovereign debts are likely to intensify regional economic contraction.

The global economic recovery, therefore, throws up a dual scenario: emerging economies face mounting pressure of inflation, and the developed world faces potential deflation.

The dual scenario makes it hard for the international community to pursue concerted policies. It also threatens to create new risks to the global recovery.

Emerging economies face a dilemma. If they withdraw their stimulus measures prematurely or scale back government spending too quickly, the global economy could go into double-dip recession because, as the engines leading the recovery, the emerging economies will lose all their steam. On the other hand, their insistence on government spending could create more serious bubbles.

Moreover, if developed countries continue to follow the "wartime-style" financial policy, they could further propel foreign funds to flood the emerging economies. But that cannot help their economies to tide over deflation risks. On the contrary, it would enlarge the bubbles in their economies.

The International Monetary Foundation has been insisting that before withdrawing their stimulus packages, the countries should reach a state of "financial soundness", show signs of a "market-driven recovery", and ensure that the withdrawal would be under well-coordinated economic policies in order to maintain stability of the world economy.

But what is worrisome is that Germany, Europe's largest economy, follows a "tightened fiscal policy" and has banned open short sales to maintain financial stability, which could worsen Europe's fiscal and banking woes.

The US, as expected, is aiming to play the dominant role in the global financial regulatory reform, expand its exports, cut government expenditure and reinvigorate the dollar in disregard to other countries' currencies and financial stability.

Japan's enthusiastic investments in other Asian countries' infrastructure, environmental protection and power projects could make it more difficult for them, including China, to curb inflation and deflate bubbles.

The new British government has said it wants better cooperation with other EU countries. Besides imposing curbs on the banking sector, it also wants to advance the pound's competitiveness against the euro and rejuvenate its industry by stimulating the development of its manufacturing sector.

The policies of the developed economies in response to the global crisis, combined with the risks of fluctuation in the international commodity and finance markets, are not conducive to an effective policy outcome at the G20 Toronto Summit.

After the Pittsburgh Summit, G20 became one of the most important international forums of global policy coordination. But it is a multi-trillion-dollar question today whether the developed world can promote "fiscal soundness", and "financial normalization" and sustain a stable international financial system in the face of the multi-faceted crises, especially the lack of stimulus programs in European countries.

The author is a research scholar with the China Institutes of Contemporary International Relations.

China Forum