Soros rides the gold wave

|

A jeweler examines 18-carat gold ring blanks at a shop in Cambridge, United Kingdom. Investment demand doubled to 1,820 tons last year as investors sought a refuge from the global recession. Graham Barclay / Bloomberg News |

LONDON - George Soros is helping drive up gold prices by doubling his bet in a market even he considers a "bubble" as Goldman Sachs Group Inc, Barclays Capital and HSBC Holdings Plc predict more gains before it bursts.

Soros Fund Management LLC, which manages about $25 billion, increased its investment in SPDR Gold Trust, the world's largest exchange-traded fund for the metal, by 152 percent in the fourth quarter, a Feb 16 Securities and Exchange Commission filing shows.

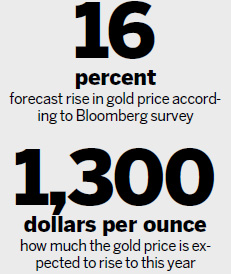

While prices have fallen 8.9 percent since reaching a record on Dec 3, 15 of 22 analysts in a Bloomberg survey say gold will reach a new high, with the median forecast predicting a 16 percent advance to as much as $1,300 an ounce this year.

"When interest rates are low we have conditions for asset bubbles to develop, and they are developing at the moment," Soros said at the World Economic Forum's annual meeting in Davos, Switzerland, in January. "The ultimate asset bubble is gold," he said.

In a Jan 28 Bloomberg Television interview, the 79-year-old billionaire recalled that former Federal Reserve Chairman Alan Greenspan warned of "irrational exuberance" in financial markets three years before the technology bubble burst in 2000. The Standard & Poor's 500 Index rose 89 percent in the period.

Buying at the start of a bubble is "rational," Soros said.

Gold's fourfold rally since the end of 2000 has also attracted money managers John Paulson, Paul Tudor Jones and David Einhorn. Paulson's Credit Opportunities Fund soared almost sixfold in 2007 by betting that subprime mortgages would plummet. Einhorn said in October that his Greenlight Capital Inc bought gold to bet against the dollar.

'Just an asset'

Tudor Investment Corp, based in Greenwich, Connecticut, increased its stake in Newmont Mining Corp, the largest US gold producer, almost fourfold in the final quarter of 2009.

Gold is "just an asset that, like everything else in life, has its time and place. And now is that time," Paul Tudor Jones said in an October letter to clients.

Funds of the four-biggest ETF firms hold 1,583 metric tons of the metal, according to data compiled by Bloomberg.

Only the central banks or governments of the US, Germany, Italy and France and the International Monetary Fund hold more.

Investment demand, including in bars and coins, doubled to 1,820 tons last year as investors sought a refuge from the global recession, according to GFMS Ltd.

That exceeded jewelry demand for the first time in three decades, the London-based research firm said on Jan 13.

Prices reached the record $1,226.56 a decade after the metal fell to a 20-year low of $251.95 amid sales by central banks.

The price fell as the economic recovery sparked a dollar rally that has pushed the US Dollar Index, a gauge against six counterparts, up 3.2 percent this year.

Gold ended last week at $1,117.60, up 18 percent in the past 12 months and 21 percent since the start of the third quarter, when Soros accumulated 2.44 million shares of the SPDR Gold Trust.

"Perhaps Soros thinks gold is going to bubble but the bubble is going to last for a while and he wants to profit from it," said Jeffrey Nichols, managing director of American Precious Metals Advisors and an adviser to central banks and mining companies. "We could have a bubble but gold can reach $2,000 or $3,000 before it's over."

Soros' New York-based firm became the fourth-biggest investor in the SPDR Gold Trust by the end of 2009, 17 years after he made $1 billion breaking the Bank of England's defense of the pound. The SPDR fund holds 1,107 tons, more than either Switzerland or China.

Paulson, Einhorn

Paulson & Co is the ETF's biggest investor, with 31.5 million shares, regulatory filings show. With each representing almost a 10th of an ounce of gold, the hedge fund firm's stake is the equivalent of about 96 tons, exceeding the holdings of Australia and Kuwait.

New York-based Paulson is also the biggest investor in Johannesburg-based AngloGold Ashanti Ltd, Africa's top producer. The Market Vectors Gold Miners ETF is Einhorn's seventh-largest holding, according to a Feb 16 filing.

Goldman predicts gold will reach $1,235 in three months and $1,380 in 12 months. Barclays Capital says the metal will average $1,235 in the fourth quarter. HSBC says it may peak at $1,300 this year.

Bloomberg News

(China Daily 03/02/2010 page14)