|

US takes patient tack on yuan policies

By Neil King Jr (Wall Street Journal)

Updated: 2005-10-10 10:43 Despite signs of mounting impatience, Treasury officials argue in public that

China is still getting acquainted with the complexities of its new system, and

can't be expected to take leaps right away. "They are going through a period of

self-education about how the system works," Mr. Adams said. To emphasize that

point, Mr. Snow plans to make one of his first stops at China's interbank

foreign-exchange market in Shanghai.

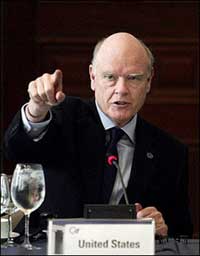

US Treasury

Secretary John Snow, pictured September 2005, will arrive in China October

11 for his first visit in two years, the tussle over the yuan is

again taking center stage. [AFP

file] | Beijing bent to years of international pressure in July when in one day it

nudged the yuan up by 2.1% against the dollar. Mr. Snow applauded the move as a

good first step but made clear that the U.S. expected bigger moves in the near

future. Under the new system, China lets the yuan -- which uses a basket of

currencies as a reference -- move 0.3% a day either way against the dollar. But

since the revaluation the yuan's value against the dollar has gone up by only

0.16%.

The yuan strengthened in special weekend trading sessions in Shanghai

following a weeklong holiday. The dollar ended at 8.0876 yuan yesterday, down

from 8.0920 yuan Sept. 30, its last trading session before the National Day

holiday.

China has taken some small steps toward greater flexibility since July, and

its central-bank governor said last week that Beijing should re-examine the

yuan's value in light of the country's swelling trade surplus. Still, Chinese

officials remain adamant that increased currency flexibility must come slowly,

and that a fully convertible yuan is at least five years away. Chinese officials

point to the havoc of the 1997 Asian financial crisis, when both Korea's and

Thailand's currencies plunged amid rampant speculation.

The Bush administration faces a decision in coming weeks over whether to

label China a "currency manipulator" in the Treasury's semiannual currency

report, due out in early November. That designation, which many in Congress and

within US industry have demanded for at least two years, would prompt talks

between the US and China and could lead to sanctions.

Mr. Adams said the Treasury was just beginning to write the report,

originally due October 15, and that any conclusions would depend in part on what

assurances the US delegation receives while in China.

Not labeling China a manipulator could invoke a swift response from Congress,

where Sens. Charles Schumer, a New York Democrat, and Lindsey Graham, a South

Carolina Republican, say they are poised to bring to the floor their bill to

impose 27.5% tariffs on Chinese imports unless Beijing lets its currency

appreciate further.

Many economists say it is only a matter of time before market forces compel

the Chinese to alter the value of the yuan. With its own imports now lagging,

China this year is on course to accumulate a total current-account surplus with

the rest of the world of about 8% of its own annual economic output -- a figure

that would normally put enormous upward pressure on any free-floating currency.

|