StanChart posts 20% gain in interim net profit

Updated: 2011-08-04 07:06

By Emma An(HK Edition)

|

|||||||||

Bank cashes in $2.52b owing to increased lending and cost controls

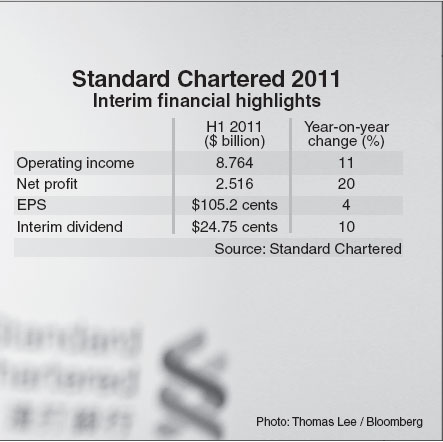

Standard Chartered Plc, the London-based but Asia-focused bank, posted a record first-half net profit of $2.52 billion on Wednesday, up 20 percent year-on-year, thanks to an increase in lending and improved cost controls.

The bank said operating income for the first half rose 11 percent to $8.76 billion year-on-year. Normalized earnings per share were up 4.1 percent to 105.2 US cents. The board declared an interim dividend of 24.75 US cents per share, up 10 percent from the same period last year.

"These are excellent results, our ninth successive first half of record profits," Chairman John Peace told reporters on Wednesday from London via a conference call.

Total lending by Standard Chartered jumped 22 percent since this time last year, the chairman noted, while lending to small and medium-sized enterprises was up 38 percent.

Net interest income gained 19 percent in the first half from a year earlier, while the net interest margin at 2.3 percent was flat compared with the first half of 2010.

The chairman said that the bank is maintaining "a tight grip on expenses", which are expected to grow broadly in line with income going forward. Standard Chartered limited cost growth to 8 percent in the first half of this year after burgeoning cost growth in 2010 as the bank hired more staff and paid more to retain talent.

The lender recorded a cost-to-income ratio of 54 percent on a normalized basis in the first half, compared with 57.9 percent in the second half of last year. The bank expects to increase its headcount by a net 1,000 this year, a day after the bigger HSBC Holdings Plc said it will cut 30,000 jobs by the end of 2013 to reduce costs.

The lender's banking business in Hong Kong was "superb" during the first half, said Jaspal Bindra, the bank's chief executive officer for Asia, with operating income up 29 percent and pre-tax profit up 55 percent to $1.5 billion and $790 million respectively .

Like many of its competitors, Standard Chartered is investing in the rapid expansion of its business on the mainland, where it generated income of $404 million in the first half, 16 percent more than during the same period last year. Including Bohai Bank, in which Standard Chartered has a 20 percent stake, profits on the mainland were up 76 percent to $137 million.

The bank has opened nine branches and sub-branchs on the mainland so far this year, taking the total to 71. It has hired more than 5,500 staff on the mainland.

Bindra said that the bank had "a challenging six months" in India, where the successive rate hikes by the Reserve Bank of India eroded margins. Pretax profit in the country dropped 39 percent to $378 million.

Return on equity at Standard Chartered stood at 13 percent in the first half, down from 14.7 percent a year ago. The bank's core tier 1 ratio moved up to 11.9 percent from 9 percent the previous year as it moves towards the requirements under the Basel III agreement.

emmaan@chinadailyhk.com

China Daily

(HK Edition 08/04/2011 page2)