Crowdfunding takes root in Shenzhen property market

Updated: 2016-01-27 08:06

By Chai Hua in Shenzhen(HK Edition)

|

|||||||||

Despite the high risks involved, crowdfunding has offered property speculators in Shenzhen a chance to dig into the housing pie as homes prices continue to go through the roof.

With as little as 100 yuan ($15.2), crowdfunding platforms give them the opportunity to take the plunge in the market via a model that simply combines real estate with funds raising - a project initiator pays part of the cost of an apartment the person intends to buy, leaving the rest to backers on fundraising platforms.

But, a year later, the purchaser has to redeem the backers' shares at market prices, or sell the property and distribute the profit according to the amount of shares contributed.

US-based fundraising website Fundrise.com was the first to apply the model in 2012, and entered the Chinese mainland market two years later. So far, 34 such platforms have sprung up on the mainland, according to a report published this month by mainland fundraising platform Zhongchou.com.

The report showed that 330 projects have since been initiated, with about 80 percent having attained their goal last year - raising a total of 651.7 million yuan.

Shenzhen-based housing crowdfunding platform ifangchou.com promises an annual return of 15 percent or above with a minimum investment of 100 yuan. The average investment period is three months.

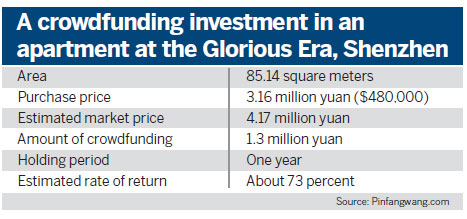

Xie Ling, general manager of another Shenzhen-based fundraising platform for second-hand homes, Pinfangwang.com, said their platform is designed for those who want to buy a house, but have difficulty in raising funds at the moment. Investors can also use the model to make an investment at a low threshold.

Pinfangwang.com said most of the projects have been initiated by the platform itself rather than individual buyers so far. Individual project initiators are required to discuss with the company in person about the projects. Xie admitted that their company can't guarantee principal and interest. In addition, they charge 5 percent of the profit as management fee if the property is appreciated.

Market experts have warned of the high risks associated with such investments. "The profit from such short-term investments depends solely on homes prices continuing to climb rapidly," said Wang Fei, director of the Centaline Property Research Center in Shenzhen.

According to Midland Reality, prices of new apartments in Shenzhen soared 52 percent last year, and are projected to go up by just 10 to 15 percent in 2016.

Industry insiders expressed concern over the credibility of project initiators. Pinfangwang.com does show the details of each transaction on its website, but does not reveal the names of buyers.

grace@chinadailyhk.com

(HK Edition 01/27/2016 page8)