Oil price trend remains up

Despite the numbers, supply and demand will push cost higher

Oil is a slippery substance easily held hostage to supply disruptions through natural events, wars, cartel agreements and political decisions.

Between all these influences it is often difficult to extract the underlying trend behavior of the NYMEX oil price.

Ten days ago the International Energy Agency (IEA) decided to dump 60 million barrels of government oil that had been previously hoarded in the strategic reserve oil stockpile. Half of this oil release comes from the US strategic reserve which holds around 727 million barrels of crude.

This is direct market intervention, although with oil prices already in retreat from $115 to $94 the timing of the intervention seems more political than economic. This type of market intervention last occurred in 2008 when oil was trading at $147. This was not enough to collapse oil prices. The collapse was triggered by the foreshadowed changes in trading regulations which put speculator positions at increased risk.

After the disaster of the 2005 Hurricane Katrina in the United States oil stocks were also released. This led to a 20 percent drop in oil prices in the following two months.

The current intervention is a drop in the ocean in terms of world oil demand. However it has delivered a body blow to the upward trend in prices that has been in place since June 2010. The release of oil stockpiles drives prices back toward long-term support around $87.

Lower oil prices provide instant relief from inflation because oil is at the core of modern logistics and production. A drop in prices at the fuel pump gives consumers more income to spend on other products. It is almost like a tax cut. Increasing domestic consumption is essential for any sustainable recovery in the US economy.

This is not a long-term policy solution to the problem of inflation or high oil prices. Drawing down on stockpiles is a policy with a clearly defined end point. This can only continue so long as stockpile inventories last and the market knows this. Nobody is going to fade this trend right now by taking long-side positions. However the next long-side trade is a certainty in a few weeks when the oil release comes to its inevitable end. Just how much profit is in the next long-side trade is revealed with chart analysis.

Chart analysis helps to identify the support levels, and the rally rebound target levels. This analysis sets up a short-side trade in the current market condition. Later, this analysis gives the foundations for a trade from the long side to capture the rebound rally, and potentially the beginning of a new longer-term upward trend.

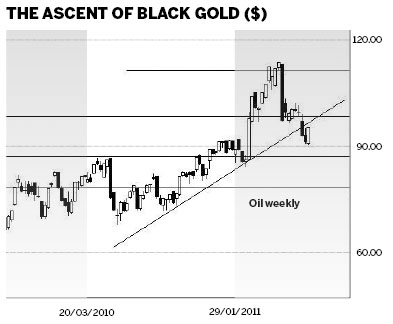

There are two significant features on the NYMEX oil chart. The first feature is the consistent support and resistance bands. These define oil price activity and indicate high probability pause-points for price activity.

The second feature is the long-term upward trend line that started in August 2010. This trend line has been broken on the downside. This upward trend line defines the bulk of the trend activity and uses the significant retreat and rebound points as anchor points for the trend line.

A natural market rebound from the trend line near $96 did not develop because it was overwhelmed by market intervention with the IEA release of strategic oil reserves. The function of the trend line as a support level failed.

This signaled a short-side trade driven by external policy decisions. The downside target is the long-term support level near $87. If this price fall is triggered by changes in the fundamentals of demand and supply then the chart would also suggest a further downside target near $77.

This is a low probability target simply because the new supply of oil is limited by the size of the stockpiles of the IEA member nations. It is also limited by political willpower as not every member nation will be prepared to see a significant depletion of their reserves.

This situation is very different from OPEC intervention in the market. OPEC members have a virtually unlimited supply that allows for an easy increase in production to meet the demand and supply balance. IEA increases in supply, created by releases from strategic reserves, are limited because they come from a relatively finite stockpile. This suggests strong support around $87 with the development of a consolidation pattern.

The consolidation behavior is the foundation of the long side trade. A breakout from the short term down trend or the short-term consolidation pattern has an immediate upside target near $99 to $100. When oil is trading below $100 the pattern of support and resistance bands are around $10 wide.

When oil moves above $100 the behavior of the market changes. The first change in behavior is an increase in volatility. The price moves up and down more rapidly and more frequently than when oil is below $100.

The second change in behavior is an increase in the width of the support and resistance bands to around $12. The first trading band target is measured from the psychological resistance level at $100 and gives an upside target near $112.

A price rise to $98 to $100 can not be easily limited or overwhelmed by further IEA releases. A price rise to this level signals an exhaustion of the IEA willpower to continue to supplement supply with new releases. This opens the way for price to quickly run past $100 and return to the increased width of the trading bands. The only significant barrier to this development is an OPEC decision to boost supply to compensate for the inability of the IEA to maintain supply at higher levels. The current price retreat is an aberration in the fundamentals of demand and supply. The price chart shows the constraints of this policy. A return to the usual demand and supply relationships restores the price activity to its previous behavior and a continuation of the upward trend.

The author is a well-known international financial technical analysis expert.

(China Daily 07/04/2011 page14)