Mighty Li takes stock of empire

Updated: 2016-01-08 09:15

By Oswald Chan(HK Edition)

|

|||||||||

A year on from going through a sweeping corporate overhaul, the sprawling business empire of HK tycoon Li Ka-shing is poised to break new ground in growth, the occasional hiccup notwithstanding. Oswald Chan reports.

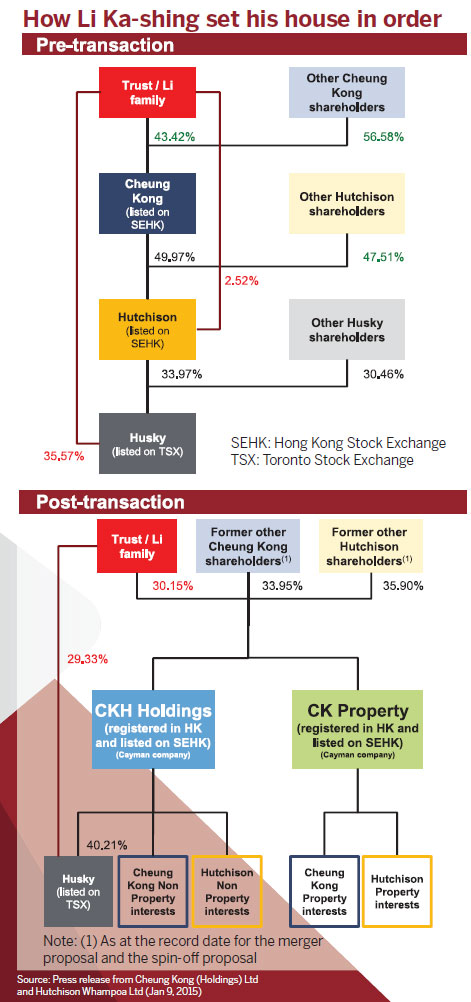

Li Ka-shing, Hong Kong's richest man and redoubtable business demigod, had kicked off 2015 by announcing in January the biggest overhaul of his $100 billion empire, by creating two new Hong Kong-listed companies to streamline corporate structure and enhance shareholder value.

And so a new holding company, CK Hutchison Holdings (CKH Holdings), was created the following March to merge the businesses of Cheung Kong (Holdings) - the real estate arm controlled by Li - and Hutchison Whampoa, the subsidiary conglomerate controlled by Cheung Kong (Holdings) , which was delisted in May last year after 37 years of trading on the Hong Kong stock market.

CKH Holdings, registered in the Cayman Islands and listed in Hong Kong, is a conglomerate with a market capitalization of HK$403 billion, according to Bloomberg estimates. Its business is spread over 50 countries and includes all non-property assets of the two merged companies, focusing on the telecoms, infrastructure, energy, retail and port-related services sectors.

Property giant

The real estate businesses of the two companies were spun off to create another new entity, Cheung Kong Property Holdings (CK Property), which listed in June last year.

CK Property is one of the top developers in Hong Kong with a land bank of 170 million square feet (15.8 million square meters) and the largest hotel owner-operator listed in the SAR. It also owns the city's second-largest rental property portfolio.

The Financial Times in January last year said the revamp was expected to add enough value to the shares in the two new groups to restore Li to his position as Asia's richest man, a distinction he lost in 2014.

"Cheung Kong and Hutchison Whampoa have grown substantially in size and scale over the past decade. The reorganization will place the companies in an even stronger position for future growth and development," Li said in the press release on Jan 9, 2015, explaining the corporate revamp plan as chairman of Cheung Kong and Hutchison Whampoa.

A 70-page filing with the Hong Kong stock exchange said the move aimed to create shareholder value in allowing all group assets to be fully reflected and remove the "layered holding structure" between Cheung Kong and Hutchison Whampoa.

However, market whispers are that Li wishes to protect his empire from any economic volatility in Hong Kong and mainland. And local tycoons appear to be taking his lead, selling mainland business assets and implementing an organizational overhaul of their holdings as a precaution.

Cheng Yu-tung, the New World Group patriarch, sold mainland properties worth 20.4 billion yuan ($3.2 billion) through his property arm New World China Land (NWCL) to Guanzhou-based developer Evergrande Real Estate Group in December. That came after Cheng had already offloaded NWCL assets in second- and third-tier mainland cities to Evergrande for 13.5 billion yuan in all.

Cheng is banking on mainland companies' property-buying spree on either side of the border to offload his real estate portfolios to get cash back and unlock investment value faster.

Cheng has also transferred his personal stakes in six Hong Kong-listed companies valued at about HK$3.8 billion to a family-held holding company, almost four years after declaring his retirement from the group in 2012.

"Injecting Cheng's personal investments into the family holding company may pave the way for personal estate management," said Terence Chong Tai-leung, executive director of the Chinese University of Hong Kong's Institute of Global Economics and Finance.

As for the reorganization of Li's empire early last year, investment bank analysts generally hailed the corporate revamp, saying it would benefit both new business entities and investors. After the revamp, CKH Holdings will benefit from enhanced liquidity and CK Property will have a clean capital structure and a separate fundraising platform as a pure property play.

Vincent Lam Siu-yeung, managing director and chief investment officer at VL Asset Management, noted: "The share price discount of a holding company (Cheung Kong) is generally 15 to 25 percent or more. Changing that structure should remove the discount."

Goldman Sachs noted that the overhaul can bestow greater business transparency, better capital allocation, aligning of management responsibilities and a clearer demarcation of the group's property and non-property divisions.

Retail and institutional investors will also benefit from the reorganization, investment banks reckoned, as they all gave the company a "buy" rating at the year-end. "There are three benefits to shareholders, including removing the holding company discount, optimizing capital structures and raising dividends - always popular with investors," said Paul Louie, head of property sector equity research Asia ex Japan at Barclays.

Win-win all around

Goldman Sachs agrees, saying the corporate restructuring will improve the two new business companies' cash flow and the ability to increase dividends for investors. The conglomerate's share price can reach to HK$126, given there is a 31 percent discount between the company share price and its net asset value.

"The conglomerate is a value creator as it grips every market opportunity to spin off its assets or enter into merger and acquisition deals to create business value. We assign it a "buy" rating with a target share price of HK$123.5," brokerage DBS Vickers said in its research report in December, adding the group may spin off retail assets to raise shareholder value.

In August, CKH Holdings announced its first interim result. The new conglomerate posted a recurring net profit after tax of HK$14.9 billion for the six months ended June 2015, 46 percent more than the Hutchison Whampoa result during the same period in 2014. On Dec 31, CKH Holdings closed at HK$104.6 per share, a surge of 39.4 percent for the whole year of 2015. It closed on Thursday at HK$100.4.

However, Li's corporate revamp plan has not been unchallenged. Efforts to merge Cheung Kong Infrastructure Holdings (CKI) with Power Assets Holdings (PAH) collapsed last November after Institutional Shareholder Services, an influential proxy advisory firm, recommended that investors reject the $12.3 billion buyout offer, saying CKI should give a better share offer deal to PAH shareholders.

The proposed merger would give CKI access to $8.7 billion in cash and equivalents held by PAH to push for more aggressive overseas infrastructure asset acquisitions and consolidate the 11 projects where both CKI and PAH have interests. It will also maximize the value of co-owned assets and support a potential re-rating of CKI.

Contact the writer at oswald@chinadailyhk.com

(HK Edition 01/08/2016 page9)