Real estate powers ahead on stimulus measures

Updated: 2015-05-06 07:55

By Zhou Wa(HK Edition)

|

|||||||||

Demand for homes adds to upward pressure in top-tier mainland cities

The property sector in first-tier mainland cities continued to gain momentum last month amid further measures to ease homes-purchase curbs and strong demand, although prices in second- and third-tier cities remained weak, market analysts say.

Since fresh easing measures were revealed on March 30, second-hand apartment transactions have heated up, and the people's urge to raise their living standards will continue to keep the market active, said Zhang Dawei, chief analyst at real-estate agent Centaline Property Agency Ltd.

"For the longer term, the demand for property on the mainland remains intact. Migration from the countryside has helped expand the urban population by 500 million in the past three decades. Over half of the population now lives in the urban areas, and the government plans to increase this ratio to 60 percent by 2020," said Joep Huntjens, head of Asian debt with NN Investment Partners.

Experts agreed that more measures to shore up the economy, including looser housing market regulations and broader monetary easing, can be expected this year.

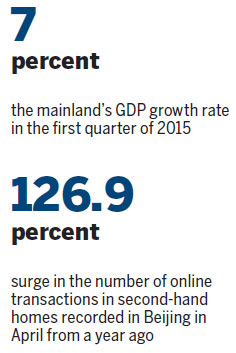

According to the latest statistics, 17,282 online transactions in second-hand homes were recorded in Beijing alone last month - up 58.4 percent on the previous month and 126.9 percent year-on-years.

Average housing prices reached 35,318 yuan ($5,693) per square meter in April - an increase of almost 3 percent from March.

Following the new round of property easing measures on March 30, Beijing consumers have abandoned their wait-and-see attitude and swung into action, said Hu Jinghui, vice-president of real-estate brokerage 5i5j Group.

He said residents aspire to upgrade their living conditions and those who are really in need of housing have entered the market.

Putting his name to the sales contract, Song Ping, 33, was relieved that he had managed to sell off his 57-square-meter apartment in Wangjing - a prime residential and technological sub-district northeast of Beijing.

"I was worried I could not afford to buy a bigger apartment later this year as property prices in Beijing keep going up," said Song, whose wife gave birth last year and his parents had traveled from Anhui province to Beijing to help take care of the baby.

"Five people living in a one-room apartment is too crowded, so we need to change to a bigger one," he said.

In Guangzhou, 247,100 square meters of second-hand homes were reportedly traded in six prime districts last month - an increase of 88.14 percent from March and a 71.3-percent rise year-on-year.

Shanghai's housing market looks equally promising, with 1.24 million square meters of new homes transacted in April - a 59.33-percent growth compared with the previous month and a year-on-year growth of 63.21 percent. It was a new record in the city's homes transaction volume in six years, according to a Shanghai-based property research institution.

A property researcher with a Shanghai public fund company said the new round of stimulus measures has also reduced the financial burden of buyers, particularly in first-tier cities.

In cities like Beijing and Shanghai, the down-payment requirement used to be as high as 70 percent.

The People's Bank of China, the Ministry of Housing and Urban-Rural Development announced on March 30 that the minimum down payment for second-home buyers would be lowered from 60 to 70 percent to 40 percent of the property's price.

The central bank also urged financial institutions to support home purchases using a combination of commercial lending and housing provident funds, while the Ministry of Finance said sales of homes bought more than two years ago would be exempt from tax, compared with the present five-year requirement.

The measures began in September last year when the central bank relaxed requirements for mortgage lending. In November, it reduced one-year benchmark lending rates by 40 basis points to 5.6 percent and lowered one-year benchmark deposit rates by 25 basis points to 2.75 percent.

A second interest-rate cut followed in late February, with the one-year lending rate trimmed by 25 basis points to 5.35 percent, while the requirements for mortgage lending were again relaxed in April.

The situation in second-and third-tier cities, however, is not that optimistic, given that real-estate prices are still soft, with no noticeable upsurge in the sales volumes.

A source at Poly Real Estate Group said the stimulus measures have not had much of an impact on the market in second-and third-tier cities, including Shenyang, Wuhan and Nanjing.

However, analysts are upbeat about prospects in first- and even second- and third-tier cities in the second half of this year.

When transaction volumes have picked up to a certain degree, prices will follow suit, said Zhang.

Huntjens reckoned that the central government's commitment to the property sector cannot be underestimated as the market is the linchpin of the broader economy.

The mainland's gross domestic product grew by an annual 7 percent in the first quarter of this year - slowing from 7.3 percent in the fourth quarter of 2014.

"If the government aims to meet its goal of 7 percent growth in 2015, the real-estate market has to stay healthy," Huntjens argued.

zhouwa@chinadaily.com.cn

|

Commercial and residential buildings are seen from the window of a building in the central business district of Beijing. As the central government changes its tack to ease housing curbs, many homes buyers in top-tier cities are planning to raise their living standards by purchasing a new apartment. Tomohiro Ohsumi / Bloomberg |

(HK Edition 05/06/2015 page1)