-

News >Bizchina

June FDI growth rate slows to 2.8%

2011-07-16 09:26

Short-term fluctuations distort overall picture, ministry says

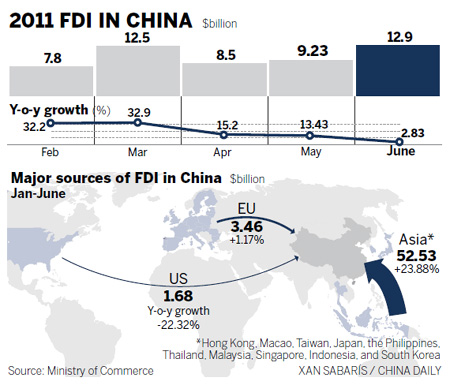

BEIJING - Growth in China's foreign direct investment (FDI) for June dropped to 2.8 percent, the lowest rate since last September, as investment from the United States declined and the European Union slowed, according to the Ministry of Commerce.

But Yao Jian, spokesman for the ministry, said China will remain an attractive destination for global FDI in the mid- and long-term and there is no sign of a sharp drop coming.

In June, China absorbed $12.9 billion in FDI, up 2.83 percent from a year earlier. That growth, the smallest since September, compared with 13.43 percent in May.

From January to June, China's FDI surged by 18.4 percent year-on-year to $60.9 billion.

"The general picture is China's FDI growth has been fluctuating for several months, but the foreign-investment environment has never changed," Yao said at the monthly news briefing on Friday.

As the cost of labor keeps rising and the nation adjusts its FDI policy, FDI growth has been on a decline from 32.9 percent in March, .

But Yao said the decline is not a trend, and he predicted that FDI in China would continue to grow this year and could surpass the total for last year, which was $105.7 billion.

"China's consumption market is very large, and the labor cost advantage could be maintained for a certain period even though labor costs have been climbing."

Jiangsu province, which traditionally has absorbed the most FDI, has nevertheless seen the FDI growth rate slow to 10 percent this year. But Zhu Min, director of the department of commerce of Jiangsu, said: "China's attractiveness is still there, and the region's annual FDI growth in 2011 will be 10 percent."

"But there is the change that more foreign investment is going to consumption-led and service sectors," he said.

During the first half of the year, the service sector outperformed the manufacturing and agriculture sectors in the FDI growth, with the flow of investments into it growing by 21.4 percent to $28.1 billion.

The decrease in the US investment and slowing growth of EU investment are the main reasons for the slowdown in FDI growth in June, Yao said.

Xia Youfu, senior professor of the University of International Business and Economics, agreed. "Uncertainties in the global economy and the bleak outlook have held back investment from developed nations," Xia said.

The World Bank recently predicted rich nations' economic growth would slow to 2.2 percent this year from 2.7 percent in 2010, while the global economy would grow by 3.2 percent in 2011. But for Zhu Min, it's hard to identify the sources of FDI trends from the figures alone because many Western companies are investing through their Asian operations.

From January to June, US investment in China fell by 22.32 percent to $1.68 billion, and the figure dropped by 24.12 percent to $1.29 billion during the first five months.

"There is no need for worry, given that US outbound investment in emerging markets, including Brazil and India, decreased sharply in the first quarter," Yao said.

Investment from the EU, a major contributor to China's FDI, is slowing. From January to June, it grew by a mere 1.17 percent to $3.46 billion, but comparatively, the investment picked up by 9.02 percent to $2.93 billion during the first five months.

In 2010, the EU's overseas investment dropped by 62 percent compared with the previous year. "It's normal and understandable that the growth of EU's investment in China has slowed," said Yao.

As part of the 12th Five-Year Plan (2011-2015), China's individual incomes will pick up substantially. During the first quarter, 13 Chinese municipalities and cities raised the minimum wage by 21 percent, and over five years, the central government will gradually raise the level by an average of more than 15 percent annually.

Partly because of the rising cost of labor, Nike, the world's leading sportswear maker, is moving its manufacturing elsewhere, and it said recently that Vietnam overtook China last year to become its biggest footwear supplier.

But this is only part of the picture. Due to the expanding domestic consumption, an increasing number of foreign companies plan or are making investments in the Chinese market, especially in consumption-led industries.

This month, the Swiss food group Nestle SA said it is engaged in talks about investing in China's largest listed confectionery company, Hsu Fu Chi International Ltd.

In the first half year, China's outbound direct investment in the non-financial sector rose by 34 percent to $23.9 billion, 40 percent of which came through mergers and acquisitions (M&A).

Chinese investment in the EU, Australia and the region of Hong Kong saw remarkable growth, but it declined in the US, ASEAN countries, Russia and Japan.

From January to June, China's ODI in the EU surged by 99.2 percent to $860 million and in the HK region by 133 percent to $14.79 billion.

"China's investment in the EU has been on rise during the past few years, and the EU will be a hot spot for Chinese ODI, especially through M&As ," Yao said.