Role reversal

Updated: 2013-09-13 07:13

By Oswald Chan(HK Edition)

|

|||||||||

Once gateway to the nation, Hong Kong is now a bridge for mainland companies 'going out'. Oswald Chan reports.

It began with the banks five years ago. Now a spate of mainland enterprises are expanding into Hong Kong's retail, property and financial sectors taking advantage of business diversification, just as some Hong Kong blue chips are offloading their local business assets. The city is experiencing the nascent rise of corporate crimsoning. And as Hong Kong exuviates its halcyon days as a last-century West-East entrepot, as it surely must, morphing inexorably into a 21st-century East-West configuration, then now is the time the city can capitalize on its unique global bridging role to enable more mainland firms to reach out into the world.

But small steps first. Mainland-based beer-to-retail conglomerate China Resources Enterprise Ltd (CRE) is one of at least seven firms which bid for tycoon Li Ka-shing's Hong Kong supermarket chain ParknShop, in July. CRE Chief Financial Officer Frank Lai went on to announce in August that CRE's bid also involved its recent joint-venture partner, UK-based grocery chain Tesco Plc.

Two months on, CRE - owner of Hong Kong's third-largest supermarket brand Vanguard, which already accounts for 7.8 percent of Hong Kong's $6.6 billion supermarket industry - now looks the frontrunner in the race. The sale of the grocery chain ParknShop is estimated to fetch between $3 billion to $4 billion.

Optimistic on Hong Kong

CRE wants the brand name. In a mainland market shocked by numerous food scares in recent years, acquiring ParknShop's brand is like an image makeover. It uplifts credibility and allows access to the chain's suppliers, thereby getting CRE's name associated with superior - and more trustworthy - merchandise. Acquiring ParknShop lets mainland consumers buy with greater confidence, goes the thinking.

In the real-estate sector, mainland property developers have been getting more proactive since last year in bidding for land parcels in Hong Kong. China Overseas successfully snatched two land parcels in the Kai Tak region whereas the Hong Kong government designated that property developers can only sell those residential flats built on these two land parcels to Hong Kong permanent residents.

Mainland flagship property developer Vanke, in cooperation with Hong Kong blue chip New World Development, also successfully bid for a land parcel in Tsuen Wan earlier this year. Vanke said its interests in the Tsuen Wan land parcel will be injected into its local-listed subsidiary, Vanke Property Overseas. Vanke President Yu Liang says the deal represents the first of many the company plans to strike and that its prospects look rosy: "We are very optimistic on Hong Kong".

As is the banking sector. Mainland business conglomerate Yue Xiu Group is bidding for Hong Kong-based family-run Chong Hing Bank. No sooner had news of the group's interest been broadcast than shares in Hong Kong's three other family-run banks, Dah Sing Banking Group, Wing Hang Bank and Bank of East Asia all posted more than 10 percent gains.

Yue Xiu is not the first mainland financial entity to acquire Hong Kong banks with an eye to further business expansion. China Merchants Bank, China Construction Bank and Industrial and Commercial Bank of China Ltd (ICBC), have all acquired Hong Kong-based banks as their business subsidiaries in the last five years, each small step the forerunner to a potential giant leap of international expansion.

The financial crisis of 2008 was the wake-up - or 'going out' - call for the nation's latent aspiration. Externally, the economies of the developed and developing countries have huge demand for overseas capital, making them receptive to acquisition by mainland companies. Internally, the needs for acquiring markets, resources, technologies and brands, as well as cost-reduction considerations, propel mainland enterprises to "go out" on a larger scale.

However, the overseas expansion trajectory is not always straightforward, a result of both local and global factors. External challenges stem from rising overseas investment protectionism, particularly in the US, and increasing global investment market risks. Internal challenges emerge from the mainland enterprises' lack of international management experience, their sometimes inadequate assessment of the global investment environment, as well as a lack of international talent to push toward internationalization.

Due to the numerous hurdles involved with overseas expansion, mainland corporations hence may find Hong Kong a more attractive proposition as their first overseas expansion destination.

"Hong Kong's mature business assets in the banking and retail sectors offer a low-risk investment opportunity for mainland companies," global accounting advisory firm PricewaterhouseCoopers (PwC) China and Hong Kong Transaction Services Leader David Brown says. "In many ways, Hong Kong is the best destination for mainland corporate acquirers because the city is considered to be less affected by the current market's cautious attitude toward business acquisitions."

Global springboard

"Hong Kong has graduated from being solely a gateway for foreign investment in the mainland, to also being a springboard for mainland firms' investment in the rest of the world," Hong Kong Trade Development Council (HKTDC) Principal Economist Daniel Poon says.

Many of the acquiring entities are still large State-owned enterprises, but the number of private businesses is steadily increasing.

Due to the mainland government leadership transition, changes in mainland economic policy direction, tightening credit conditions and the mainland's slowing economic growth, mainland companies recently adopted a "wait and see" attitude toward mergers and acquisitions (M&As).

Many of them were more cautious in acquiring business assets in the country, Hong Kong and Macao in the first half of 2013, as deal volumes stood at 1,375 transactions which remains below previous highs, PwC says in its latest mergers and acquisitions (M&A) mid-year report released in late August, adding that these M&A deals were valued at $119.5 billion.

Despite mainland corporations being relatively lackluster in conducting M&As in Hong Kong, the contribution of mainland companies toward the M&A market in Hong Kong is impressive.

According to the Hong Kong government, the mainland was the most important source of direct investment in Hong Kong in 2012 (accounting for 36.3 percent of the total $1,074 billion). The majority of the investment was related to the service industries including investment, real estate, professional and business services; banking; and import/export, wholesale and retail trades.

Mainland companies are poised to make further overseas business expansion as the country's enterprises still have a "huge stomach" for overseas technology, management skills and brand acquisitions.

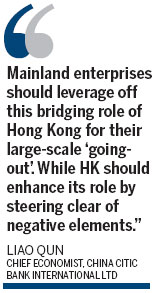

According to China CITIC's report, China's outbound FDI will experience a compound annual growth rate of more than 20 percent in the next five years, subsequently reaching more than $200 billion in 2017.

Contact the writer at oswald@chinadailyhk.com

(HK Edition 09/13/2013 page6)