Orient Overseas profit plunges 86%

Updated: 2011-08-09 07:16

By Jasmine Wang(HK Edition)

|

|||||||||

|

Orient Overseas' container ship being loaded with containers at the Modern Terminals area in Hong Kong. Daniel J. Groshong / Bloomberg |

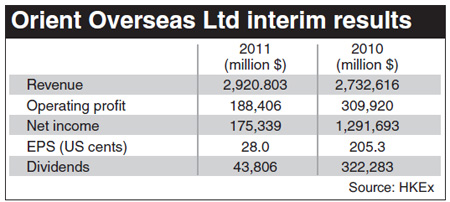

Orient Overseas (International) Ltd, operator of Hong Kong's biggest container line, reported an 86 percent slump in its first-half profit and said it expected "difficult" conditions this year as shipping rates decline.

Net income fell to $175 million, or 28 cents a share, in the six months ended June 30 from $1.28 billion, or 205.3 US cents, a year earlier, the shipping line said in a statement to the Hong Kong Stock Exchange on Monday. That compares with the $65.7 million average estimate in a Bloomberg survey of three analysts. Revenue rose 6.9 percent to $2.92 billion.

The shipping line handled 2.44 million 20-foot containers in the first half, up 9.4 percent year on year. Freight rates to charter container vessels have fallen as new capacity outpaced demand growth, particularly on the Asia-Europe trades.

"With the industry still to absorb further new capacity in the second half of the year, and given the uncertain economic outlook in the United States and Europe, together with the ongoing pressure from energy costs, we expect that trading conditions in the second half of this year will be difficult," the company said in the statement. Slowing consumer spending in the US may damp demand for electronics, toys and other goods made in Asia.

Orient Overseas' operating profit fell 39 percent to $188.4 million as fuel costs rose. The line paid an average $593 per metric ton for bunker fuel in the first half, 19 percent higher than the $500 per metric ton in January, the company said.

The shipping line had a $1 billion gain from selling property in the year-earlier period. Net income also slumped in the first half because of a one-time gain in the year-earlier period. In January last year, the company agreed to sell its mainland property assets to CapitaLand Ltd for $2.2 billion.

The shipping line declared an interim dividend of 7 cents per share, with no special dividend payment.

Orient Overseas fell 6.3 percent to HK$39.65 on Friday. The stock has plunged 47 percent this year, compared with a 9.1 percent decline in the benchmark Hang Seng index. The stock closed trading in Hong Kong on Monday, shaving off another 3.78 percent at HK$38.15.

A.P. Moeller-Maersk A/S, owner of the world's biggest container shipping line, and 14 other carriers will levy a peak-season surcharge two months later than previously scheduled amid weaker-than-expected demand, the Transpacific Stabilization Agreement said on August 3. The group had said in November it would impose a $400 per 40-foot container surcharge from June 15.

Rates to move 40-foot containers to the US west coast from Shanghai dropped 16 percent in the first half, while the rates for Europe-bound cargo slumped 36 percent, according to Clarkson Plc, the world's biggest shipbroker.

Orient Overseas said it took delivery of one new-build vessel in the first half and took the second delivery in July. It is due to receive another six 8,888-box ships by 2014 and all vessels in its fleet are fully deployed.

Bloomberg

(HK Edition 08/09/2011 page2)