HK-listed firms falling behind regional rivals in corporate governance stakes

Updated: 2016-10-07 07:36

By Oswald Chan in Hong Kong(HK Edition)

|

|||||||||

Hong Kong-listed companies lag behind rivals in corporate governance (CG) performance, with researchers identifying weaknesses in audit independence, investor communication and corporate transparency.

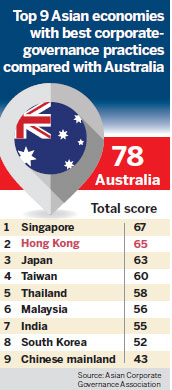

Hong Kong scored a total of 65 points in CG performance, lower than Australia and Singapore in the "CG Watch 2016" report released on Sept 29 by CITIC Securities' wholly-owned CLSA Ltd and Asian Corporate Governance Association (ACGA) - a non-profit professional body dedicated to advance CG standards in Asia.

The survey studied the CG standards of 1,047 companies in 12 Asian countries and regions. Five categories, including CG rules and practices, enforcement, political and regulatory environment, accounting as well as auditing and CG culture were examined.

Although Hong Kong is still ranked in the top five in CG performance, the report found the city has not showed any signs of improvement, and performances are not consistent.

The first major deficiency is financial reporting, with some Hong Kong-listed firms still without an independent audit regulator. Frequency and timing of financial reporting also remains a concern, and disclosure around large expense items is problematic.

Another study by global auditing advisory firm PricewaterhouseCoopers (PwC) released on Sept 29 revealed among the 230 listed companies on the Hang Seng Index and Hang Seng Chinese Enterprise Index, only 20 percent of them have sufficient resources, qualification and experienced internal staff. This indicates listed companies are not fully confident in the adequacy of its internal audit function.

"Hong Kong companies needs to enhance the independence of audit regulators and promote CG culture as the two major strategic priorities to strengthen the local CG ecosystem," ACGA's secretary general Jamie Allen said.

The lack of investor communication by Hong Kong-listed companies is also evident. According to a survey by the Hong Kong Institute of Chartered Secretaries (HKICS), 58 percent of surveyed listed firms lack an investor communication strategy and 38 percent of them do not know their shareholders. Many also do not regularly or routinely monitor their shareholder bases.

The survey revealed a majority of listed enterprises do not think shareholders should be treated equally, with 56 percent of respondents saying engagement should only be with institutional investors and long-term shareholders.

The results are based on 413 responses from company secretaries and senior management in listed entities about current practices in shareholder communication.

"The stick for companies to comply with the regulation is not enough. The carrot is also important. If companies can see the benefits of enhancing shareholder communication that can boost share trading and share prices, the top management naturally will strengthen the investor relation function," HKICS President Ivan Tam Kwok-wing said on Sept 21.

"Hong Kong's listed companies' compliance to shareholder communication falls short of the global best practice standard as compliance practice varies across different enterprises. Hong Kong firms have genuine need for improvement," HKICS' technical consultation panel member Peter Greenwood said.

There are three elements of the shareholding structure in Hong Kong which impedes the development of shareholder communication, Greenwood said.

"Most of the Hong Kong-listed corporations have substantial shareholders such as family owners or estate institutions. Senior management may feel that communication with these major or institutional shareholders is already adequate, hence ignoring communication with other retail investors," he said.

"Shareholder activism in Hong Kong is also not vocal as in US and European countries due to cultural reasons, thus lessening the urgent need for senior management to engage in investor communication."

Also, active hostile takeover bids are rare in Hong Kong, Greenwood said, which holds back transparency for investors.

"If there is threat of a hostile takeover, it will weigh heavily for senior management to keep constant engagement with their institutional and retail investors in order to defend the company from a third-party takeover."

While there have been some improvements in director training and risk reporting, board composition remains largely conservative in Hong Kong.

"Broad diversity in terms of more females, younger non-executives and non-government organization representatives should be sought to enhance better representation and hence transparency," said Richard Welford, chairman of business consultancy firm CSR Asia.

"More local-listed companies have learned to provide information to engage customers and other stakeholders. Their jobs are more than just issuing annual reports," CSR Asia Executive Director Erin Lyon said.

"Board diversity is not defined as whether there are more females in the board. It should be evaluated whether the board members can provide adequate business skills and expertise to support company performances," said Cimi Leung Nam, a risk assurance partner at PwC.

The CLSA also recommends for locally-listed firms to improve disclosure on large unexplained expenses, more communication among regulators, whistleblower protection for auditors, an independent audit regulator and introduce board evaluations to enhance CG standards in Hong Kong.

Meanwhile CSR Asia and independent environment, social and governance (ESG) reporting research firm Sustainalytics released a sustainability report in September, which also exposed Hong Kong's poor performances. It showed only six Hong Kong-listed companies are in the top 100 companies in Asia in satisfying ESG disclosure compliances, including mitigating the negative impacts of climate changes as well as promoting water conservation and human rights.

oswald@chinadailyhk.com

Better governance a win-win for firms

Whether improving CG (corporate governance) procedures and ESG (environment, social and governance) reporting will immediately uplift share prices is debatable, but instigating change would strengthen companies' fundamentals that will benefit them in the long haul.

"Better CG procedures will lead to better corporate fundamentals. When companies have higher CG scores, the check and balances instilled would enable companies to prioritize the cost of capital issue resulting in lower earnings or balance sheet risks," said Shaun Cochran, global head of thematic research at CLSA.

Founded in 1901 and listed in Hong Kong in 1998, CLP Holdings - a global utility conglomerate investing in a portfolio of infrastructure assets in Hong Kong and overseas - maintains a variety of communication channels to engage shareholders.

The company keeps shareholders in the loop by publishing reports and announcements, maintains its corporate website and organizes shareholder visits, investor meetings and analyst meetings.

"All these communication channels add value as effective shareholder communication builds loyalty and trust. Dialogue promotes and enhances accountability of the management and board of directors," CLP's Deputy Company Secretary Michael Ling said.

Hong Kong Institute of Chartered Secretaries recommends locally-listed corporations to develop an investor relations strategy within its corporate strategy, in order to identify and regularly review its shareholder base. Corporate senior management should also formulate and review policies of shareholder communication and shareholder engagement.

oswald chan

|

A man jogs near the Sydney Harbour Bridge in Australia. A recent survey shows that Australia outperformed the 12 Asian economies surveyed, including Hong Kong and Singapore, in corporate-governance practices among listed companies. Brendon Thorne / Bloomberg |

(HK Edition 10/07/2016 page5)