Hong Kong Outlook 2010

Updated: 2010-01-27 07:36

By Joey Kwok, Li Tao and Cheng Waiman(HK Edition)

|

|||||||

Overview

The beginning of the year is the time to look ahead. After the roller caster ride last year, the economic environment is looking brighter for Hong Kong in 2010. However, bumpy external conditions and worries about asset bubbles are creating challenges to the investment market this year. In its special report on the city's investment outlook, China Daily takes a look ahead at the big picture as well as the key sectors of banking and property on their prospects this year.

According to HSBC, the recovery in domestic demand in Hong Kong is likely to be sustained in 2010. So far, the combination of an easier fiscal stance and cheap home financing has resulted in private consumption rising for two consecutive quarters since the second quarter last year.

HSBC believes the city's asset markets should continue to benefit from loose monetary policy that should remain for some time. This prolonged wealth effect and increased job security will encourage local residents to spend more.

JP Morgan forecast Hong Kong's real GDP to grow by 5.9 percent in 2010, following a 2.6 percent decline in 2009. The investment bank expects a significant economic recovery in 2010 to help drive a further re-rating of the market.

Private consumption, investment, government spending and exports are all expected to increase, with positive revisions of earnings and net asset values as the economy improves.

But JP Morgan also said even if export growth is weaker-than-expected, domestic consumption and government spending are expected to improve this year.

According to Credit Suisse, the first phase of the post-crisis recovery has been foreign fund flows into Asia buying relatively safe (low geared) investments. Going into 2010, when the financial system starts to stabilize and risks become more assessable, the investment bank believes cash-rich corporations in Hong Kong will start to use cash piles to look for investment opportunities overseas.

In Hong Kong, not many corporations will have overseas investment experience and the required risk appetite. Instead, the investment bank believes they will step up their investment locally (buying into land banks in Hong Kong) or expand in China again.

Stock Market

What's ahead for 2010?

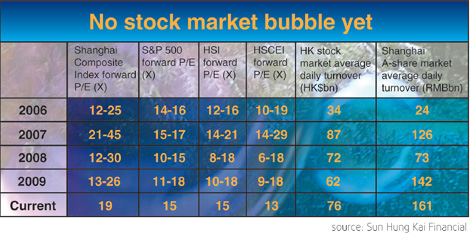

Apparently, a market turning even further upward. For example, Sun Hung Kai Financial's forecast for the Hang Seng Index is 28,000 and the Hang Seng China Enterprises Index is 17,500.

After reaching significant lows in March 2009, many indices around the world rebounded by approximately 70 percent by the end of 2009. Hong Kong has eclipsed these gains, with the Hang Seng Index soaring 93 percent and the Hang Seng China Enterprises Index surging 94 percent.

"We expect discretionary consumer stocks to outperform in 2010, and we also recommend buying asset inflation hedges and stocks of companies that will benefit from growth-oriented government policies," said Alvin Chong, head of research, Sun Hung Kai Financial.

"In addition, it is important to buy into companies that can deploy capital efficiently to lift returns, including those that can maintain high dividends and expand their market share post-crisis," Chong said.

From an undervaluation of 40 percent relative to the region at the beginning of 2008, Credit Suisse believes the Hong Kong market is now at a slight overvaluation of 8 percent.

The investment bank believes the next market driver will be a real recovery in the export sector on the back of the gradual global trade recovery. The trading sector accounts for 15 percent of employment in Hong Kong. It believes the recovery of this, together with the peaking of unemployment, will provide a strong income effect on the economy.

Credit Suisse also believes that local retail and commercial properties will be the prime beneficiaries of this recovery in the real economy. Furthermore, two other key themes - trade and retail - are what the investment bank believes the market will focus on.

JP Morgan expects earnings forecasts can increase along with P/E ratios, given that sentiment can improve further. The investment bank is overweight on property and commercial/industrial sectors. It believes property developers, retailers and selective exporters should benefit in the current environment. It recommends underweighting utilities. Within the commercial/industrial sector, aviation is expected to see a late-cycle recovery.

Banks

Banks in Hong Kong are likely to continue operating in a satisfactory environment stepping into 2010, analysts said.

International credit-rating agency Moody's has recently changed the outlook for Hong Kong's banking system to stable from negative, as the sector benefits from the global economic recovery and solid economic conditions on the mainland.

"The Chinese government is tightening its monetary policy, which improves the chance that bank credits will grow at a more sustainable, healthy rate," said Leo Wah, a senior analyst at Moody's.

Wah added that banks in Hong Kong are increasing their risk appetite in lending and their treasury operations with care, which will allow banks to enjoy better profitability without taking too much additional risk, while optimizing the risk and return profile.

He noted that downside risks for Hong Kong remain, but due to strong financial profiles, crisis-test management teams and a stringent regulatory regime, there isn't a long list of factors that may cause serious damage to the banks.

Investment bank Credit Suisse expects some of the local banks in Hong Kong to show a better performance by recording higher net interest margins in 2010.

"Interest rates have already bottomed and will revert sometime in 2010, depending on the pace of the economic recovery. We believe the larger banks in Hong Kong, Hang Seng Bank and Bank of China (Hong Kong), are likely to see an improvement in net interest margins from the rise in inter-bank rates," said Cusson Leung, head of Hong Kong research at Credit Suisse.

Leung added that the potential recovery in trade finance should also offset some of the slowdown in mortgage loan growth.

The investment bank also selects HSBC Holdings as its top pick among all the banks in Hong Kong, saying that HSBC remains attractive, because of its leverage with rising rates, strong balance sheet, as well as its being growth driven by Asia and lower-than-expected US or UK credit losses.

UBS, on the other hand, picks Bank of China (Hong Kong) as its top call in Hong Kong, as the bank posted a healthy core equity tier 1 ratio of 11.2 percent in the first half of 2009.

UBS, however, believes Hong Kong banks, with excessive levels of liquidity, may start to extend loans more aggressively in an effort to pursue greater yields by leading-up the balance sheet.

Property

Many market experts expect prices in Hong Kong to rise further in 2010.

Real estate broker CB Richard Ellis Group (CBRE) earlier said that luxury and mass residential home prices in Hong Kong may surge 20 percent and 15 percent, respectively, benefiting from the extremely low interest-rate environment.

Justin Chiu, Executive director of Cheung Kong (Holdings), also estimated prices for luxury homes and new mass-market homes to rise 10 to 15 percent and 15 to 20 percent, respectively, in 2010.

Chiu said he "didn't really see a bubble" in the local property market, but he advised buyers to be cautious, as there could be some speculative investments in the real estate market.

Despite the increase in local home prices in 2009, Goldman Sachs said concerns on the potential housing bubble in the Hong Kong real estate market are overdone.

"Unlike the previous bubble in the mid-90s, mortgage loan growth has lagged behind the property price rise this time. Measures of speculative activities, affordability and carrying costs are healthy," said Anthony Wu, analyst at Goldman Sachs (Asia). Wu added that the housing bubble concerns are premature and that concerns about developer stocks' weakness are unwarranted.

UBS also expressed optimism in the local property sector in 2010. The investment bank forecast that the rise in home prices will not be "irrational", as the SAR government may launch more measures to curb home prices rising too much.

"Given the propensity for Hong Kong property to react with higher volatility than the magnitude of the US currency's depreciation, we continue to expect strong property price rises in Hong Kong as the US dollar depreciation process plays out," the investment bank said. UBS also estimates that the property-related economics measures to be reported in the first half of 2010 will be positive, due to the low-base in the previous year.

(HK Edition 01/27/2010 page4)