Bad loans grow, but no doomsday yet for mainland banks, experts say

Updated: 2016-05-10 08:37

By Luo Weiteng in Hong Kong(HK Edition)

|

|||||||||

|

A man walks past the Bank of China Head Office in Beijng. The ever-increasing non-performing loans ratio has darkened the picture of profitability of mainland lenders. Given the banking sector's bad loans and flat profit woes, industry insiders believe that what matters is how far mainland banks can go to capitalize on the supportive polices and business opportunities, which would directly determine the outcome. Roy Liu / China Daily |

The specter of mounting bad loans and shrinking profits will continue to haunt the Chinese mainland's banking industry, while the country's bold moves for supportive policies and reforms may spell opportunities in the long run, say analysts.

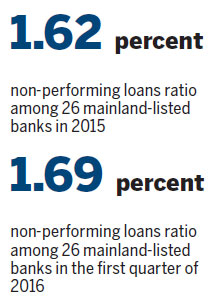

Non-performing loans (NPLs) among 26 mainland-listed banks stood at 1.62 percent of outstanding credit on average last year, marking the fourth consecutive annual increase in the NPL balance of listed banks and the third straight annual rise in the NPL ratio, Kelvin Leung, partner of financial services at Ernst & Young, said in Hong Kong on Monday.

By the end of 2015, outstanding balances stood at 1.67 percent, or 1.27 trillion yuan ($195.2 billion), according to China Banking Regulatory Commission.

As narrowing net interest margins and growing provisions that banks have to set aside for loans weigh on profitability, the combined net profit growth of 26 listed banks on the mainland declined by 5.47 percentage points, marking the fifth annual drop in a row, according to Ernst & Young.

For the first quarter of the year, NPLs among the listed banks climbed to 1.69 percent of outstanding credit to 1.07 trillion yuan, while net profit growth continued to slow - to 2.66 percent from 3.25 percent a year ago - said Leung.

A handful of mainland rural and city commercial banks may face the risk of collapse as their aggressive lending put too much pressure on capital flow and credit business, said Iris Pang, Hong Kong-based senior economist for Greater China at Natixis.

Rural and city commercial banks, however, managed to post high doubt-digit growth last year due to their small size and the great emphasis placed on fee-based businesses, while large commercial banks maintained single-digit growth, Ernst & Young said.

However, Pang pointed out, any possible collapse of banks would be merely "cuts and bruises" and would not damage the banking industry's core.

"Basically, it would be too early to project losses for the Chinese mainland's 'Big Five' banks, which somehow managed to hive off some toxic assets due to a reduction in the coverage ratio," she said.

"And, it would be too ridiculous to project doomsday for the mainland's banking system as someone has suggested."

Most of the soured debt held by mainland-listed banks comes from the manufacturing, wholesale and retail businesses in the Yangtze River Delta, the Pearl River Delta and the eastern coastal regions, where surging labor costs, slowing export growth and a cooled domestic economy continue to crimp companies' profits and generate overcapacity.

"Uncertainties over mainland banks' asset quality and earnings growth could hardly wane in the short term, indicating that the lingering concern of bad loans and declining profits would ring true, at least in the short run," Leung noted.

The picture portrayed by Ernst & Young was definitely much bullish than that of brokerage CLSA, which warned last Friday that Chinese mainland banks' NPLs amounted to a staggering 15 to 19 percent of their outstanding balances last year, with potential losses reaching $1 trillion or more.

Dismissing the dim views of the mainland's banking sector, Jack Chan, managing partner of financial services for Greater China at Ernst & Young, said he would not be that pessimistic.

He pinned high hopes on the country's economic recovery, renminbi internationalization and the much-hyped Belt and Road Initiative delivering a long-term respite for the banking sector's bad loans and flat profit woes.

Chan also bet big on the high-profile internet finance boom helping the banking industry carve out a new profit model.

But what matters is how far mainland-listed banks can go to capitalize on the supportive polices and business opportunities, which would directly determine the outcome. This would vary from bank to bank, leaving some happy and others unhappy, he said.

In its latest move to grapple with escalating bad debt, the world's second-largest economy has been touting a plan that will allow banks to convert as much as 1 trillion yuan of toxic loans into equity.

Chan believes the swap stands as one more option for listed banks to reduce their bad loan burdens. But this technique definitely could not be solely relied upon to solve such a vex problem once and for all.

Everything works according to the existing regulations of the China Banking Regulatory Commission. If a loan is converted into equity, the amount of risk-weighted assets (RWAs) must be enlarged four times for equities held for two years by the bank, and 12.5 times if held longer, something that may result in capital strains for banks.

Without any easing of regulations concerning RWAs, the debt-to-equity swap cannot be rolled out on a large scale for the listed banks, Chan said.

sophia@chinadailyhk.com

(HK Edition 05/10/2016 page7)