Startups lifting off into 'maker space'

Updated: 2016-06-03 07:42

By Chai Hua in Shenzhen(HK Edition)

|

|||||||

There's growing concern over whether incubators, which mainly serve as "middlemen landlords", can sustain themselves after several on the Chinese mainland went to the wall due to financial difficulties.

But, industry insiders are seeing it in a different light, saying incubators can help plug the high vacancy rate in Shenzhen's office leasing market.

For instance, "maker space" - a kind of incubator that provides co-working space for startups - has emerged as a business model for the office leasing sector and will become a significant part of it, according to Chen Zhenfeng, chief executive officer of Xiaoweifeng Information Technology Co.

Shenzhen-based Xiaowei-feng came into being last year as an online platform in cooperation with some 300 "maker space" and traditional working space providers to help startups secure suitable offices for their operations.

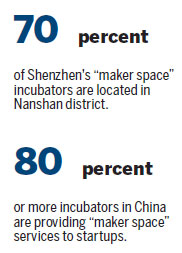

Currently, more than 80 percent of mainland incubators offer similar services, says a report by iiMedia Data Corp - a third-party, data-mining organization.

"Maker space" runners rent and furnish traditional offices in buildings, factories and industrial parks before leasing them to startup tenants who would take up desks.

Some industry experts are skeptical about the business concept, arguing that most startups are running on tight purse strings and are unable, or reluctant, to fork out high rents. This has been reflected in a string of closures of such offices in Shenzhen, the most recent being that of Firebird Institution, which used to serve high-tech companies and startups, including Uber.

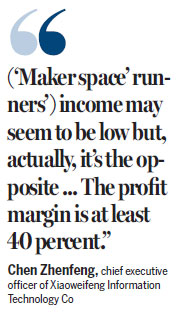

However, Chen believes the "maker space" model, theoretically, can rake in remarkable profits. "Their income may seem to be low but, actually, it's the opposite," he explains. "The profit margin is at least 40 percent."

At the same time, their clients may find it more economical than renting traditional offices. For a startup with six employees, it can rent a room with six desks and share the meeting room with others for between 6,000 and 9,000 yuan ($910 to $1,370) a month in a "maker space" incubator. But, small offices are not ubiquitous in the traditional office leasing market, which normally provides offices of more than 100 square meters.

According to Chen, the average rent for a desk is 1,000 to 1,200 yuan in the Nanshan district, where about 70 percent of "maker space" incubators in Shenzhen are located. Besides, a flexible rental period, starting from three months, is on offer.

By comparison, the average rent for a traditional Grade-A office in the same area can be as high as 120 yuan per square meter, with a minimum rental period of one year, according to property agency Midland Realty.

Due to their flexibility, "maker spaces" have become popular among startups, registering an average occupancy rate of above 90 percent last year.

Financial and professional services firm Jones Lang LaSalle estimates that the supply of Grade-A offices in Shenzhen will hit a historical high this year, generating an average vacancy rate of more than 20 percent. Generally speaking, if the ratio is above 15 percent, it would mean a tenant-dominated market.

Andrew Ness, head of China research at international property consultancy DTZ, said the change in company structure and employee numbers has a huge impact on current office models, especially in first-tier mainland cities.

In his view, the demand for large traditional offices and lengthy leasing periods will decline. Instead, a flexible and interaction-focused office model will provide better services for knowledge-incentive, innovative entrepreneurs.

Chen added that major clients in office buildings used to be large government-owned and foreign enterprises on the mainland, but an increasing number of startups or small and medium-sized enterprise have come onto the market.

He said the occupancy rate of "maker space" offices will start to fall as more competitors emerge, with the number of incubators in Shenzhen having soared from a dozen to more than 1,000 in the past two years. "At present, the occupancy rate is about 50 percent and many incubators are on the line."

Despite the challenges ahead, many more companies are still flocking to the industry. Chen believes the "maker space" business model, instead of being just an eye-opener for investors, will play a bigger role in the office property market, capturing some 10 to 20 percent.

Shenzhen Huaqiang Holdings - a listed electronics technology group - set up a "maker space" of about 5,000 square meters last year on the 7th floor of its own office building, charging tenants 1,200 yuan per desk.

Lin Kai - the project's operations director - said they have secured about 40 teams of tenants so far, with an occupancy rate of about 90 percent. Although the incubator has managed to break even, he's confident that bigger profits will come from the company's investing in some startups in the building.

The burgeoning industry has also attracted some traditional office managers, both local and global. The Executive Centre - one of the world's leading serviced office providers - has opened co-working offices in Singapore and Sydney, and plans to open more in Shanghai and Seoul.

Ding Jie - the company's regional director for China - told China Daily that "co-working" offices are proving to be a viable and innovative alternative to the traditional corporate office environment.

"With growing startup communities, the demand (for co-working space) is buoyant in China and is likely to continue going up in future," she said.

grace@chinadailyhk.com

|

A view of Shenzhen's Futian district. "Maker spaces" - incubators that provide co-working space - have become popular among startups due to their flexibility in leasing conditions. Edmond Tang / China Daily |

(HK Edition 06/03/2016 page6)