HK's offshore yuan deposits decline

Updated: 2014-09-11 09:03

By Felix Gao in Hong Kong(HK Edition)

|

|||||||||

Hong Kong - the world's largest offshore yuan center - has seen a slowdown in the growth of its renminbi capital pool.

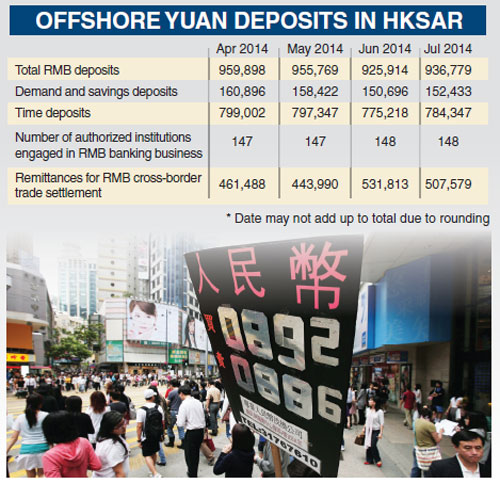

According to the Hong Kong Monetary Authority, the city's offshore yuan deposits declined consecutively for two months - in May and June - as corporate deposits decreased, while growth in individual savings has been stable.

The total amount of offshore yuan deposits in the SAR hit a peak of 959.9 billion yuan in April after eight months of growth. But, in May and June, the pool declined by 34 billion yuan to 925.9 billion yuan.

BNP Paribas said the growth of offshore yuan deposits in the SAR has been slowing steadily since late last year. Incremental deposits in 2013 were 257.4 billion yuan but, in the first half of this year, the amount was down to just 65.4 billion yuan.

Nathan Chow, an economist with the Development Bank of Singapore (DBS), said the narrowed premium which offshore renminbi trades over onshore renminbi (CNH-CNY premium) was the reason for the fall in deposits. As many onshore importers used this premium to conduct arbitrage via trade settlement in the past few years, Hong Kong's renminbi deposits increased at a fast pace, and corporate deposits accounted for 70 percent of renminbi deposits. But the devaluation of the yuan earlier this year had narrowed the premium progressively. "As the recent rebound of the renminbi exchange rate would recover the CNH-CNY premium, I believe that the decline in offshore renminbi deposits would not last a long period," Chow said.

According to DBS, the RMB Index for VVinning Enterprises, the proportion of companies putting their renminbi back into deposit accounts in the second quarter of this year rose to 54 percent, against 38 percent in the first quarter. Standard Chartered said it expected the yuan's appreciation to resume in the second half of the year, and the premium which offshore renminbi trades over onshore renminbi would widen. The bank said in its frontier report for the 2014 first half that it's confident that yuan deposits in Hong Kong would reach 1.15 to 1.2 trillion yuan by the end of this year.

Ivan Chung, a senior analyst with Moody's Investors Service, said the decline in Hong Kong's renminbi deposits has been affected by the stock market's performance. "The Hong Kong stock market has been performing well in recent months and it channels investors' funds to the market. Moreover, the recovering US and European economies also drain investments to overseas markets."

Chung compared the current offshore renminbi market to a few years earlier to further explain the decline in deposits. He said that two to three years ago, the yuan's appreciation was much stronger than expected, and the local equity market was less vibrant than today's, so the offshore renminbi was a relatively more attractive investment at that time, thereby driving the strong growth of deposits.

Xiao Lisheng, assistant research fellow of the Institute of World Economics and Politics at the China Academy of Social Sciences, said he's not optimistic about the high growth of Hong Kong's renminbi deposits in the second half of this year.

He said two key driving forces - the expectation of an exchange rate appreciation and the weakening CNH-CNY premium - are at play. He estimated that the deposits growth rate in 2014 would see a sharp decline and renminbi deposits would only reach 1 to 1.1 trillion yuan by the end of this year.

Xiao said the effect of the Shanghai-Hong Kong Stock Connect on Hong Kong's renminbi deposits still remains to be seen. "The scheme is still in its trial stage and has a scale limit. It will promote the circulation of offshore renminbi but, on the other hand, as this flow channel is bi-directional, Hong Kong's renminbi deposits may flow back into the mainland stock market," Xiao said.

BNP Paribas said in a report the slowdown in offshore renminbi deposit accumulation highlighted the vulnerability of the current offshore renminbi circulation mechanism, given its reliance on trade settlement.

The bank suggested that the authorities could boost the offshore renminbi pool by relaxing restrictions, such as raising the threshold for renminbi denominated overseas direct investment (ODI) project amounts, subject to approval and streamlining application procedures.

A more active way could be lifting the limits on renminbi conversion for Hong Kong residents and/or renminbi outward remittance from mainland individuals (currently $50,000 per year) and letting the relative attractiveness of offshore renminbi deposit rates pull increased offshore funds into the offshore renminbi pool, the bank said. BNP Paribas suggested that more genuine reforms allowing onshore deposits to flow directly into offshore markets, accompanied by a wider and necessary changes to the mainland's financial system, would eventually be required to sustain growth in offshore renminbi deposits to support the expansion of offshore renminbi markets and assets for true international currency status to be achieved.

felix@chinadailyhk.com

(HK Edition 09/11/2014 page9)