Experts urge nation to invest in Europe, but with caution

|

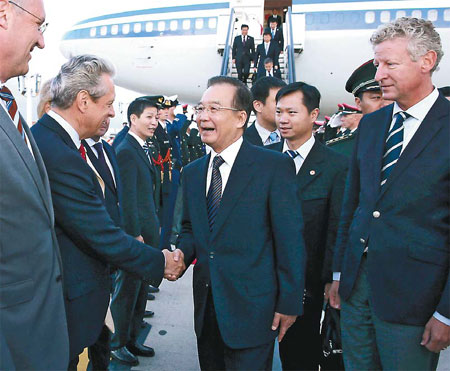

Premier Wen Jiabao arrives at the airport in Brussels on Wednesday for the 15th China-European Union Summit and his official visit to Belgium. Pang Xinglei / Xinhua |

China should continue to buy European sovereign bonds in a bid to shore up the world's confidence in its largest trading partner, but purchases should be based on sound business evaluation, experts have said.

During German Chancellor Angela Merkel's visit to China in late August Premier Wen Jiabao pledged to continue to buy European bonds, but also noted that China's purchases would require it to "fully evaluate risk".

According to Ding Chun, director of the Europe Research Center at Shanghai-based Fudan University, "China is giving support to the EU at a strategic level, but when it comes to the actual buying of bonds, safety issues should be fully considered."

Bala Ramasamy, professor of economics with China-EU International Business School, said: "It is in China's interests to continue buying European bonds. Let's put it this way, if China stops doing so, the chance of a European default will be much higher."

The EU is China's largest trading partner, with a trade volume of $593.9 billion in 2011. China has also been a regular buyer of bonds issued by the EU's bailout fund and the sovereign debt of various eurozone nations.

According to Ramasamy, China's strategy makes sense. "China, like any individual or institutional investor, wants to make sure that its assets are protected and its debtor is credible and the EU's leaders know this," he said.

Wen made his concerns over the purchase of EU bonds public during a news conference with Merkel in August.

"The European debt crisis has continued to deteriorate, giving rise to serious concerns in the international community. Frankly, I am worried," he said.

The European Union has made efforts to deal with the continuing crisis. A ruling made by the German Supreme Court last week cleared the country's participation in the European Stability Mechanism bailout and the ECB, the EU's central bank, announced bold plans to buy unlimited sovereign bonds to hold down borrowing costs. But experts believe the eurozone remains unlikely to walk out of trouble in the next two or three years, given the gloomy situation in Greece and deteriorating economic conditions in Spain and Italy.

"It would be rather good news if no more European nations fell into a fiscal mess in the next three years," said Liang Yanfen, an international finance expert with a think tank under the Commerce Ministry. She said China should use financial tools such as hedging instruments as a safeguard when investing in European bonds.

Besides bonds, China could also aid the recovery of the European economy through direct investment, although there are barriers to doing so. These could be overcome through a combination of Chinese entrepreneurs becoming more familiar with the European business environment and Europe becoming more open.

"China will increase its investment in Europe under the condition that Europe is more open to China's investment," said Liang.

China, the world's second largest economy, invested $7.56 billion in the European market in 2011.

China Construction Bank, the nation's second largest bank, said this week it expects to wrap up an overseas takeover this year.

Citing Wang Hongzhang, chairman of China Construction Bank, the Financial Times said the bank had identified Britain, France and Germany as attractive targets and could invest as much as $15 billion, exceeding China's combined investment over the last two years.

According to Ramasamy, now is a good time to buy European banks as their market capitalization is low, but Chinese banks should be careful in selecting acquisition targets.

Beyond banking, there are other sectors worthy of investment, including pharmaceuticals and renewable energy, according to Ramasamy.

"When making an investment decision, societal benefits should be taken into consideration along with business benefits. For example, whether the investment could bring China more technologies," he added.

Contact the writer at zhengyangpeng@chinadaily.com.cn.