IMF rules out home price bubble

Updated: 2012-10-13 07:27

By Oswald Chen(HK Edition)

|

|||||||||

|

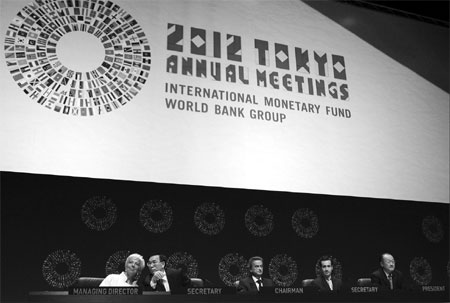

From left: Christine Lagarde, managing director of the International Monetary Fund (IMF); Lin Jianhai, corporate secretary of the IMF; Riad Salameh, governor of the Bank of Lebanon and chairman of the IMF Boards of Governors; Jorge Familiar Calderon, corporate secretary of the World Bank Group; and Jim Yong Kim, president of the World Bank Group, attend the plenary session at the annual meetings of the IMF and the World Bank Group in Tokyo, Japan, on Friday. Haruyoshi Yamaguchi / Bloomberg |

Int'l body cautions more property price cooling measures needed

The Hong Kong government may need to introduce more prudential measures to restraint local home prices from surging as the city's short term residential prices can be very volatile, the International Monetary Authority (IMF) cautioned.

"We (the IMF) do not see a bubble in Hong Kong residential prices. (Yet) the possibility that there will be (a) downturn in local house prices - you can rule that out," IMF Hong Kong SAR Resident Representative Sean Craig said after the presentation of the "Global Financial Stability Report" on Friday.

"Between now (following Hong Kong government's introduction of measures to enhance land supply) and (the time) supply comes into the market, there will be short-term price volatility in the local home market," said Craig.

The Centa-City Leading Index (CCL), an index compiled by Centaline Property Agency to reflect secondary private residential property price changes, rose for the third consecutive month to a historical high of 111.11. The index level represents a cumulative increase of 2.72 percent in the past three months.

Based on the current CCL level, local home prices have already exceeded the 1997 peak level by nearly 8 percent. Local property prices even soared by nearly 96 percent from the trough level registered in late 2008 and has jumped 16 percent from early 2012.

The Hong Kong government introduced a spate of measures including enhancing land supply, accelerating land sales program and implementing the "Hong Kong land for Hong Kong people" policy to restrict property sales to mainland home buyers.

The city's de facto bank Hong Kong Monetary Authority (HKMA) in September also launched various counter-cyclical prudential measures, including tightening the underwriting criteria to mortgage loan borrowers and imposed a ceiling cap for loan tenor to strengthen local banks' risk management in mortgage lending.

"The government in the last few years has put in initiatives to increase supply and this will start (taking) effect on (home) prices," said Craig.

He added that the HKMA prudential measures can "insulate the banking system and consumers (mortgage loan borrowers) from the effect of home price volatility as well."

Meanwhile, the HKMA Chief Executive Norman Chan said that the recent measures are effective in enhancing risk management of local banks, adding that the HKMA will introduce more anti-cyclical measures to stabilize the local banking sector if necessary.

"The current average loan-to-value ratio of those newly arranged mortgage loans has dipped to 57 percent from the 64 percent three years ago. The current income-to-lending ratio also slipped to 37 percent from the 41 percent three years ago. These indicators reflect the measures are effective to maintain the local banking system's stability," Chan reckoned after the Friday Treasury Markets Summit.

Chan added that though the US' third round of quantitative easing policy (QE3) does not elicit huge capital inflows into the city at this stage, but its effects on the local housing sector still needs to be monitored as the market expects the low interest rate environment to be extended over a long period of time.

Local home prices will be fuelled by tight land supply and low interest rate expectations but the home price buoyancy will also be outweighed by the unfavorable economic data, global economic slowdown and the increasing gap between house price surge and income growth level, Chan concluded.

oswald@chinadailyhk.com

(HK Edition 10/13/2012 page2)